[Article Headline]

With the natural gas market stuck in wait-and-see mode as traders and analysts seek more clarity on the impacts of coronavirus containment measures, futures traded close to even Wednesday. The April Nymex contract added 0.6 cents to settle at $1.659/MMBtu.

In the spot market, mild temperatures in the forecast accompanied a mix of price moves, with NGI’s Spot Gas National Avg. ultimately sliding 1.5 cents to $1.460.

The coronavirus pandemic has left energy analysts with the unenviable task of trying to light the path forward without the benefit of a historical comparison to offer insight into the present situation.

“Covid-19 is creating wholly unprecedented impacts across energy markets, compelling radical changes to our forward balance expectations and challenging standard assumptions,” Genscape Inc. senior natural gas analyst Rick Margolin said in a note to clients Wednesday. “The challenge of forecasting is made difficult by the fact that there are no true precedents or analogs for what is happening now and for how long. Thus, we expect our forecast changes to be frequent and potentially stark over the weeks and months ahead.”

Natural gas prices have tumbled to historically low levels recently, and, as a primary input in Genscape’s modeling, this has “generated significant changes” to the firm’s projections.

“We have sharply reduced our production outlooks,” Margolin said.

Due to sharp declines in commodity prices, Genscape’s 2020 natural gas production forecast has dropped by around 1.1 Bcf/d compared to the firm’s expectations as of six weeks ago.

“Though we still expect Cal 2020 to post overall year/year growth from Cal 2019, by September we expect to see the first signs of same-month year/year declines, and winter 2020/21 will show declines to winter 2019/20,” Margolin said. “Our Cal 2021 production forecast has been revised down exponentially more, by about 5.6 Bcf/d from previous. At current forward curve prices, there are a handful of prominent basins whose rig counts are projected to drop to zero.”

Of course, the demand side of the market is hardly immune to Covid-19, and the impacts for natural gas are “unquestionably bearish,” according to Margolin.

“Some businesses have already been permanently destroyed, and school districts across the country have already declared no return to session this academic year,” the analyst said.

Genscape has removed about 0.4 Bcf/d of demand from its forecast for summer 2020, driven by declines in the industrial sector.

“Our overall reductions to gas demand this summer would be higher except that expectations for power burn were actually revised up by 0.1 Bcf/d, with lower prices generating enough price-sensitive switching to outweigh expectations for lower electricity loads,” Margolin said.

Meanwhile, gas traders also have to factor in the latest Energy Information Administration (EIA) storage data, with Thursday’s report expected to show a lighter-than-average withdrawal for the week ending March 20.

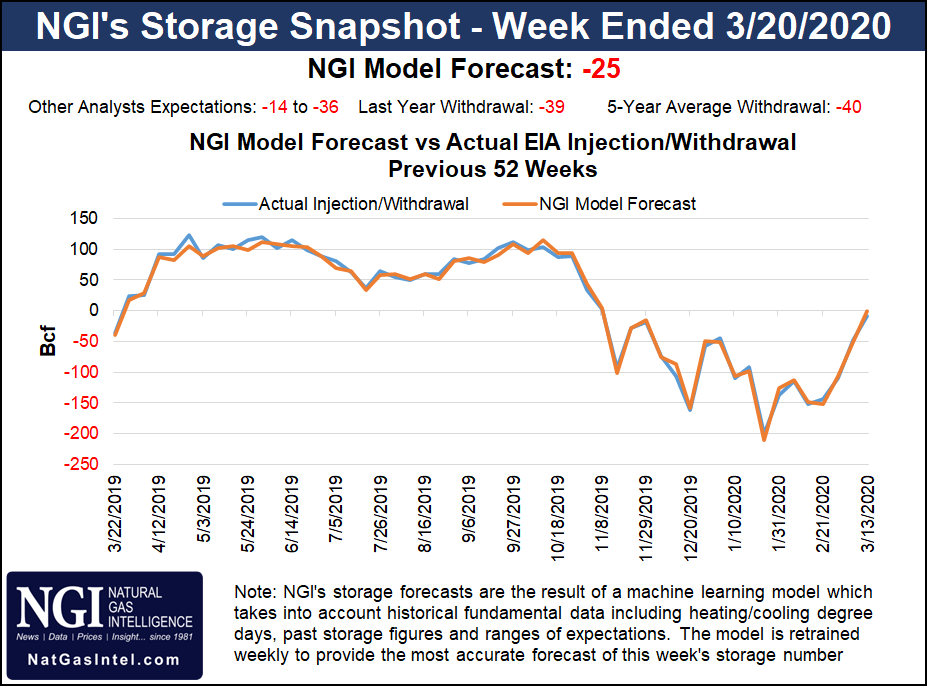

A Bloomberg survey Wednesday showed a median prediction for a 30 Bcf withdrawal, while a Wall Street Journal poll showed an average estimate of minus 27 Bcf. A Reuters survey landed on a 25 Bcf withdrawal, matching the 25 Bcf pull predicted by NGI’s model. Estimates ranged from minus 14 Bcf to minus 36 Bcf.

Energy Aspects issued a preliminary estimate for a 21 Bcf withdrawal.

An increase in gas-weighted heating degree days during the report period “should drive residential/commercial and power demand higher,” the firm said. “In addition, our models indicate week/week production is up by 0.9 Bcf/d.”

Last year, EIA recorded a 39 Bcf pull for the similar week, and the five-year average is a withdrawal of 40 Bcf.

In terms of the latest indicators on balances, Bespoke Weather Services said Wednesday it “did not see anything new, data-wise, that argued for a move in either direction, with the next few EIA numbers likely to reflect loosening as the economy slows, although we still argue that a lot of that is priced in at these levels, and it now becomes a duration issue.

“If the impacts of the virus can be contained and we see improvement into summer, we see upside risks to prices rather easily as long as oil stays low,” Bespoke said. Oil is likely to see much more demand lost compared to gas, “especially since we are heading into the time of year where natural gas demand is low anyway.”

Spot prices at benchmark Henry Hub finished unchanged at $1.705 on average Wednesday, and several regional averages finished within a nickel of even as most areas continued to look forward to pleasant temperatures in the days ahead.

“Very warm to hot temperatures will continue across the southern U.S. the next few days, with highs of upper 70s and 80s, locally 90s over Texas and surrounding states,” NatGasWeather said. “It’s also mild across the southern Great Lakes, Ohio Valley, Mid-Atlantic and East, with highs of 50s and 70s to aid light national demand…with very little coverage of 30s anywhere in the country, national demand will remain light through the weekend.”

The Northeast and Appalachia recorded some of the largest discounts on the day. Transco Zone 6 NY tumbled 27.5 cents to $1.380, while farther upstream, Dominion South slid 9.5 cents to $1.305.

Meanwhile, a few hubs in the northwestern portion of the Lower 48 saw modest day/day gains. Northwest Sumas picked up 2.5 cents to $1.505, while Malin added 2.0 cents to $1.520.

“The unsettled pattern that has been affecting large portions of the western U.S. with showery conditions and below-average temperatures” will continue through Thursday, according to the National Weather Service. The system responsible for this pattern was expected to continue pushing “southeastward from along the West Coast Wednesday morning, into the Great Basin on Thursday and into the Southwest by early Friday.”

Elsewhere in the western United States, SoCal Border Avg. eased 6.5 cents to $1.505, while El Paso S. Mainline/N. Baja dropped 14.5 cents to $1.455.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |