Shale Daily | E&P | NGI All News Access

Crestwood Signs G&P Deal with Oxy, Brings Online New Bucking Horse Plant

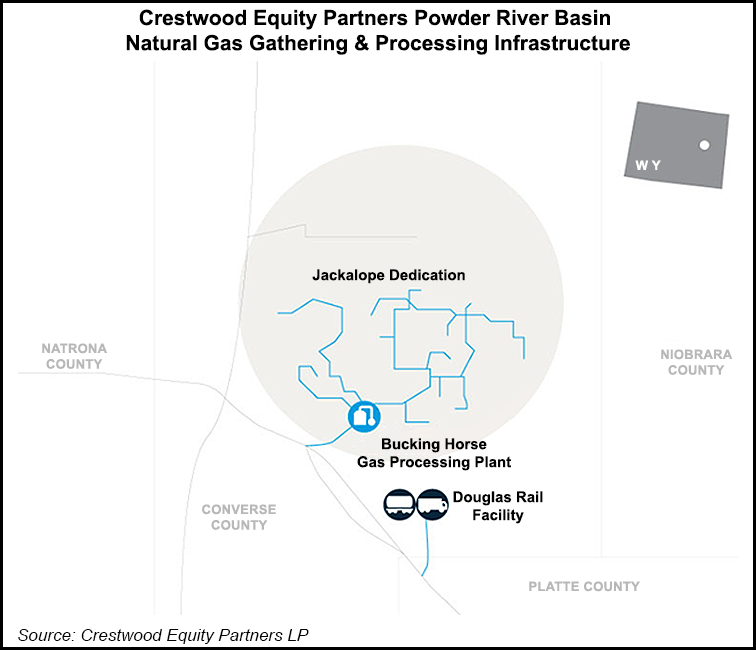

Crestwood Equity Partners LP has inked a new gathering and processing agreement to provide wellhead services for Occidental Petroleum Corp.’s (Oxy) 2020 delineation program in the Powder River Basin (PRB).

The dedication is on the eastern portion of the existing Jackalope Gas Gathering Services system, which Crestwood fully acquired from Williams last year, and would require “minimal incremental capital” to connect the wells due to their proximity to the existing system, according to management.

“The multiple stacked plays in the basin provide enormous potential for our producers, and as a result, capital continues to be allocated to growing oil production in the basin,” Crestwood CEO Robert Phillips said.

Oxy, one of the largest operators in the basin with around 400,000 net undeveloped acres, continues to assess the PRB assets it acquired in its takeover of Anadarko Petroleum Corp., although management doesn’t expect to be “very aggressive” in the basin this year. Instead, activity likely will pick up toward the latter part of 2021, CEO Vicki Hollub said last month during a fourth quarter earnings call.

“That team will make some significant noise in the Powder River, I believe, once they get started,” she said.

Oxy also is in discussions with Wyoming state officials to sell 1 million surface acres and over 4 million mineral acres as it works to pay off debt. The land includes revenues from producing royalties, primarily from trona, but also from oil and gas, coal, other hard minerals and surface use, such as wind farms and grazing, according to Oxy Senior Vice President, Corporate Strategy & Development Oscar Brown.

The executive said that while the state has “clearly communicated a lot of interest in this asset, it is a competitive process, and there’s a large number of qualified participants in that. And the winner of that asset will be one of the largest land and mineral owners in the United States.”

Crestwood also brought into service an expansion of its Bucking Horse processing system in Converse County, WY, an asset that management views as “part of the solution to reduce flaring in eastern Wyoming.”

The 200 MMcf/d Bucking Horse II processing plant brings Crestwood’s total processing capacity in the basin to 345 MMcf/d and completes Crestwood’s three-year investment program to align its assets with its producers’ plans in the company’s core growth basins, according to Phillips, who said the plant was brought online on time and under budget.

The expansion positions Crestwood to be “extremely competitive at attracting new third-party volumes” from producers like Occidental and others “that are starting their development and delineation programs in 2020, as well as offset processors that may need excess capacity or are thinking about shutting down old plants and trying to optimize their facilities,” Phillips said last month on a fourth quarter earnings call.

“We’re in a good position there to add significant volumes to our processing complex and probably add significant acreage to our commercial footprint there in the heart and core of the Powder River Basin,” the company chief said.

There are currently 19 rigs running in the Powder River Basin, three of which are running on acreage dedicated to the Jackalope system, according to Crestwood. For full-year 2019, the Jackalope system averaged gathering volumes of 145 MMcf/d and processing volumes of 125 MMcf/d, increases of 41% and 46%, respectively, over 2018.

Crestwood expects to connect 45-50 wells to the Jackalope system this year based on current development plans from Oxy, as well as Chesapeake Energy Corp. and Oklahoma-based Panther Energy Co. LLC. The firm estimates volume growth of 10% for gathering volumes and 15% for processing volumes over full-year 2019.

With the Bucking Horse II plant complete, Crestwood’s capital requirements in the basin are expected to decrease substantially, with future capital invested towards various expansion and optimization projects across the system, including line looping and compression.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |