Natural Gas Futures Volatile as Economic Uncertainty Abounds

As the coronavirus officially became a pandemic, and as energy traders continued to try to steer through a whirlwind of economic uncertainty, natural gas futures turned in a volatile day of trading Wednesday. After approaching the $2.000/MMBtu mark, the April Nymex contract ultimately fell back to settle at $1.878, down 5.8 cents.

In the spot market, Western U.S. hubs led another day of widespread gains throughout the Lower 48; NGI’s Spot Gas National Avg. added 9.5 cents to $1.745.

It initially seemed like natural gas would build on the sharp gains recorded in the previous two sessions, as prices rallied to as high as $1.998 early Wednesday. But with questions swirling around the broader demand impacts from the coronavirus outbreak, and with weather-driven demand projections still underwhelming, bulls couldn’t keep the momentum going.

“The curve structure today was not nearly as foolish as the last couple of days, but the underlying issues remain the same,” Bespoke Weather Services said in a note following Wednesday’s close. “The pattern remains warm, despite cold in the western half of the nation, and balances remain in a state that we would consider bullish at these price levels.

“The problem is, first of all, we have rallied a significant amount since Monday morning, so we were due for a breather, and we also do not yet know how much demand will be destroyed by cancellation of events due to the coronavirus.”

Meanwhile, it was another tough day in an extraordinarily tough week for crude prices, with the April West Texas Intermediate Nymex contract sliding $1.38 to settle at $32.98/bbl. Rystad Energy analysts in a note Wednesday said they wouldn’t rule out $20 oil in the near future. The firm estimated that the Organization of the Petroleum Exporting Countries (OPEC) and its allies are “locked and loaded” to add 1.5-2.5 million b/d to global supplies over the next three months.

The rally for natural gas to start the week reflects “a belief that steep” capital expenditure cuts from U.S. shale producers “will result in quick, steep declines in production of associated gas, tightening the natural gas market,” according to EBW Analytics Group. “In addition, with a massive short position still outstanding, short-covering may also have played an important role.”

The latest guidance heading into Wednesday’s trading left the weather-driven demand picture for gas largely unchanged, but the potential demand shocks from the coronavirus still loom large over the economy as a whole, according to EBW. They cited reported comments from European Central Bank President Christine Lagarde warning “that the global economy faces a major economic shock unless immediate action is taken.”

On the exports front, the introduction of feed gas to Train 3 at the Freeport liquefied natural gas (LNG) terminal, part of the final commissioning stage for the facility located on Quintana Island on the Texas coast, could add about 0.6 Bcf/d of demand for the U.S. market, according to Tudor, Pickering, Holt & Co. (TPH).

“However, more LNG supply is the opposite of what the global market needs, as pricing has dipped to all-time lows and demand is quickly peeling off as we move into shoulder season,” TPH analysts said in a note to clients Wednesday. Average Dutch TTF (aka Title Transfer Facility) strip pricing for the second and third quarters would “effectively” put U.S. LNG exports “on the margin, with an estimated spread of around 2 cents/MMBtu on a variable cost basis, assuming gas is sourced at a price equal to Henry Hub.”

Japan Korea Marker (JKM) strip pricing over the same time frame would put U.S. LNG “out of the money on a variable cost basis,” according to TPH.

The introduction of feed gas at Freeport Train 3 comes about two months earlier than TPH modeling had indicated. “In a vacuum” this development “shaves about 36 Bcf off year-end U.S. storage balances, but given the state of the global macro, we expect this will be offset by reduced utilization of LNG facilities, which remains the largest risk to U.S. pricing as we move into trough demand season.”

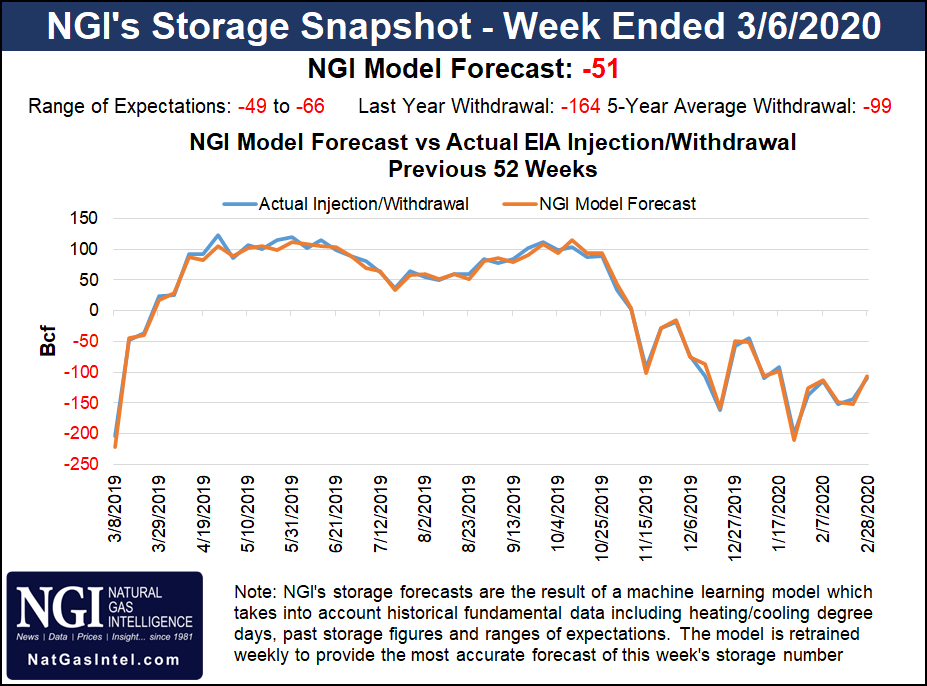

Meanwhile, estimates show the Energy Information Administration (EIA) reporting a lighter-than-average weekly withdrawal from U.S. natural gas stocks on Thursday. A Bloomberg survey Wednesday showed a median 56 Bcf pull, while a Reuters poll landed on a withdrawal of 59 Bcf.

NGI’s model predicted a 51 Bcf withdrawal for the EIA report, which covers the week ended March 6. Estimates as of Wednesday ranged from minus 49 Bcf to minus 66 Bcf.

Last year, EIA recorded a 164 Bcf pull for the similar week, and the five-year average is a withdrawal of 99 Bcf.

Spot prices posted widespread gains for a second straight day Wednesday, paced by a 7.0-cent increase at benchmark Henry Hub.

Western U.S. hubs posted some of the largest increases ahead of cooler temperatures expected to move into regional demand centers by the weekend. Maxar’s Weather Desk called for temperatures to drop to around 8-10 degrees below normal in Seattle over the weekend, including lows in the upper 20s to low 30s. Farther south, the forecaster also called for Burbank to see cooler-than-normal conditions starting Saturday.

Kern River jumped 27.0 cents to $1.980, while Northwest Sumas rallied 30.5 cents to $2.175. In Arizona/Nevada, El Paso S. Mainline/N. Baja slid 5.0 cents to $1.775.

El Paso Natural Gas notified shippers Tuesday of an equipment failure at the Topock compressor, a force majeure event reducing capacity through the pipeline’s “MOJTHRU” location by 117,000 Dth/d and through “MOJAVE” by 54,000 Dth/d until further notice.

Downstream of the maintenance, in California, SoCal Citygate added 16.5 cents to $2.395.

The hydroelectric generation outlook for the Western U.S. has “degraded in recent weeks,” according to Genscape Inc.

In California, drought conditions have reduced snowpack levels in the state to well below-normal levels, the firm said. Based on current snowpack, Genscape estimates that California Independent System Operator (aka CAISO) hydro generation will average 2.75 GWh/d from March through July, about 57% of year-ago levels and 20% below the 10-year average.

The Pacific Northwest’s hydro season projects to be slightly stronger than normal, with hydro generation in the region expected to average close to 13.8 GWh/d from April through July, 22% above year-ago levels and about 1% more than the 10-year average, according to Genscape.

“Pacific region snowpack levels can change very quickly in either direction,” Genscape senior natural gas analyst Rick Margolin said. “Just as quickly as California’s recent drought has wiped out snowpack, Pacific storm systems can pummel the Sierras and Cascades and rebuild snowpack in a matter of days. Right now, weather forecasts are indicating the potential for just such an event later this week and into next.”

Also important to note, according to Margolin, is that California typically imports power from the Pacific Northwest, suggesting a high hydro year to the north could partly offset weak hydro generation in California.

“The bullish impact a low hydro year has on gas markets has progressively diminished over the years with increases in the amount of non-hydro renewable generation capacity additions in the region,” Margolin said. “In California, this has been primarily via solar, and in the Pacific Northwest it has been wind.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |