NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Column: Mexico’s Once Sleepy Pacific Coast Could See New Natural Gas Options as Development Continues

Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column as part of a regular series on understanding this process, written by Eduardo Prud’homme.

Prud’homme was central to the development of Cenagas, the nation’s natural gas pipeline operator, an entity formed in 2015 as part of the energy reform process. He began his career at national oil company Petróleos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), rising to be chief economist, and from July 2015 through February served as the ISO chief officer for Cenagas, where he oversaw the technical, commercial and economic management of the nascent Natural Gas Integrated System (Sistrangas).

The opinions and positions expressed by Prud’homme do not necessarily reflect the views of NGI’s Mexico Gas Price Index.

In the 1990s, with the commercial opening of Mexico, a discussion of a paradigm shift in the energy sector began. “Neoliberals” sought to convert the state energy giants Petróleos Mexicanos (Pemex) and Comisión Federal de Electricidad (CFE) into companies guided by the economic principles of cost minimization and value maximization. Among the plans for change in the energy sector was a reconfiguration of the entire national refining system that, with large investments in coking plants, would extract the highest possible value out of the heavy and sour Maya crude being produced by Pemex.

One aspect of this ambitious plan was that it would limit the availability of fuel oil on the Pacific coast for power generation. At the same time, public concerns also emerged. The black columns of smoke pluming out of power plants running on fuel oil were not only a public health problem for local communities but also a discouragement to visitors who wanted to enjoy the splendid beaches of the area. The burning of fuel oil to generate electricity no longer seemed a sustainable solution for the stability of the electricity sector in this part of Mexico, and so natural gas emerged as a viable alternative in an area that had historically been neglected by the large gas pipeline system run by Pemex.

The first step in this direction occurred in Baja California. The Rosarito and Mexicali generation plants began to run on gas from a pipeline system owned by Sempra Energy that interconnected with southern California. Gradually, this system began to expand and gain complexity in its operations with the construction of a liquefied natural gas (LNG) import plant, Energia Costa Azul (ECA). In an area where the presence of Pemex was non-existent in the field of natural gas, other agents began to fill the vacuum and CFE began to gain relevance as a promoting agent of the natural gas industry in Mexico. For CFE, it was easy to show the energy ministry the savings of replacing the burning of an expensive and inefficient fuel with natural gas and for it to gain permission to build new infrastructure.

The seed of what is now CFEnergia, CFE’s gas trading arm, grew from a modernization plan that sought to extend the gas network of the country. Pipelines were planned to meet a prospective demand of 1.6 Bcf/d on the West Coast, of which 1.3 was related to electricity consumption. Interestingly, in the design of tenders for these pipelines, consumption was not limited to CFE. At the request of the governments of the states of Sonora and Sinaloa, third party demand was also considered, including, for example, a fertilizer plant. In addition, the consumption of 210 MMcf/d for industrial use, 32 MMcf/d for residential users and 8 MMcf/d for businesses was included. The potential volume on the Western side of the country would reach its maximum after a ramp-up that would culminate in 2025.

Each pipeline that was part of this comprehensive plan was tendered individually through a competitive process. After meeting technical requirements, the economic proposal with the lowest net present value of payment obligations for CFE won. In the northwest area, Infraestructura Energética Nova (IEnova), the Mexican unit of Sempra, and Transcanada Corp., which today is TC Energía, were the winners of the four tendered systems.

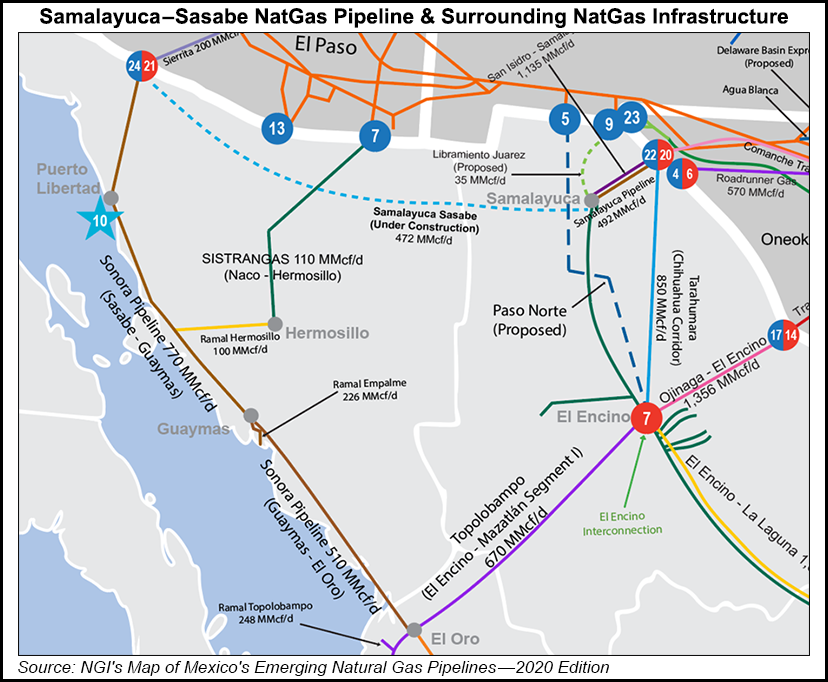

IEnova integrated its two pipelines into a single system. The Sonora Gas Pipeline or Sásabe-El Oro extends 833 kilometers and is divided into two large segments. The first 36-inch diameter segment extends from the border with Arizona in the town of Sásabe, Sonora, to Guaymas with capacity to transport 770 MMc/fd of gas. This segment also includes a 20 kilometer-line that goes to Puerto Libertad to feed the CFE generation plant there. The second segment travels 328 kilometers from Guaymas to El Oro, with capacity of 507 MMcf/d.

In the town of El Oro, the Sonora Gas Pipeline connects to the TC system in the state of Chihuahua. Like IEnova, the latter company agglomerated the routes won in two tenders into a single transport system. The Northwest Natural Gas Conveyor system or El Encino-Mazatlan is a gas pipeline made up of two segments. The first goes from El Encino, south of the city of Chihuahua to the port of Topolobampo, on a 540-kilometer path that crosses the Sierra Madre Occidental. The section that connects El Encino with El Oro has a capacity of 520 MMcf/d. The second section that runs between El Oro and Topolobampo has a capacity of 460 MMcf/d. The El Oro-Mazatlán segment is connected to the IEnova system and its capacity of 200 MMcf/d has as its main destination the Mazatlan Thermoelectric Power Plant.

The philosophy was essentially to receive gas from Arizona and the El Paso Natural Gas system and move the fuel south along the Pacific coast to serve the converted power plants in Puerto Libertad, Topolobampo and Mazatlan. New plants in Topolobampo, Guaymas and Mazatlan with an approximate consumption of 0.5 Bcf/d would reinforce the national electricity system. The injection in El Encino would be fed from the Tarahumara gas pipeline, owned by Fermaca, that starts on the border near Ciudad Juárez (adjacent to El Paso, Texas).

All of this was proposed and implemented before the 2013-14 energy reform, and before Waha became the center of attention for the decision makers of CFE’s gas trading branch. The administration of President Peña Nieto gave a second boost to this region with the Five-Year Gas Pipeline Plan where connectivity to Waha became important to meet the consumption of the Northwest and North of the country.

Sásabe was set as a destination for a route that starts from Samalayuca, which in turn receives gas from a pipeline that reinforces the import capacity in San Isidro. El Encino was set as a destination point for a system that starts at another border point in Ojinaga. Today there is a complex network in place that has generated important expectations as a relief for Permian Basin producers where production is booming.

In practice however, demand is already served by pipelines in operation. In Sasabe there are few days that require volumes greater than 100 MMcf/d. In essence, the existing and potential demand is the same except for some plants that are planned on paper, but not under construction. Hence, the news of the delay on the Carso gas pipeline has had little operational effect, though it does limit the possibility of improving price conditions. Put simply, CFE doesn’t need all the gas it contracted.

But this does open up new avenues for development. One interesting solution: a transfer of significant capacity can give way to LNG export projects in which Mexico could serve as a transit point between cheap U.S. gas and Asian markets. I will go into further detail on this and other possible natural gas projects in my next column.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |