NGI Mexico GPI | E&P | NGI All News Access

Talos Cuts Capex, Still Aiming for 2020 FID at Zama Discovery Offshore Mexico

Talos Energy Inc. is still targeting a final investment decision (FID) in 2020 at its Zama oil discovery offshore Mexico, CEO Timothy Duncan said Thursday, despite pending questions surrounding the ultimate ownership split of production from the deposit.

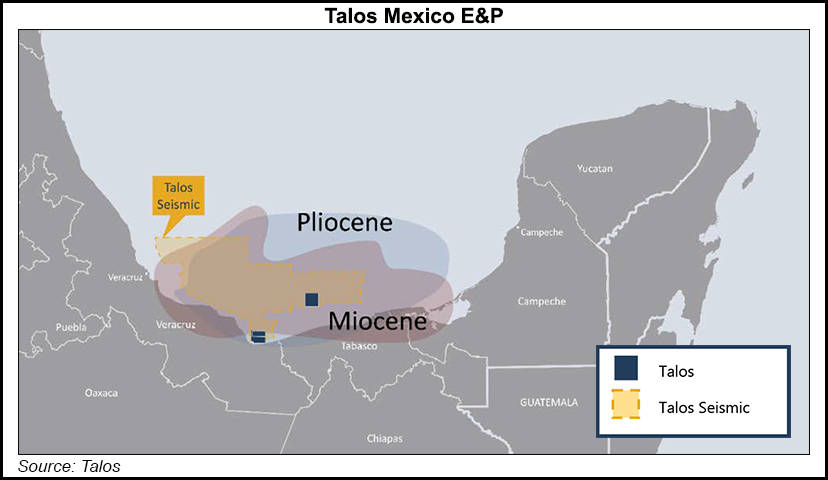

The discovery, announced at shallow water Block 7 in 2017 by a Talos-led consortium, straddles a neighboring block operated by Mexico’s state oil company, Petróleos Mexicanos.

Although a contingent resource estimate of Zama found in January that about 60% of the resources were within the Talos block, Pemex CEO Octavio Romero Oropeza said in late January that “we consider that we have the largest part of the discovery. But independent of who has what, Pemex is going to drill exploratory wells to confirm these data.”

On Thursday, Duncan said, “Talos continues to focus on front end engineering design, or FEED, of the project. Our goal is to declare FID on this development still in 2020, so we can have first oil as soon as possible. But as we’ve mentioned before, the timing of FID is dependent on the conclusion of our unitization agreement with Pemex. We continue to be engaged with Pemex on those discussions, and we’re hoping for a quick resolution.”

In 2018, under Mexico’s previous government, Pemex and the Block 7 consortium signed a pre-unitization agreement to set a path toward a unitization agreement in the event a shared reservoir was confirmed.

Because of the uncertain outlook for West Texas Intermediate (WTI) oil prices amid the coronavirus outbreak and a price war between the Organization for the Petroleum Exporting Countries (OPEC) and Russia, the Houston-based independent is reducing its 2020 capital expenditure (capex) guidance by more than $125 million.

Talos “is well positioned to weather the current market conditions,” Duncan said. “Our portfolio of producing assets is resilient, with premium pricing to WTI, a favorable fiscal regime, and competitive lifting costs.”

Talos has hedged about 10.6 million bbl of 2020 oil production at a WTI price of about $54/bbl, “which will help preserve our cash flow generation profile in the near-term,” Duncan said.

The capex reduction would entail a combination of lower capital investments and a reduction in operating expenses, the CEO said.

“The drilling projects that we expect to remain in our budget in 2020 are those focused on quick turnarounds to first oil and existing nearby infrastructure that can still come online in 2020 or early 2021…which will further position us to withstand a prolonged downturn.”

“With these measures, we estimate that we can sustain a positive free cash flow business at a breakeven point below $30/bbl with our hedges,” Duncan said. “We expect to provide additional detailed, revised 2020 guidance in the coming weeks.”

The April 2020 WTI futures contract opened at $31.65/bbl Thursday, and had reached an intraday high of $33.63 before dropping back below $32 in the afternoon.

In its previous 2020 guidance published in mid February, Talos forecasted average daily production of 66,800-70,200 boe/d, and capital expenditures of $520-545 million.

In late February Talos completed an acquisition of U.S. Gulf of Mexico assets that produced 19,000 boe/d during 3Q2019, and which boast estimated proved and probable (2P) reserves of 68 million boe.

Talos reported production of 54,000 boe/d (73% oil) in the fourth quarter, versus 53,400 boe/d in the similar 2018 period, with the entirety coming from its U.S. GOM assets.

Net income totaled $0.3 million (1 cent/share) in 4Q2019, versus $306.3 million ($5.66) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |