Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Diversified in Talks to Grow Legacy Asset Base in Appalachia

Diversified Gas & Oil plc said Wednesday it is again negotiating to expand its massive conventional oil and natural gas asset position in Appalachia with a conditional agreement to acquire thousands of old wells and midstream infrastructure.

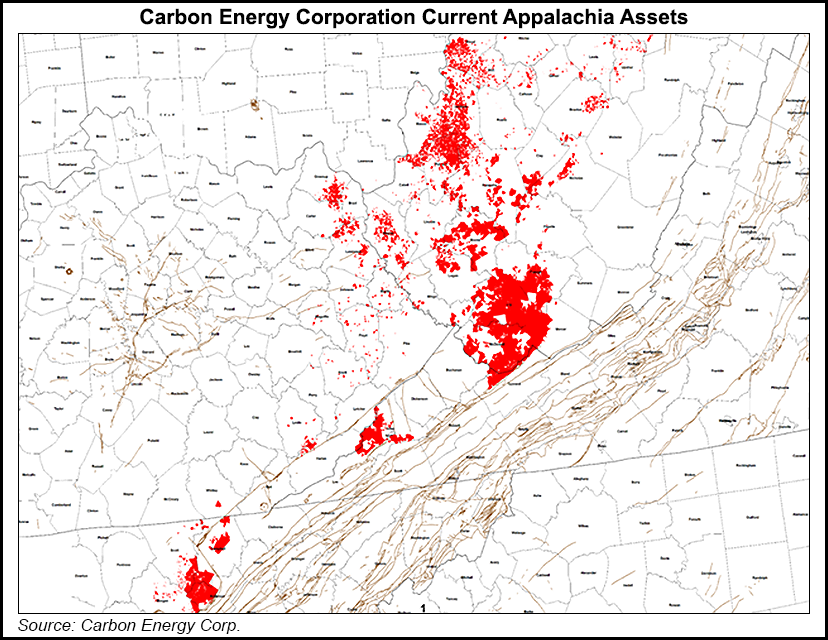

The company said it has struck a tentative $110 million deal with Denver-based Carbon Energy Corp. to buy 6,500 wells spread across Kentucky, Tennessee and West Virginia, where it already operates. Diversified stressed that it is still negotiating terms of the agreement and conducting due diligence.

Alabama-based Diversified has drilled few wells, instead relying on a steady drip of production from legacy assets to drive cash flow. The company has utilized its lower overhead to take advantage of other down markets in the past to build its 60,000 well portfolio, which also extends into Ohio, Pennsylvania and Virginia, and includes unconventional assets too.

The company said the wells it wants to acquire from Carbon, which holds assets in California and Illinois in addition to Appalachia, currently produce 59.4 MMcfe/d, or 9,900 boe/d. Diversified produced 84,800 boe/d last year, of which 70,000 boe/d was produced by legacy assets.

The Carbon package would also come with 4,700 miles of intrastate gathering pipeline in West Virginia and two active natural gas storage fields. If it completes the deal, Diversified said it would use funds available under its revolving bank facility.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |