NGI The Weekly Gas Market Report | Coronavirus | E&P | NGI All News Access

Lower 48 Shut-Ins Said Likely as E&P Capex Cuts Won’t Dent Short-Term Oversupply from Covid-19

Until people are traveling again, on the road or in the air, the economic benefits of cheap oil “remain largely theoretical,” as Covid-19’s hit to global demand is worse than the impact of the financial crisis, according to Raymond James & Associates Inc.

The untold number of capital expenditure (capex) reductions announced by the exploration and production (E&P) sector is going to reduce supply, but not for a while, said analysts John Freeman and Pavel Molchanov in a note to clients Monday.

“By contrast, shut-ins of existing production would lead to less supply right now,” the analysts said. “This issue only comes up when prices are truly depressed, but it can be perhaps surprisingly needle-moving.”

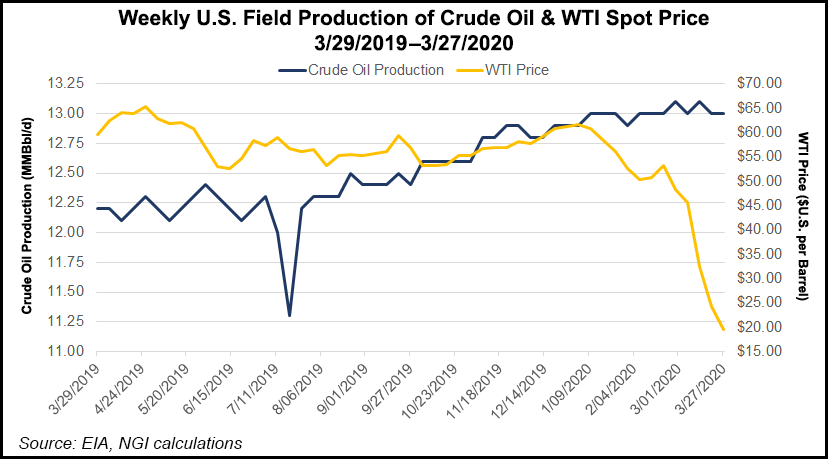

On a small scale, they wrote, shut-ins already are visible, and more are expected, including across the United States. However, when the pandemic subsides and demand returns, some of the shut-in wells may never resume producing, which could result in a “rapid bounce in oil prices,” that could be above the Raymond James base-case forecast for 2021 of $55/bbl West Texas Intermediate (WTI).

E&Ps can be flexible when developing the short-cycle supplies in the Lower 48 fields.

“The shut-in/start-up costs here are significantly lower as compared to many of the world’s deepwater and other long-lead-time projects,” Freeman and Molchanov said. There also is an abundance of stripper wells with low production rates, which often produce less than 25 b/d of oil.

“At the beginning of 2020, these wells accounted for 1.6 million b/d of crude production. Over the next few months, many if not most of these wells are likely to be shut in, and some portion of those will be permanently abandoned,” the analyst team said. “Of all the Lower 48 wells producing less than 25 b/d, nearly 70% are operated by private E&Ps.”

The basin-by-basin numbers vary, with the public/private split roughly 50/50 in the Permian and Denver-Julesburg basins, and around 20/80 in the Anadarko Basin.

“Given that private E&Ps are more likely to shut in wells as compared to their public peers, we think that the Anadarko Basin — and Oklahoma more broadly — will be the focal point of U.S. shut-ins,” analysts said.

No basin, however, is immune from well shut-ins. The analysts estimate potential U.S. shut-ins reaching 400,000 b/d at $20 WTI, climbing to 1.0 million b/d, or 8% of domestic crude production, at $10 WTI, where prices bottomed in 1999.

“Looking purely at well-level economics, up to 1.0 million b/d of U.S. supply is at risk of shut-ins — but that is only one part of the picture,” Freeman and Molchanov said. “Global storage levels are currently near 60% capacity, and the closer they get to 80% (the theoretical maximum operating capacity), the more challenging moving and storing oil becomes…

“Assuming that roughly 20% of global oil demand is offline during the second quarter because of Covid-19, that equates to global inventory builds of 20 million b/d-plus, implying that the 80% mark would be reached before the end of June.”

If the global inventory reaches that build, “well economics would become essentially irrelevant,” the analysts said. “Producers would be forced to shut-in, because at that point there would be literally nowhere to store the extra barrels.”

The Railroad Commission of Texas (RRC) last month said it was considering a change to policy that could allow the state’s E&Ps to curtail oil output in light of the epic decline in crude pricing, basically prorationing production. The change came after a “couple” of Texas producers inquired into the feasibility of making the change.

The E&Ps, identified as Permian heavyweights Pioneer Natural Resources Co. and Parsley Energy Inc., already have reduced capex sharply for the year. The RRC is scheduled to discuss the prorationing on April 14.

“The message is simple: either proactively shut-in production or be forced to anyway when storage capacity is maxed out and oil prices plummet,” Freeman and Molchanov said. “We envision that testing the $10 threshold is likely in the second quarter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |