Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

4Q2019 Earnings: PDC to Cut More Costs, Reduce DJ Basin, Permian Activity in 2020

PDC Energy Inc.’s oil and gas sales declined last year as commodity prices fell, offsetting a 23% increase in year/year production and a 22% annual decline in total costs.

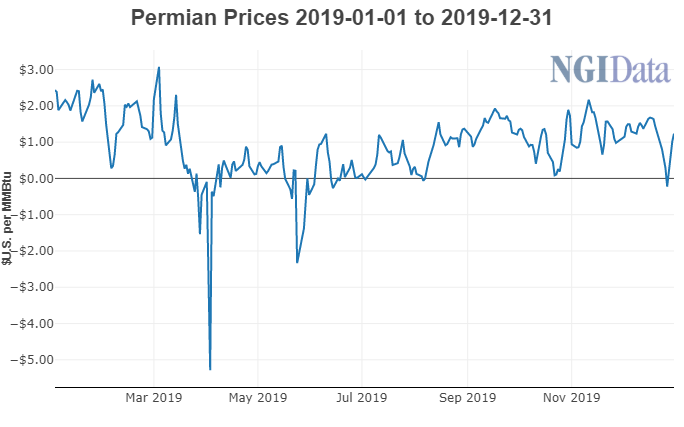

The Denver-based operator, one of the largest producers in the Denver-Julesburg (DJ) Basin after its recent $1.7 billion acquisition of SRC Energy Inc., said it would cut back activity this year in Colorado and West Texas, where it also has assets in the Permian Basin. PDC’s average realized prices for crude oil, natural gas and natural gas liquids fell 24% year/year to $26.46/boe in 2019.

Up to $1.1 billion is earmarked for capital spending this year, or 15% less than the combined spending by SRC and PDC in 2019. Production is still forecast to grow by 6% to 205,000-215,000 boe/d versus the combined volumes of PDC and SRC Energy in 2019.

“The decrease in capital investments is expected to be realized through anticipated reductions to drilling and completion costs, as well as less than originally planned development activity in each basin,” management said.

Like its peers, the company’s plans could change as they were rolled out before crude prices plunged on Monday after a price war broke out between Russia and the Organization of the Petroleum Exporting Countries. Some Lower 48 oil and gas producers have already reacted to the oil rout by announcing plans to curb spending and activity through the rest of the year. At least one producer, Permian Basin pure-play Parsley Energy Inc., has revised its baseline capital expenditures assumption from a $50/bbl West Texas Intermediate (WTI) oil price to a $30-35 average price for the rest of this year.

PDC’s 2020 capital budget contemplated a $52.50 WTI price and a $2.00/Mcf Henry Hub price.

The company produced 49.4 million boe last year, or 23% more than in 2018. Full-year oil production increased 13% year/year to 19.2 million bbl. Overall production volumes also increased during the fourth quarter to 13.1 million boe from 11.8 million boe in the year-ago period.

The Wattenberg field in the DJ of northeastern Colorado continues to drive volumes, accounting for an average of 104,000 boe/d during 2019. Management said last summer it expected higher line pressures in the Wattenberg as the result of a delayed processing capacity expansion, something it’s dealt with periodically in recent years as activity has ramped up in the Rockies. But line pressures reduced as the year came to an end and helped drive a 4% sequential increase in average fourth quarter production of 108,000 boe/d.

In the Permian’s Delaware sub-basin, PDC produced an average of 31,000 boe/d in 2019 and an average of 34,000 boe/d in the fourth quarter. Management said the company realized drilling and completion efficiencies throughout the year, resulting in an 18% decrease in average spud-to-rig release drill times to 27 days and average drilling and completion costs $1,200 per foot, an improvement of 20% from 2018 levels.

In addition to the merger with SRC, PDC also divested its Permian Delaware midstream assets and instituted a stock repurchase plan last year. The company announced changes to its board recently and changes to executive compensation after fending off some shareholder resistance last year.

PDC reported a fourth quarter net loss of $21 million (minus 34 cents), compared with net income of $179 million ($2.71) in the year-ago period.

For the full year, the company reported a net loss of $57 million (minus 89 cents), compared with net income of $2 million (3 cents) in 2018. Management attributed the loss to the steep decline in commodity prices.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |