Natural Gas Futures Continue Gains as ‘Solid Bottom’ Potentially in Place

The natural gas futures market extended its recent move higher Wednesday, with fading cold weather potentially allowing traders to shift their attention to tighter balances. Continuing to rebound after a test of long-term support late last week, the April Nymex contract picked up another 2.7 cents to settle at $1.827/MMBtu. May settled at $1.865, also up 2.7 cents.

In the spot market, a positive day for West Texas hubs helped send NGI’s Spot Gas National Avg. 5.0 cents higher to $1.560/MMBtu.

Mild temperatures have been more or less baked into the outlook well into the month of March, and Wednesday’s guidance did little to change that perception. As the shoulder season approaches, it’s possible the market would more easily “shrug off” what figures to be weak weather-driven demand ahead, according to Bespoke Weather Services.

“The balance side of the equation remains supportive, in our view, and can now steal some of the market’s attention now that we are late in the weather-heavy season,” Bespoke said. “It is worth a brief mention also that we have noticed a strange correlation with the equities market as well, as large rallies there seem to drag the natural gas market a little higher.

“…We prefer neutrality still in the near term, although we do expect prices to move higher as we move into the spring season, barring any confirmation” of a major slowdown in liquefied natural gas (LNG) exports.

EBW Analytics Group said the price action this week suggests “a belief that a solid bottom is in place” at Friday’s intraday low around $1.645.

In addition to warmer-than-normal temperatures forecast for the next couple weeks, “as we move deeper into March, increased wind and solar output may further suppress demand,” EBW said. “It is possible, though, that natural gas will continue to push higher near term.”

Genscape Inc. described recent natural gas price gains along the forward curve as an apparent “sympathy move with oil.

“As weather forecasts continue to revise warmer and remove demand from the near-term outlook, the forwards price gains appear to be pegged to the modest rally in crude,” Genscape senior natural gas analyst Rick Margolin said. West Texas Intermediate futures rallied Tuesday “on prospects of production cuts” from the Organization of Petroleum Exporting Countries (aka OPEC).

Oil futures pulled back slightly Wednesday, going on to settle at $46.78/bbl, off 40 cents day/day.

Energy analysts have been closely monitoring the impacts of the coronavirus outbreak, and, at least as it pertains to oil markets, the theme from the latest research Wednesday was demand destruction. In fact, world oil demand in the first quarter is forecast to decline by the largest volume in history, exceeding the fall-off during the financial crisis that began in late 2008.

“This is a sudden, instant demand shock, and the scale of the decline is unprecedented,” said IHS Markit’s Jim Burkhard, head of oil markets. Because of the “unprecedented stoppage” in Chinese economic activity during February, and the subsequent spread of Covid-19, “we estimate that world oil demand in first quarter 2020 will be 3.8 million b/d lower than a year earlier,” representing a revision of 4.5 million b/d from estimates before the spread of Covid-19, as it is officially known.

“Never before has such a quarterly drop been recorded,” Burkhard said. “The previous largest decline was in 2009, when oil demand fell 3.6 million b/d in the first quarter.”

The fate of oil markets could have implications for associated gas production in the North American onshore. Based on Genscape estimates, Lower 48 dry gas production volumes have been “in retreat” recently, averaging 92.6 Bcf/d through the first four days of March. That’s down around 0.6 Bcf/d from the average over the final seven days of February.

The firm said in a note to clients that Gulf Coast region production is down 0.27 Bcf/d, with Permian volumes off by 0.22 Bcf/d. Rockies output is down around 0.15 Bcf/d, and production in the Midcontinent is down around 0.1 Bcf/d.

“We believe there is close to 0.6 Bcf/d of freeze-offs, with the bulk in the Green River area of southwestern Wyoming and some in the Denver-Julesburg,” Genscape said.

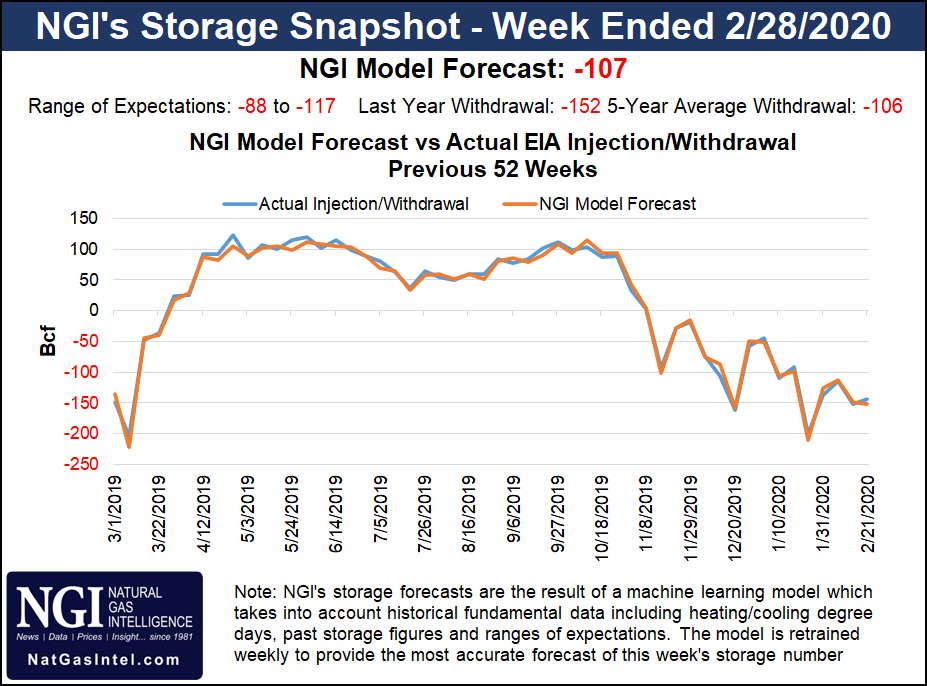

Meanwhile, estimates have been pointing to a near-average withdrawal from Thursday’s weekly Energy Information Administration (EIA) storage report.

A Reuters poll settled on a withdrawal of 108 Bcf for the week ended Feb. 28, while a Wall Street Journal survey landed on a 109 Bcf pull. Estimates submitted to Bloomberg showed a median withdrawal of 110 Bcf. Across the surveys, expectations ranged from a pull of 88 Bcf up to a withdrawal of 117 Bcf. NGI’s model predicted a 106 Bcf withdrawal.

Last year, EIA recorded a 152 Bcf withdrawal for the similar week, and the five-year average is a pull of 106 Bcf.

Energy Aspects issued a preliminary estimate for a 116 Bcf withdrawal.

“An erosion in degree days has dragged down our estimated residential/commercial demand by 5 Bcf/d,” the firm said. “This could be the last triple-digit withdrawal of the season,” depending on the amount of weather-driven demand that materializes during the report week ended March 13.

After dropping below zero to start the week, West Texas hubs clawed their way back into positive territory in day-ahead trading Wednesday. Waha added 42.0 cents to average 28.5 cents.

The arrival of spring might cause some unpleasant flashbacks for West Texas natural gas sellers, who had to pay dearly at times to unload their volumes in the spot market in 2019. An imbalance between Permian Basin associated gas production and available takeaway capacity has continually seen West Texas prices trade at a steep discount to surrounding regions.

Demand across the border in Mexico could provide a release valve for some of the pent-up Permian supply, but Grupo Carso SAB de CV has once again pushed back the completion date of its 36-inch diameter, 472 MMcf/d Samalayuca-Sasabe pipeline, with startup now projected for September. Genscape Inc. analysts have said the delay prolongs about 0.25 Bcf/d of relief for the Permian, arguing that the pipeline “provides an alternative, cheaper, more direct route for Permian molecules to flow to northwestern Mexican markets.”

One piece of good news for Permian producers is that the final segment of the Wahalajara system, the 0.9 Bcf/d Villa de Reyes-Aguascalientes-Guadalajara pipeline, is to be complete by the end of the month, a spokesperson for developer Fermaca recently told NGI’s Mexico GPI.

In December, the 453-kilometer (281-mile), 1.3 Bcf/d La Laguna-Aguascalientes pipeline, the first part of the system, began commercial operation. When the system is fully functional, it would move gas from Waha to Mexico’s industrial heart of Guadalajara.

Elsewhere in the Lower 48, spot prices generally traded within a nickel of even as cooler temperatures and wintry precipitation arriving in parts of the Midwest and East the next few days proved insufficient to really move the needle.

“An area of low pressure taking shape over the lower Canadian Prairies will move into the Upper Midwest Wednesday night,” the National Weather Service said. “In advance of the storm, snow will fall across the Upper Midwest and northern Great Lakes late Wednesday into Thursday.

“As an upper level trough associated with this system dives south and east towards the Northeast on Friday, colder temperatures will also filter southward behind a passing cold front, leading to a combination of rain showers along the coast and snow showers in the central and northern Appalachians. Some accumulating snow in parts of the interior Northeast is possible Friday evening.”

Modest gains were the norm in the Midwest. Joliet picked up 4.5 cents to $1.660. Farther east, Algonquin Citygate added 2.0 cents to $1.685, while Tenn Zone 6 200L gained 13.5 cents to $1.900.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |