Shale Daily | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

4Q2019 Earnings: Goodrich Well Hedged Against Low Natural Gas Prices, CEO Says

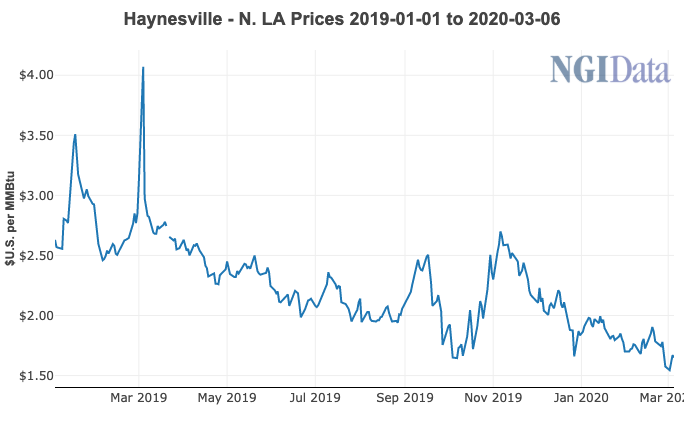

Haynesville Shale pure play Goodrich Petroleum Corp. is well positioned relative to its peers to withstand low natural gas prices and general market uncertainty, company executives said Thursday.

“The current natural gas market presents challenges for all natural gas producers and we’re no exception,” CEO Gil Goodrich told analysts during a 4Q2019 earnings call.

However, the Houston-based company’s low level of debt compared to peers, the quality of its Haynesville assets, “and our very good hedge position” give the firm “great flexibility to deliver positive results during this period of low natural gas prices,” he said. “Our hedging position continues to provide us with excellent protection from the current low prices and delivered almost $10 million in realized derivative gains in 2019.”

Goodrich added that the company’s net realized gas prices averaged $2.53/Mcf in the fourth quarter, when factoring in realized hedge gains on natural gas derivatives.

Having emerged relatively unscathed from bankruptcy protection in 2016, the company is no stranger to adversity.

Its CEO acknowledged, however, that upstream activity in the Haynesville, located mostly in northwestern Louisiana and partially in East Texas, is likely to continue slowing in 2020.

“Our internal numbers suggest that the Haynesville rig count hit about 60 rigs at a peak last year and the most recent week it’s at 38,” Goodrich said. “My personal belief is that that number comes inside of 30 and probably does fairly soon.”

COO Robert Turnham highlighted improvements in well performance, saying “even at a $2.25 gas price, we can generate a 40% IRR [internal rate of return] on our average 7,500-foot lateral wells.”

He added, “Haynesville economics are driven by high volumes, attractive netbacks relative to Henry Hub as compared to other gas basins, low service costs, low lifting costs, and severance tax abatement until the earlier of two years or payout of the well.”

Turnham said that “although we can’t control commodity prices, our team is executing well, our balance sheet is in good shape with low debt metrics, we have a nice hedge position that is minimizing our commodity price risk, and a unit cost structure that is declining, creating competitive margins.”

Goodrich said the firm has slowed its pace of development in response to current low gas prices, and that it expects to generate free cash flow in 2020.

Goodrich delivered a 12.4% return on capital invested (ROCE) in 2019, “which ranks fourth out of the 39 companies in our peer group that have reported fourth quarter financials as of Tuesday,” Turnham said.

Despite the impacts of the coronavirus and liquefied natural gas (LNG) oversupply on pricing, “the back half of this year ought to be better for gas prices and likely for oil prices as well,” Turnham said.

Production averaged 145 MMcfe/d (98% natural gas) in 4Q2019, up from 99 MMcfe/d (97% natural gas) in 4Q2018.

Full-year output grew to 131 MMcfe/d (98% natural gas) from 71 MMcfe/d (95% natural gas).

Midpoint production guidance for 2020 is 149.3 MMcfe/d (99% natural gas), with capital expenditure (capex) in the range of $55-$65 million, down from $98.4 million in 2019.

Goodrich expects an average realized natural gas price of Henry Hub less 20-30 cents for the year.

Goodrich reported a net loss of $900,000 for the fourth quarter (minus 8 cents/share), versus net income of $8.1 million (68 cents/share) in the year-ago period.

Full-year net income rose to $13.3 million ($1.09/share) from $1.8 million (15 cents/share).

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |