Shale Daily | Coronavirus | E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Canadian Oil and Gas Industry Reverses Investment Course on Coronavirus Worries

Only two months after predicting the first investment growth since 2014, the Canadian oil and gas industry has reversed course by retreating into austerity to survive the coronavirus pandemic and dizzying commodity price drops.

Corporate budget cuts announced so far add up to more than double the C$2 billion ($1.5 billion) collective increase forecast Jan. 30 for 2020 by the sector’s chief trade association, the Canadian Association of Petroleum Producers (CAPP).

Self-discipline is essential for surviving instability by preserving assets, production and capital, say two senior firms responsible for nearly half of the spending reductions: Canadian Natural Resources Ltd. (CNRL) and Husky Energy Inc.

In cutting its 2020 budget by C$1.09 billion ($818 million) or 27%, down to a “sustaining” C$2.96 billion ($2.2 billion), CNRL emphasized that strict financial restraint does not make production take a corresponding dive.

The firm said, “Canadian Natural’s asset base has low sustaining capital and low reservoir risk which allows it to effectively manage through commodity price cycles, with little impact on our near term production levels and net asset value, thereby preserving long term value for our shareholders and creditors.”

CNRL calls its resource crown jewel — a 43-year reserve of Alberta bitumen produced at a rate of 430,000-475,000 b/d as synthetic crude oil (SCO), a source of cash flow strength. SCO fetches premium light oil prices still well above operating costs of US$13 per barrel, reports the firm.

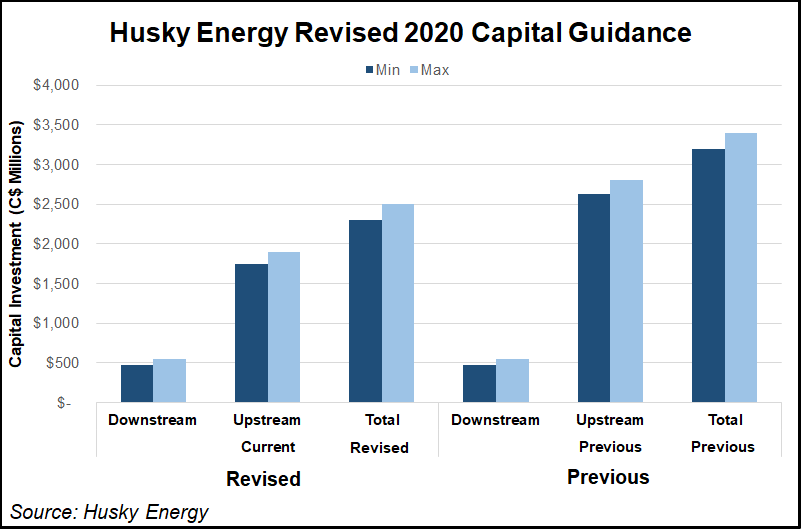

Husky likewise called its C$1 billion ($750 million), 33% 2020 budget cut to C$2.3-$2.5 billion ($1.7-1.9 billion) a case of “protecting value in an extended low commodity price environment.”

Production will be trimmed but only by volumes that remain to be set as “safe and orderly reduction or shut-in” at locations “where it is cash negative on a variable cost basis at current prices,” said Husky.

Cuts are less drastic so far at specialists in natural gas and liquid byproducts, which were pared down into lean operations by low and volatile Canadian prices for years before Covid-19 and the oil market-share war between Russia and Saudi Arabia.

Seven Generations Energy Ltd., aka 7G, a fixture of the liquids-rich Montney Shale formation, kept a C$900 million ($675 million) 2020 budget by limiting its cut to C$200 million ($150 million) or 18%.

“The company will demonstrate its resilience and emerge from this downturn stronger and better-positioned than ever before,” predicted 7G president Marty Proctor.

Imperial Oil Ltd., the 140-year-old elder dean of the Canadian fossil fuel industry, also stayed calm and sounded an optimistic note while announcing no immediate budget or production cuts.

“Over its long history, Imperial has faced numerous periods of low global crude oil prices,” the firm reminded shareholders Thursday in an update on plans for coping with the current pandemic and market instability.

After suspending the next Imperial oilsands project due to pipeline capacity shortages and Organization of the Petroleum Exporting Countries (OPEC)-like Alberta government production quotas, company president Brad Corson reported “We are naturally at a lower spending period in the cycle.”

Corson added, “Imperial’s integrated business model [spanning wells to refined products] and strong financial position provide resilience. The company is well-positioned to weather periods of market volatility, including reduced demand and low crude oil prices.”

Long-distance, long-range Trans Mountain, TC Energy Corp. and Enbridge Inc. pipeline projects continue. But in a prominent case of austerity spreading into Canadian fossil fuel delivery and processing, Pembina Pipeline Corp. announced a strategy of “maintaining significant future upside” by postponing but not cancelling additions.

Pembina deferred C$4.5 billion ($3.4 billion) in Alberta and British Columbia pipeline, processing, terminal and petrochemical expansions that had early-2020s completion targets. The schedule changes resulted in a current-year spending cut of 40-50%, down to C$1.2-$1.4 billion ($900 million-$1 billion).

Canadian industry analysts rate Covid-19 and the oil market-share war as most menacing for drilling, service and supply contractors that rely on production growth and replacement.

ARC Energy Research Institute executive director Peter Tertzakian, a history buff, warns against letting the modern troubles repeat “market death” that the Black Death inflicted on medieval energy workers that ran waterpower and windmills.

“Gutting the oilfield service sector will deplete the labor pool by thousands of jobs and make it doubly hard for an already hobbling industry to recover after the chaos ends,” predicts Tertzakian.

“These are the workers on the front lines of extracting a suite of products that put gas in your car, heat your home and transport your food, among many other vital things in our modern economy.”

Along with Tertzakian, the Canadian Association of Oilwell Drilling Contractors and Petroleum Services Association of Canada hoped for targeted help beyond corporate tax payment deadline extensions and loan programs announced so far for all industries by the federal and provincial governments.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |