No Surprises from EIA as Natural Gas Storage Report Inspires Futures Selling

The Energy Information Administration (EIA) Thursday reported an on-target 109 Bcf weekly withdrawal from U.S. natural gas stocks, but the number brought out some selling in the futures market.

The 109 Bcf pull more or less perfectly matched consensus predictions and was also close to the five-year average withdrawal of 106 Bcf. Last year, EIA recorded a 152 Bcf withdrawal for the similar week.

In the hour or so leading up to this week’s report, the April Nymex contract traded as high as $1.823/MMBtu and as low as $1.798. As the print crossed trading screens at 10:30 a.m. ET, the front month moved up and down in the $1.800-1.820 area before sliding

By 11 a.m. ET, April was trading around $1.797, down 3.0 cents from Wednesday’s settle.

Prior to the report, market observers had been looking for a triple-digit withdrawal very close to the actual figure.

A Reuters poll settled on a withdrawal of 108 Bcf, while a Wall Street Journal survey landed on a 109 Bcf pull. Estimates submitted to Bloomberg showed a median withdrawal of 110 Bcf. Across the surveys, expectations ranged from a pull of 88 Bcf up to a withdrawal of 117 Bcf for the report, which covers the week ended Feb. 28. NGI’s model predicted a 106 Bcf withdrawal.

“We feel this shows that last week’s bearish miss was an aberration, or somewhat of a ”make-up’ for the prior week’s bullish miss,” Bespoke Weather Services told clients shortly following EIA’s report. The print “reflects balances that are back tighter, supportive of prices at these low levels, all else equal, though we are still fighting a very warm, low demand weather pattern.

“Our end-of-season is now around 1.96 Tcf, higher than a week ago thanks to continued warmth.”

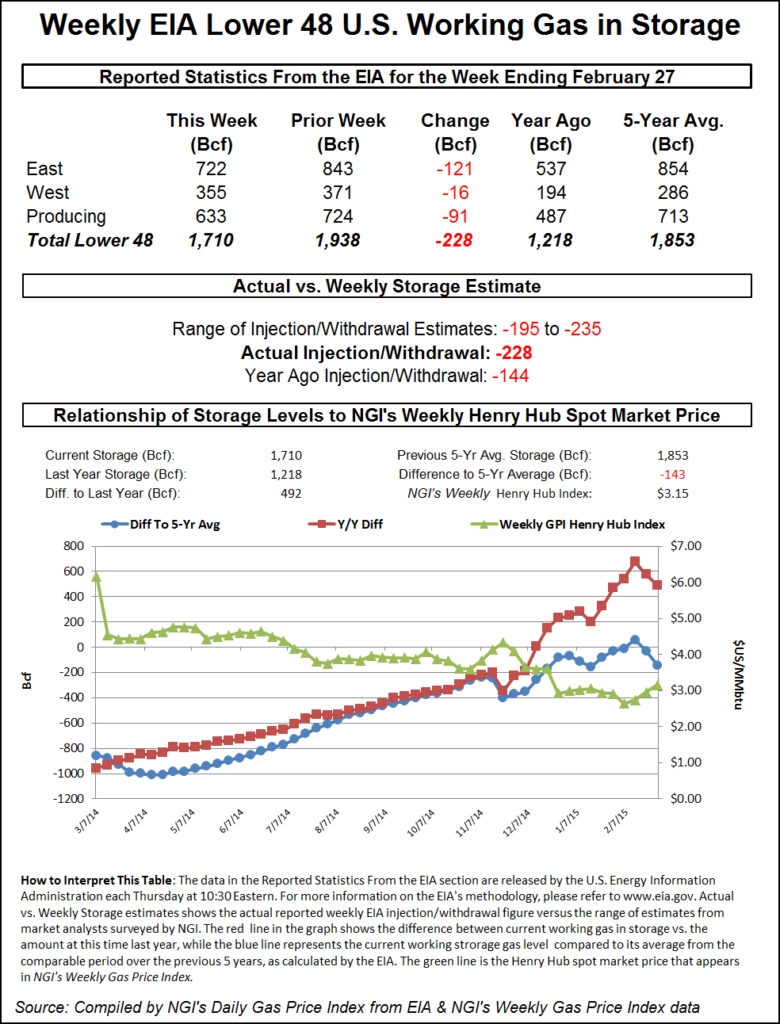

Total Lower 48 working gas in underground storage stood at 2,091 Bcf as of Feb. 28, 680 Bcf (48.2%) higher than year-ago stocks and 176 Bcf (9.2%) above the five-year average, according to EIA.

By region, the East and Midwest each withdrew 33 Bcf week/week. The Mountain region pulled 7 Bcf, while the Pacific saw a net injection of 1 Bcf. EIA recorded a 37 Bcf withdrawal in the South Central; salt stocks decreased by 15 Bcf, while nonsalt saw a 23 Bcf drawdown.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |