Hornbeck Offshore to Restructure as Impact from Low Oil Prices, Coronavirus Takes Toll

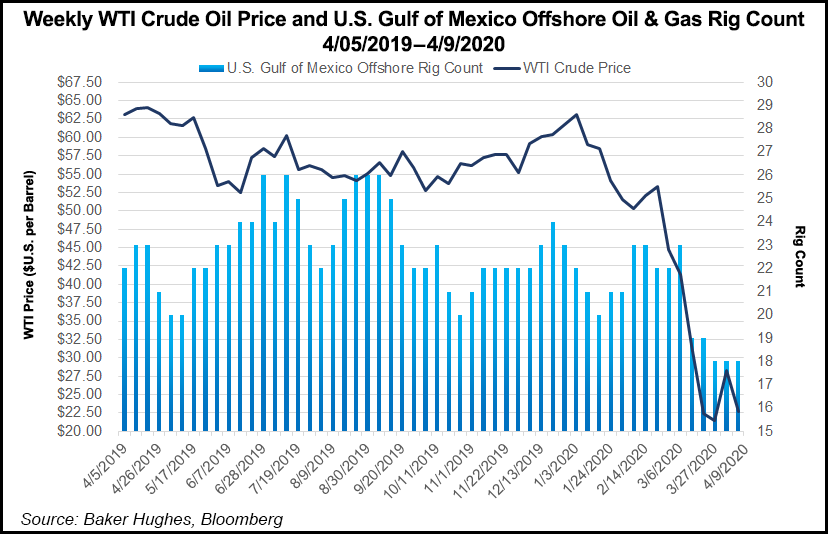

Stung by the decline in activity from low oil price and the coronavirus pandemic, Gulf of Mexico operator Hornbeck Offshore Services Inc. said it plans to file for Chapter 11 to restructure.

The Covington, LA-based firm provides service vessels for the Gulf of Mexico and offshore Latin America.

“The Covid-19 pandemic and the recent drop in oil prices due to an acute global supply-demand imbalance have significantly impacted the industries we serve, making an already challenging environment for the company even more difficult,” said CEO Todd M. Hornbeck. “The shared objectives of the company and our creditors are to meaningfully reduce the company’s financial leverage on a consensual basis and source new capital to position the company for future growth.”

Hornbeck’s secured lenders and unsecured noteholders joined the company on “a game plan for an expedited court-supervised financial restructuring process,” he said. “This consensual approach to reorganization and recapitalization is in the best long-term interest of our company, as it will enable us to take advantage of new opportunities while continuing to support our customers, retain our employees and pay our vendors.”

The restructuring support agreement (RSA) brings together secured lenders holding 83% of the company’s aggregate secured indebtedness and unsecured noteholders holding around 79% of the aggregate unsecured notes outstanding.

Hornbeck expects to file a prepackaged Chapter 11 case in the U.S. Bankruptcy Court for the Southern District of Texas in the coming weeks with a targeted completion date by the end of June.

The RSA would include a $75 million debtor-in-possession term loan facility provided by existing creditors and permitted use of existing cash on hand and generated from operations to support the business during the financial restructuring process.

Hornbeck expects to operate without disruption to its customers, vendors and workforce. The RSA would provide payment in full of all vendors and employees. In addition, under the reorganization contemplated under the RSA, Hornbeck would be able to delever its capital structure by providing access once it emerges from bankruptcy to $100 million of equity through a common stock offering and for financing strategic initiatives.

Kirkland & Ellis LLP, Winstead PC and Jackson Walker LLP are serving as legal counsel while Guggenheim Securities LLC is acting as financial adviser. Portage Point Partners LLC is serving as restructuring adviser, and Stretto is serving as claims and noticing agent.

Lower 48 independent Whiting Petroleum Corp. recently filed for Chapter 11 protection, citing low oil prices and the uncertain outlook for the sector.

North America’s exploration and production companies have a “staggering level” of debt maturing in the 2020-2024 time frame and limited access to credit, Moody’s Investors Service said in February. Without work from their customers, the oilfield services sector is facing mounting issues as well.

Kroll Bond Rating Agency expects the industry to face “strong headwinds throughout 2020, resulting in a steady stream of bankruptcies.” The “same credit factors that brought down companies during the prior downturn hold true this time around. Liquidity is king and access to long-term capital will continue to be a problem for many high-yield issuers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |