Wyoming Governor Signs Oil, Natural Gas Tax Relief Bill Into Law

Wyoming Gov. Mark Gordon on Friday signed into law a bill authorizing tax breaks for new oil and natural gas production “in specified price environments and for specific periods,” providing a bit of relief to producers struggling with market volatility caused by the coronavirus outbreak and a price war between Saudi Arabia and Russia.

Under the legislation, 2% of the market value of production resulting from wells drilled on or after July 1 would be exempt from severance tax, as long as necessary conditions are met.

The normal severance tax on Wyoming oil and gas production is 6% of fair market value.

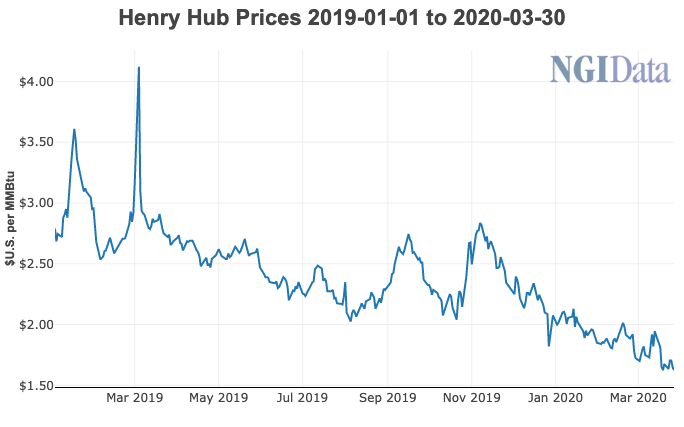

In the case of natural gas, the 2% exemption would only apply if the rolling average Henry Hub spot price is below $2.95/Mcf for the 12 months immediately preceding first production.

For crude oil, the corresponding West Texas Intermediate ceiling price is $50/bbl.

If applicable, the exemption is to cover the full 2% rate for the first six months of production, and drop to 1% for the next six months of production.

Wyoming produced 297,000 b/d of oil in December, up 1.4% year/year, according to the Energy Information Administration. Natural gas output, meanwhile, dipped 1% to 4.26 Bcf/d.

Earlier this month, Gordon signed into law two other bills impacting the oil and gas sector. One relates to how the Wyoming Oil and Gas Conservation Commission handles underground disposal laws, while the other created the Wyoming Energy Authority, merging the state’s infrastructure and pipeline authorities.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |