NGI All News Access | Coronavirus | LNG Insight | Markets

LNG Recap: Busy Stretch for U.S. Export Development as Global Outlook Remains Weak

U.S. liquefied natural gas (LNG) exports bounced back during the week ending Feb. 26 as 18 vessels departed carrying 69 Bcf, according to the Energy Information Administration (EIA).*

That compares to 14 ships carrying 49 Bcf that left the prior week, when foggy conditions along the Gulf Coast and terminal maintenance impacted operations, including feed gas deliveries.

Genscape Inc. said Tuesday pipeline deliveries to U.S. export terminals have dropped again to 7.19 Bcf/d, the “lowest mark in 18 days and the second lowest level in 45 days.” The firm said deliveries to Cheniere Energy Inc.’s Sabine Pass facility, the largest of its kind in the country, were down to 2.6 Bcf/d on Tuesday, the lowest level since mid-January. Genscape said “monitors detected disruptions to operations at a couple of trains” there.

NGI’s U.S. LNG Export Tracker showed a similar drop in feed gas, with volumes dipping below the 7 Bcf/d mark from a high of nearly 9 Bcf/d on Saturday.

[View NGI’s U.S. LNG Export Tracker]

However, deliveries to Sempra Energy’s Cameron LNG terminal in Louisiana have been on the rise. The company said Monday the facility’s second train has started commercial operations. The terminal came online last August and a third train is expected to start commercial operations in 3Q2020.

FERC on Monday also authorized the Kinder Morgan Inc. (KMI) Elba LNG terminal in Georgia to start service from its fifth moveable modular liquefaction system. Elba’s first LNG cargo left late last year. All 10 of the smaller 0.3 million metric tons/year (mmty) units are expected to enter service this year.

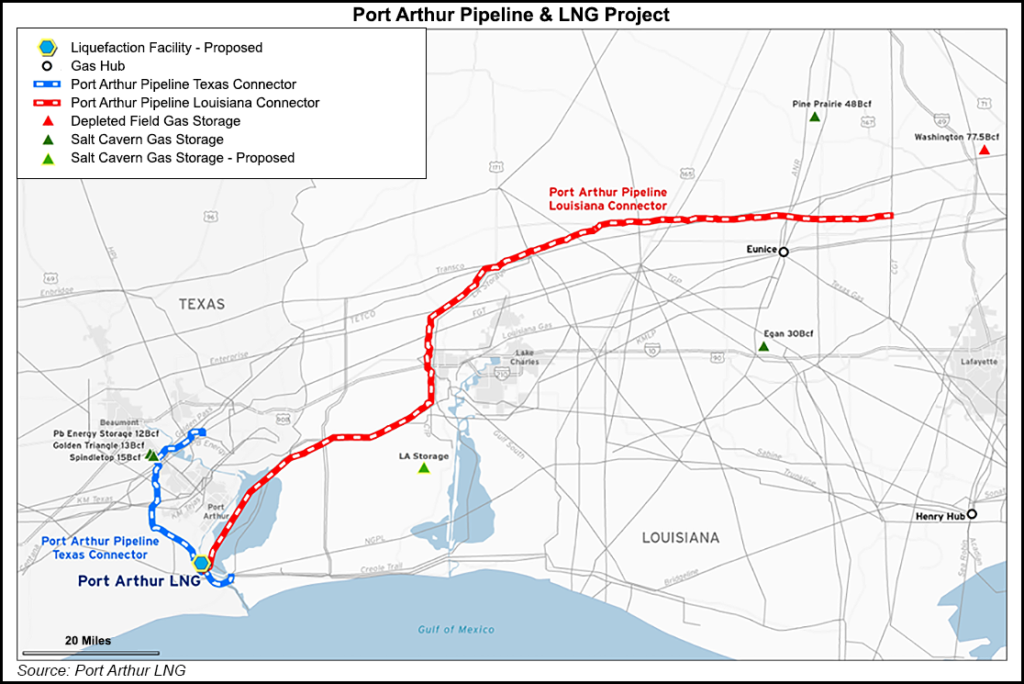

Meanwhile, another Sempra project inched forward on Tuesday. The company entered a fixed-price engineering, procurement and construction contract for the Port Arthur LNG terminal under development east of Houston near the Houston Ship Channel. Sempra has tentative supply and equity investment deals with an affiliate of Saudi Arabian Oil Co., aka Saudi Aramco, and an agreement to supply Polish Oil & Gas Co. However, the 13.5 mmty facility would need to finalize other customer commitments, secure financing and secure permits before it becomes reality.

Topping a busy stretch for U.S. development, Venture Global LNG Inc. signed a deal last week to supply Paris-based utility Électricité de France SA with 1 mmty for 20 years from its proposed Plaquemines LNG facility in Louisiana. KMI in early February filed two applications with the Federal Energy Regulatory Commission to supply Plaquemines with 2 Bcf/d.

The Evangeline Pass project calls for expansions and modifications to existing infrastructure on the Southern Natural Gas and Tennessee Gas Pipeline systems that are expected to enter service in 2022.

U.S. LNG producers continue to face headwinds in the global market, which has been roiled by a supply glut and the coronavirus outbreak.

Oil prices staged a comeback on Monday after a historically bad stretch last week. Hopes that the Organization of the Petroleum Exporting Countries and its allies announce further production cuts and the Federal Reserve’s decision to cut U.S. interest rates didn’t seem to have much of an impact during a volatile session on Tuesday.

Henry Hub, along with key natural gas futures in North Asia and Europe, also saw gains as the week got underway, but the outlook is still grim.

“The renewed macro sentiment has spilled over to European gas markets as well, providing support on the whole curve,” said Schneider Electric analyst Balint Balazs of Monday’s gains. However, any increase in “near-term contracts should be limited” as European fundamentals remain unchanged.

LNG sendout on the continent is expected to spike this week as more cargoes can unload now that windy weather has died down and natural gas storage inventories still remain high on consistently warm weather and a forecast that looks the same heading into March, Balazs said.

In China, where demand has been impacted in recent weeks by the coronavirus outbreak, imports appear to be normalizing again, said ClipperData’s Kaleem Asghar, director of LNG analytics. There were only five vessels floating in the Asia Pacific on Tuesday, with one near China, Asghar said, adding that 18 cargoes had unloaded at Chinese terminals in the past seven days.

Concerns about the virus and its impact on global commodities persist. A spike in cases in Japan and South Korea, among the world’s top LNG buyers, continues to threaten demand as measures to help stop the spread, such as the closing of schools in Japan, could limit imports at a time when inventories are already high.

Prices remain low as the maximum Gulf Coast LNG netback for April between North Asia and Europe on Monday (March 2) was $2.361/MMBtu, or only 0.605 cents above where Henry Hub futures settled, according to NGI data.

*Clarification: The original version of this story overstated the number of LNG vessels that left the United States during the week ending Feb. 26 because of a third-party data reporting error. The mistake was unknowingly republished by the EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |