Utica Shale | E&P | NGI All News Access

Estimates Show Ohio Oil Production Shattered 19th Century Record Last Year

Oil production in Ohio last year likely surpassed the state’s all-time record set in 1896 if estimates included in the Ohio Oil and Gas Association’s (OOGA) annual Debrosse Memorial Report prove accurate.

According to the report, combined conventional and unconventional oil production hit 27.9 million bbl in 2019, up from 22.7 million bbl in 2018 and well above the 23.9 million bbl record set in 1896. In the 19th century, a boom in the Trenton Limestone for a time turned the state into the nation’s leading crude producer.

The bulk of last year’s oil volumes, or 24.9 million bbl, were produced by horizontal wells mostly drilled to the Utica Shale. Conventional vertical wells drilled to shallower formations such as the Clinton Sandstone accounted for 2.9 million bbl, according to Debrosse report estimates. While the state’s horizontal well operators are required to report production data quarterly, vertical operators report are required to submit their data every year by March 31.

Combined conventional and unconventional natural gas production reached 2.8 Tcf, up from 2.4 Tcf in last year’s report. Nearly all gas production came from the Utica, according to the estimates, which aligned with official production data issued last month for horizontal wells. Unconventional oil estimates in the Debrosse report also aligned with year-end figures released by the state.

Oil production in Ohio has undulated with commodity prices since 2012, when Utica development started ramping up. Natural gas prices declined last year and sent more operators to liquids-rich acreage.

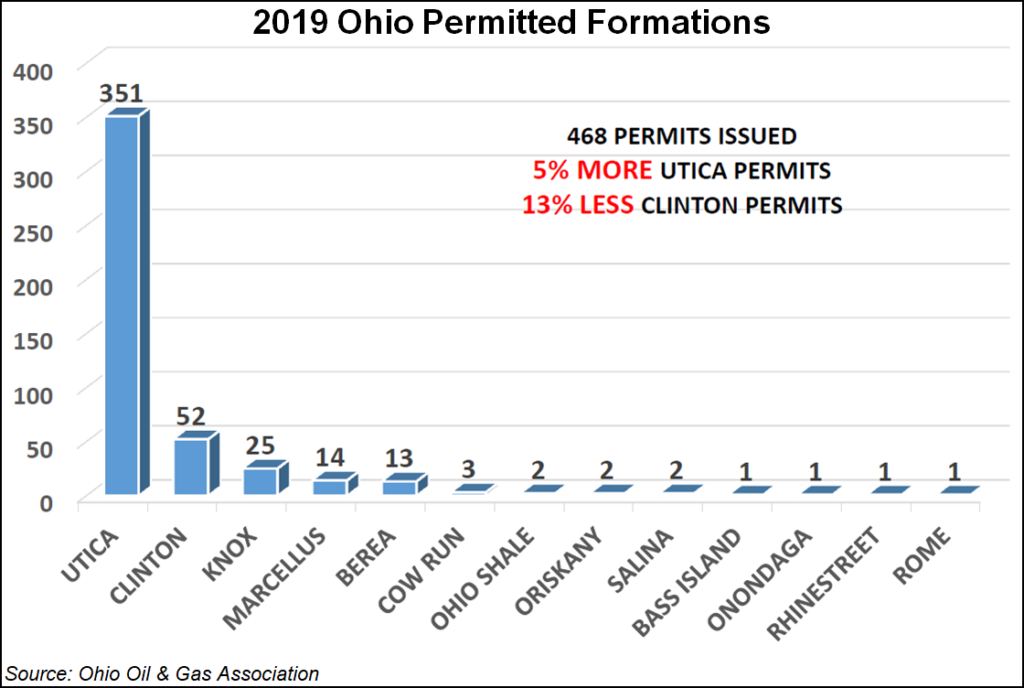

Beyond oil volumes, many of the metrics included in the OOGA report remained steady. Drilling permits in the state fell 5% year/year to 468, while completions were flat over the same time at 406.

Similar to 2018, Ascent Resources LLC at No. 1 and Gulfport Energy Corp. at No. 2 were the state’s most active operators by wells drilled last year. An affiliate of Encino Energy LLC, which acquired all of Chesapeake Energy Corp.’s Utica assets in 2018, displaced Antero Resources Corp. as the third most active operator. Appalachian pure-play Antero has shifted its focus to liquids-rich acreage in West Virginia as gas prices have fallen.

Ascent accounted for 28% of the wells drilled in the state last year, while Gulfport accounted for 14% and EAP Ohio LLC accounted for 10%. Ascent also drilled the most footage of any operator in the state last year at 2.3 million feet.

Overall, footage drilled by operators was flat in 2019, but still high at 6.5 million feet as producers continue drilling longer, more efficient wells. Last year’s total was well above the 1.8 million feet drilled in 2011, when the first commercial Utica production was reported.

The Debrosse report also counted 41 companies that completed wells in the state last year, roughly in line with the 38 recorded in 2018. Before the Utica land rush got underway in 2008, there were more than 180 exploration and production companies working in the state, but that number has declined every year since as assets in the basin have been consolidated by dominant operators. From 2011-2013, as Utica activity steadily increased, there were more than 100 independents at work, according to the report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |