NGI All News Access | Coronavirus | Markets

EIA Reports Larger-Than-Expected Storage Pull, Briefly Nudging Natural Gas Futures Higher

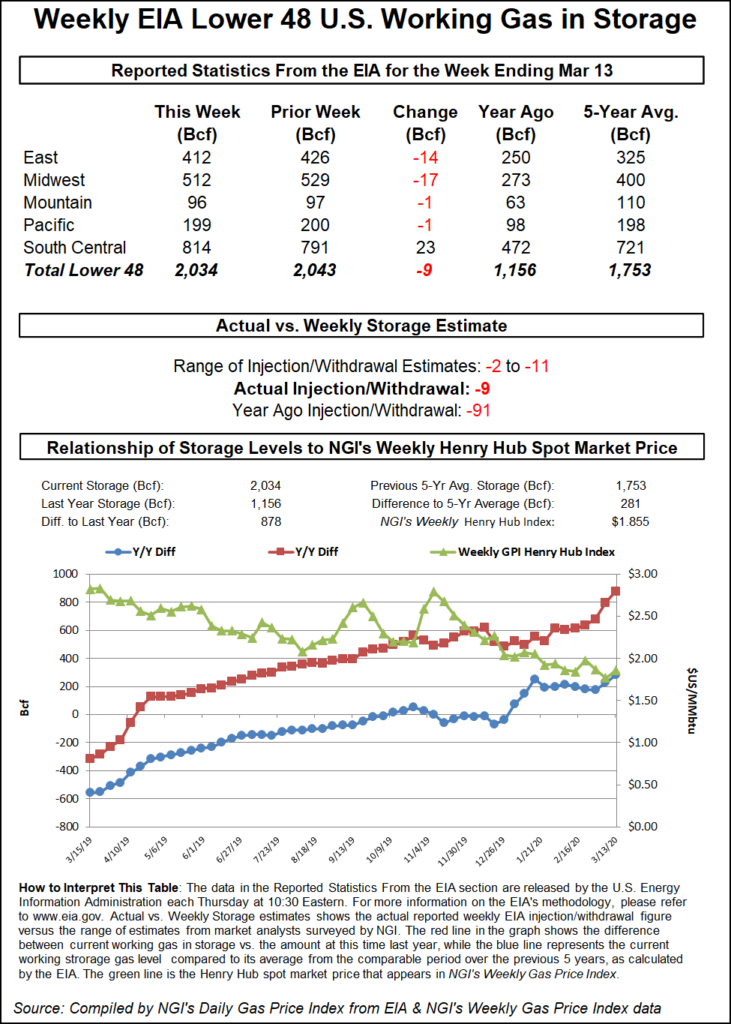

The Energy Information Administration (EIA) on Thursday reported a larger-than-expected 9 Bcf weekly withdrawal from U.S. natural gas stocks, giving a temporary bump to a futures market laden with uncertainty over the coronavirus pandemic.

The 9 Bcf withdrawal, while to the bullish side of consensus, falls well short of both the 91 Bcf withdrawal EIA recorded for the year-ago period and the five-year average pull of 63 Bcf.

After a sharp sell-off in Wednesday’s session took the front month down to around four-year lows, futures pared some of those losses in early trading Thursday. In the half hour leading up to EIA’s 10:30 a.m. ET report, the April contract traded in a range from $1.625 up to $1.639.

As the report crossed trading screens, the front month climbed to as high as $1.650. By around 11 a.m. ET, however, April was trading back down to $1.627, up 2.3 cents from Wednesday’s settle.

The market is likely to take a greater interest in upcoming EIA reports as traders look for clues of the impact of coronavirus containment measures on demand, according to Bespoke Weather Services.

“This number is not as tight as many that we saw over the last several weeks,” Bespoke said. However, the figure is also “not related to any slowdown in the economy due to the virus, as last week was before we began to see shutdowns.

“Numbers the next few weeks will be more useful in determining how much demand loss is actually taking place,” and upcoming reports will likely “carry more weight in terms of market impact.”

Prior to the report, a Bloomberg survey showed a median estimate for a 3 Bcf withdrawal, while a Reuters poll landed on a consensus pull of 6 Bcf. Estimates ranged from minus 2 Bcf to minus 11 Bcf. NGI’s model predicted a 1 Bcf withdrawal.

Total Lower 48 working gas in underground storage stood at 2,034 Bcf as of March 13, 878 Bcf (76.0%) above year-ago levels and 281 Bcf (16.0%) higher than the five-year average, according to EIA.

By region, the Midwest withdrew 17 Bcf, while 14 Bcf was pulled in the East. The Mountain and Pacific regions each withdrew 1 Bcf week/week. In the South Central, 12 Bcf was injected into salt stocks, with nonsalt also seeing a net 12 Bcf injection for the period, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |