NGI Mexico GPI | E&P | NGI All News Access

Colombia’s Ecopetrol First LatAm NOC to Slash Capex Amid Oversupply, Coronavirus

Colombia’s Ecopetrol SA on Tuesday became the first Latin American national oil company (NOC) to announce 2020 spending cuts in the wake of twin supply and demand shocks that have left global energy markets reeling.

The 88.5% state-owned company, whose shares trade on the New York Stock Exchange and the Colombian stock market, said it is slashing its 2020 capital expenditures (capex) by $1.2 billion to a new range of $3.3-4.3 billion, citing plummeting oil prices and the coronavirus pandemic.

Ecopetrol indicated it will postpone projects that are in the early stages, focusing instead on maintaining production and cash flow. In addition to the capex reduction, Ecopetrol is slashing 2 trillion pesos ($490 million) in costs through an austerity plan to take immediate effect. The plan includes restrictions on travel, sponsorships and event participation, and is aimed at “the prioritization of operational activities…”

Ecopetrol highlighted that the Brent crude benchmark has fallen by over 40% since the end of 2019. Brent had fallen under $30/bbl in mid-afternoon trading Tuesday.

The company is maintaining its 2020 production guidance of 745,000-760,000 boe/d.

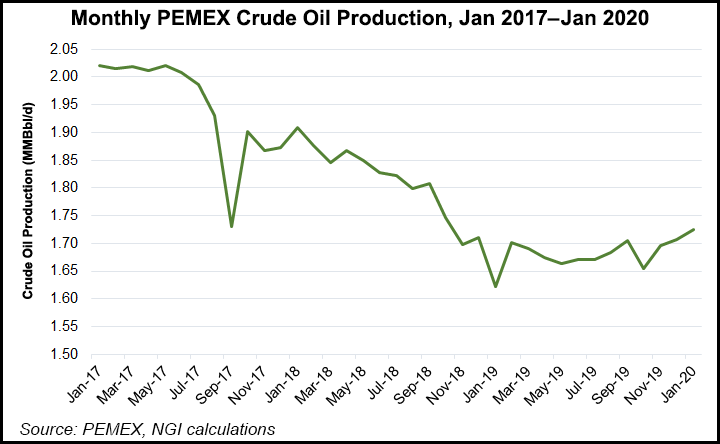

Mexico’s 100% state-owned oil company Petróleos Mexicanos (Pemex), meanwhile, has made no indication of plans to cut capex in 2020, even as Mexico’s crude export basket has tanked and peer companies swiftly announce spending cuts.

New research from Welligence Energy Analytics has concluded that between Ecopetrol, Pemex and Brazil’s Petróleo Brasileiro SA (Petrobras), Pemex is the most vulnerable to a sustained period of low oil prices.

Although Latin America’s upstream segment as a whole is relatively well positioned to weather low oil prices, “the national oil companies are the biggest losers — not a surprise given they are also the biggest producers,” said Welligence’s Ruaraidh Montgomery, director of research, in a note last week. “The Big Three of Petrobras, Pemex and Ecopetrol collectively lose almost $10 billion in cash flow in our $45/bbl scenario. While Petrobras and Ecopetrol will continue to generate positive cash flow, Pemex is forced into negative cash flow by its tough fiscal terms.”

Despite the headwinds facing Latin American NOCs, researchers said only about 6% of the roughly 7 million b/d of oil being produced in the region, excluding Venezuela, is at risk of being deferred in 2020 under a $45/bbl scenario.

The April 2020 West Texas Intermediate futures contract was trading at around $27/bbl as of Tuesday, after opening at $28.69/bbl. Mexico’s crude export basket stood at $24.19/bbl.

Mexico President Andrés Manuel López Obrador has argued that low oil prices will benefit consumers.

However, for countries such as Mexico, where the finance ministry projects oil revenues to account for 17.9% budgetary income in 2020, a prolonged low-price environment could prove disastrous, according to a recent analysis by the International Energy Agency (IEA), the global energy watchdog.

“In some countries, large-scale production and exports of oil and gas provide vital income to finance their national budgets, which means volatility in global energy markets can translate almost instantly into macroeconomic pressure,” IEA researchers said. “When prices fall, these ”producer economies’ have often responded by trimming their spending, cutting salaries for public sector employees, and axing or delaying large capital projects. These measures have previously contributed to slower economic growth — or even contraction.”

Analysts at IHS Markit said Monday the current situation “points to the possible buildup of the most extreme global oil supply surplus ever recorded.” Previously, the largest six-month global surplus since 2000 lasted from late 2015 to early 2016, when it was a cumulative 360 million bbl, analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |