NGI Mexico GPI | Markets | NGI All News Access

CFEnergía Opens Tender for Natural Gas Supply in Mexico’s Baja California Sur

CFEnergía, the gas marketing arm of Mexican utility Comision Federal de Electricidad (CFE), has issued a call for gas supply in the state of Baja California Sur through “any type of technology.”

The competition will be open to national and international bidders and will be held in Spanish. Information on the tender, including required documents and forms, is available here. Documents to register are available in both English and Spanish on the website.

Pre-registration for interested parties can be done by emailing concursos@cfenergia.com with the required documents through Tuesday, March 17. Delivery of Terms of Reference to interested parties will occur Thursday March 26th .

The points of natural gas delivery will be at power plants Baja California Sur VI, Lechería, CCC BCS, CCC Todos Santos and UME Punta Prieta. The aim of the “competitive and transparent” tender is to allow Baja California Sur to have access to natural gas for the first time “to generate electricity in a more efficient and environmentally friendly way.”

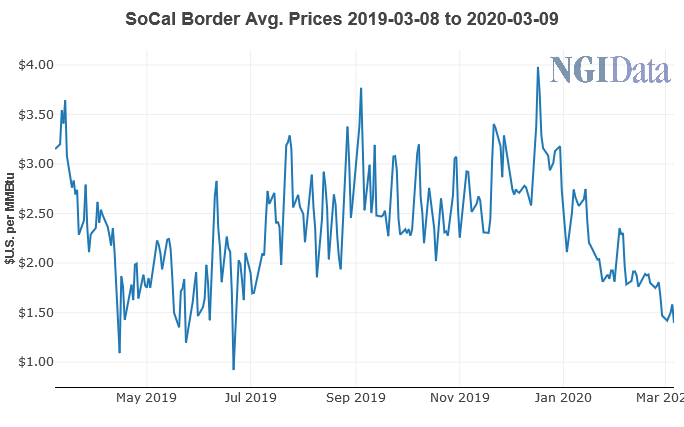

The price of natural gas at NGI‘s SoCal Border Average just north of the border was $1.395/MMBtu on Friday. NGI‘s SoCal Border Average is the reference price index for hundreds of swap and physical contracts that are traded both bilaterally and on the Intercontinental Exchange (ICE).

Baja California Sur is cut off from the national Mexican power grid, and the pipeline system, and as a result sees some of the highest power rates in Mexico, along with periodic power disruptions. Since it has no natural gas supply, the bulk of its electricity is generated from fuel oil and diesel.

The options could include virtual pipelines via trucks or more likely, vessels. U.S. firm New Fortress Energy (NFE) is one company advancing construction of a small-scale liquefied natural gas (LNG) receiving and regasification terminal in the port of Pichilingue in Baja California Sur.

First gas is expected in the third quarter, the company said in a recent presentation, while the project will reach run rate in the fourth quarter. When complete, the facility will be Mexico’s fourth LNG import option.

Pichilingue is located just north of La Paz, the state capital. The NFE project comes with a 105 MW gas-fired power plant and truck-loading bays for the supply of LNG to local hotel and industrial customers.

At a recent energy conference in Mexico City, Gas Natural México (Naturgy Mexico) CEO Jose Sanleandro said that states in Mexico with natural gas have significantly higher gross domestic product than those without. “Natural gas increases investment, jobs, brings downs costs, and it contributes to improving the environment by displacing wood and fuel oil. It’s our mission as a sector to tell people this. We need to do a lot of work as a sector to educate, and also tell the new government so it understands the importance of natural gas to the country.”

Sanleandro, who is also vice president of natural gas association Asociación Mexicana de Gas Natural (AMGN), which represents more than 100 local natural gas companies, offered the example of the Bajío region in central Mexico, which includes parts of the states of Aguascalientes, Jalisco, Guanajuato, and Querétaro, as an example of this success.

During 2008-2018, GDP rose by 36% in the region as access to natural gas increased dramatically. End-users jumped from 70,000 to 210,000 in the period, and pipeline infrastructure rose from 2,500 kilometers (km) to 5,400 km.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |