NGI All News Access | Coronavirus | Infrastructure | Markets

Against Backdrop of Coronavirus Fears, Natural Gas Futures Retreat

On another down day for major stock indexes amid coronavirus concerns, natural gas futures Thursday failed to extend their recent run higher, with an on-target storage figure and mild weather offering little upside for prices. The April Nymex contract went on to settle 5.5 cents lower at $1.772/MMBtu. May fell 5.2 cents to $1.813.

In the spot market, a short-lived blast of cold to close out the week helped push Northeast prices slightly higher; NGI’s Spot Gas National Avg. added 2.5 cents to $1.585.

April West Texas Intermediate crude futures tumbled 88 cents to settle at $45.90/bbl Thursday, echoing a drop in stocks as the spread of the coronavirus has disrupted business as usual for the world’s economy.

In another sign of the global outbreak’s impact on energy demand, the Organization of the Petroleum Exporting Countries (OPEC) on Thursday recommended that members reduce global crude output through the end of the year, with an additional adjustment through June.

Last December the Saudi-led cartel and its allies, including Russia, had agreed to reduce collective output by around 1.7 million b/d. In concluding a special, or “extraordinary” meeting in Vienna on Thursday, OPEC recommended the reduced output level extend through the end of the year.

In addition, because of “current fundamentals and the consensus on market perspectives,” OPEC recommended a further adjustment of 1.5 million b/d through the end of June.

The move follows forecasts that world oil demand in the first quarter will decline by the largest volume in history, exceeding the fall-off during the financial crisis that began in late 2008.

Against this backdrop, a natural gas market already weighed down by a supply glut and mild weather couldn’t muster any further upward momentum Thursday. After testing four-year lows around $1.650 late last week, the front month rebounded to as high as $1.847 in Thursday’s session before reversing course.

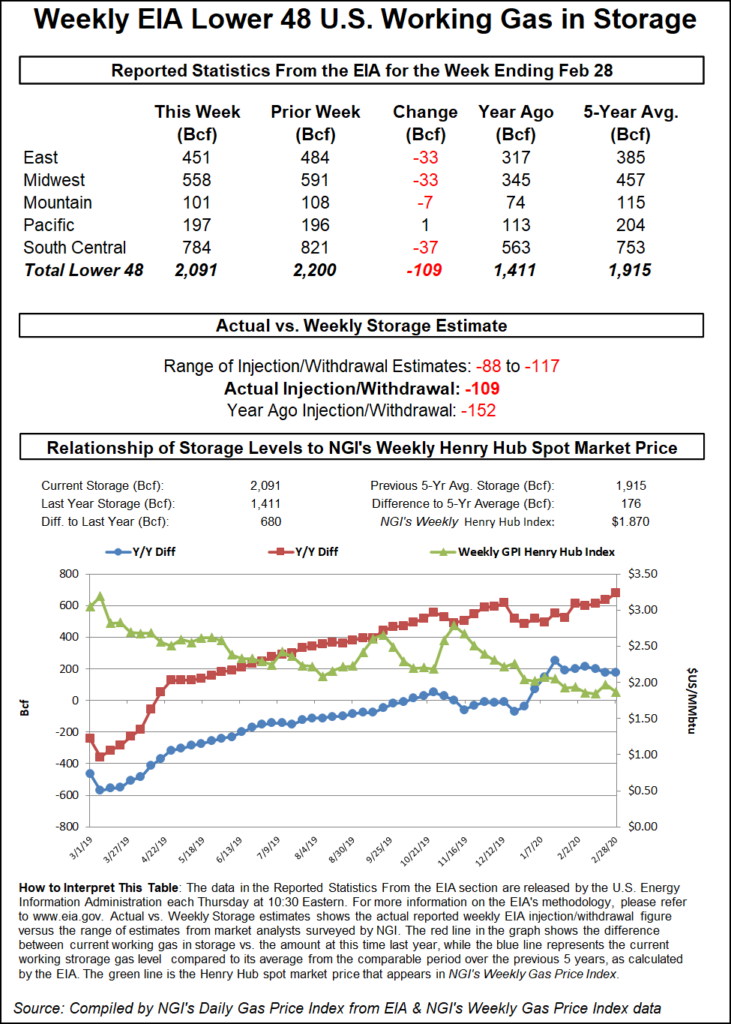

A good chunk of the day’s selling occurred after the Energy Information Administration (EIA) reported an on-target 109 Bcf weekly withdrawal from U.S. gas stocks at 10:30 a.m. ET.

The 109 Bcf pull, recorded for the week ended Feb. 28, more or less perfectly matched consensus predictions and was also close to the five-year average withdrawal of 106 Bcf. Last year, EIA recorded a 152 Bcf withdrawal for the similar week.

A Reuters poll had settled on a withdrawal of 108 Bcf, while a Wall Street Journal survey had landed on a 109 Bcf pull. Estimates submitted to Bloomberg had shown a median withdrawal of 110 Bcf. NGI’s model predicted a 106 Bcf withdrawal.

“We feel this shows that last week’s bearish miss was an aberration, or somewhat of a ”make-up’ for the prior week’s bullish miss,” Bespoke Weather Services told clients shortly following EIA’s report. The print “reflects balances that are back tighter, supportive of prices at these low levels, all else equal, though we are still fighting a very warm, low demand weather pattern.

“Our end-of-season is now around 1.96 Tcf, higher than a week ago thanks to continued warmth.”

Total Lower 48 working gas in underground storage stood at 2,091 Bcf as of Feb. 28, 680 Bcf (48.2%) higher than year-ago stocks and 176 Bcf (9.2%) above the five-year average, according to EIA.

By region, the East and Midwest each withdrew 33 Bcf week/week. The Mountain region pulled 7 Bcf, while the Pacific saw a net injection of 1 Bcf. EIA recorded a 37 Bcf withdrawal in the South Central; salt stocks decreased by 15 Bcf, while nonsalt saw a 23 Bcf drawdown.

Thursday’s report was in line with historical norms, but the next three EIA storage numbers are on track to come in lighter than normal as warm conditions figure to dominate most of the country over the next 15 days, according to NatGasWeather.

“There’s still a quick cold shot across the Midwest and East” on Friday and Saturday, “but the pattern after is quite bearish with cold air retreating into Canada” and providing “only glancing shots” of chillier temperatures for the northernmost portions of the United States, the forecaster said.

The American and European datasets “are both bearish and would require much colder trends to change sentiment. Again, there’s still time for stronger pushes of cold air to arrive into the U.S. to cash in on the tighter balance, but this needs to show up in the maps very soon.”

A brief spell of chillier temperatures sweeping through to close out the week helped to nudge Northeast prices higher Thursday, although gains were less than impressive. Transco Zone 6 NY added 2.0 cents to average $1.675.

“A quick cool shot will race across the Great Lakes and Northeast Friday to Saturday for a modest bump in national demand as lows drop into the teens to 30s,” NatGasWeather said Thursday. “Not strong, just better demand for a couple days.”

The bump in demand barely registered on Midwest prices, as hubs in the region followed up gains in Wednesday’s trading with losses Thursday. Michigan Consolidated slid 2.5 cents to $1.655.

Out West, points throughout the Rockies and Pacific Northwest saw modest gains on the day. Northwest Sumas climbed 8.5 cents to $1.555.

North of the border in Canada, Westcoast Station 2 picked up C$10.5 cents to average C$1.795/GJ.

Following the results of a Transportation Safety Board of Canada (TSB) investigation into the October 2018 pipeline rupture near Prince George, British Columbia (BC), Enbridge Inc.’s Westcoast Energy system could see future capacity restrictions to allow for inspections, according to Genscape Inc.

“The rupture caused a shutdown of the pipe and later significant capacity reductions,” Genscape senior natural gas analyst Rick Margolin noted. “This triggered extreme basis volatility in downstream Pacific Northwest markets along with periodic outages and curtailments to consumers in BC. The pipe was eventually returned to full service last year, but future inspections and remediation may be in store based on TSB’s findings.”

In its report the TSB attributed the rupture to “stress corrosion cracks” on the outside of the pipeline’s surface that “grew over time” and eventually combined into a “larger single crack” that led to failure under normal operating pressure.

For its part, Enbridge said in a notice to shippers that it has since completed a “comprehensive pipeline integrity program” in an effort to prevent a similar incident from occurring in the future.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |