NGI All News Access | LNG Insight | Markets

LNG Recap: U.S. Feed Gas Deliveries Spike; Coronavirus Weighs on European Demand

Feed gas deliveries to U.S. liquefied natural gas (LNG) export terminals bounced back over the weekend, surpassing 9 Bcf/d and hitting their highest point in weeks.

Foggy weather along parts of the Gulf Coast and periodic outages at both the Sabine Pass and Corpus Christi terminals in recent weeks have tested storage capacity and made it difficult at times for ships to load cargoes.

While fog is still expected to be a factor through the end of the week, Genscape Inc. noted that pipeline shipments to terminals “rebounded with a vengeance” over the weekend and hit a 50-day high of 9.2 Bcf/d on Saturday. Volumes hit a 126-day low of 6.3 Bcf/d last week, Genscape said. NGI’s U.S. LNG Export Tracker showed that feed gas deliveries broke the 9 Bcf/d mark on Friday and remained consistent through Monday.

As conditions improved, U.S. exports increased during the week ending March 18. Sixteen vessels departed carrying 59 Bcf, according to the Energy Information Administration. That’s up from 14 vessels that left in the prior week carrying 51 Bcf.

Elsewhere in the country on Monday, Tellurian Inc. received a lifeline, announcing that the maturity on its 2019 term loan has been extended by 18 months. It had been due in May. Feeling the squeeze of a global gas glut and the coronavirus’ impacts, the company earlier this month highlighted plans to cut corporate spending, reshuffle management and reduce its workforce as it works toward sanctioning the massive Driftwood LNG terminal in Louisiana.

“We are working remotely with potential equity partners for the Driftwood project and implementing measures to keep our team safe and productive to regain commercial momentum when the effects of Covid-19 subside,” CEO Meg Gentle said Monday.

The pandemic continued to weigh on European natural gas prices on Monday, with the Dutch Title Transfer Facility trading near lows not seen since the global recession in 2009. Measures across the continent to curb the spread of the virus intensified over the weekend. Germany, a major consumer of gas in Europe, implemented further restrictions and joined a growing list of countries that have imposed near lockdowns.

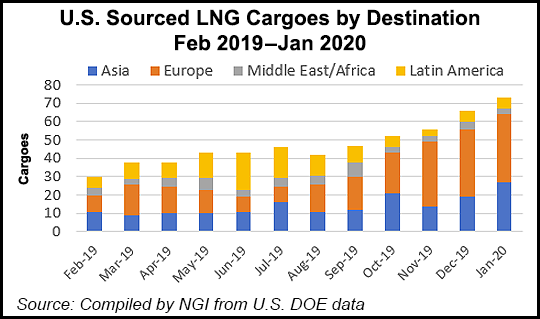

Europe is a major destination for both U.S. LNG cargoes and global spot volumes. Italy, the hardest hit country, also ordered nearly all industrial production to halt on Saturday, further weakening the economic and energy demand outlooks.

ClipperData said Monday that there were eight vessels floating with LNG aboard around Europe, including two near Spain’s Atlantic Coast, four near continental Europe and two near the Mediterrnean, an indication that the continent’s ability to take in gas could be strained.

But spurred on by low prices and recovering demand, Asian buyers appear more willing to take in additional cargoes. Front month and spot LNG prices in Asia are trading well above $3.00/MMBtu after dipping below that point in recent weeks.

“On the cargo side, China is likely to need higher imports in the short term as the country begins its recovery, as many head back to work and industrial demand increases,” Norwegian shipbroker Fearnleys AS said last week of the coronavirus’ impact. “This could see growth in spot opportunities over the next couple of months.”

Lower crude prices also have made oil-linked LNG purchases more attractive. Brent crude has slipped below $30.00/bbl as demand is expected to decline due to the virus and a price war between the Organization of the Petroleum Exporting Countries and Russia continues.

While that’s reinforced a buyer’s market, it’s also giving projects with more crude exposure pause. Reuters reported last week that a final investment decision on the Rovuma LNG project offshore Mozambique that was expected in the first half of this year could be delayed. ExxonMobil Corp., Eni SpA and China National Petroleum Corp. are partners on the project.

Exxon signaled last week that it is reconsidering its 2020 spending plans given the steep decline in oil prices. Other major global LNG players such as Royal Dutch Shell plc and Total SA said Monday they would cut spending.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |