Shale Daily | E&P | NGI All News Access

NatGas Production Up Again Last Year in Ohio and Pennsylvania

Unconventional natural gas production in Ohio and Pennsylvania again posted gains last year, but the annual growth rate in both states slowed as operators have cut budgets amid a slide in commodity prices.

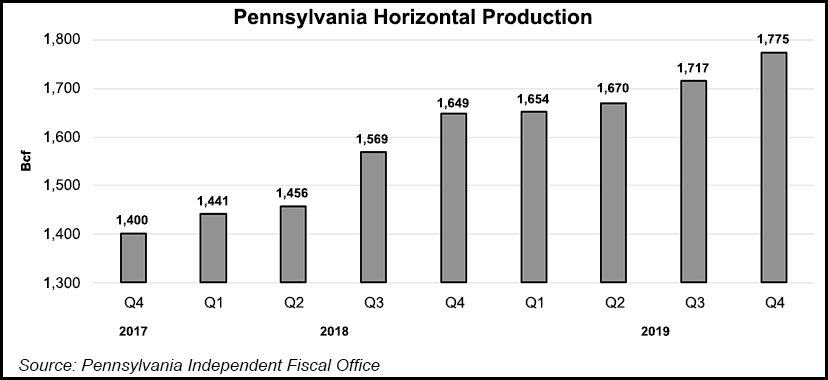

In Pennsylvania, the nation’s second largest gas-producing state behind Texas, unconventional operators reported 6.8 Tcf of production last year, up 11.4% compared to 2018, according to recently released data from the state’s Independent Fiscal Office (IFO). That compares to an average annual growth rate of 18.9% between 2012 and 2019. Volumes in Pennsylvania are mostly driven by the Marcellus, Utica and Upper Devonian shales.

Fourth quarter natural gas production in the state was also more modest at 1.78 Tcf, up about 7.6% from the year-ago period, the lowest growth rate in more than two years IFO said. Volumes were also up from 1.72 Tcf in 3Q2019. The IFO noted that from 4Q2017 to 4Q2019, horizontal production increased by 26.8%. There’s been a quarter/quarter increase in horizontal production for 14 consecutive quarters. The IFO also tracks results from vertical wells drilled to unconventional formations, but they account for a marginal share of quarterly volumes.

Operators reported production from 9,442 wells in 2019, compared to 8,737 the prior year. Well inventory, which the IFO defines as those shut-in or drilled, but not completed (DUC), also declined by 11.8% year/year to 1,288 wells in the fourth quarter, which was also down 6% from 3Q2019.

Producers have leaned more on their DUC inventory in Appalachia as they’ve cut development spending in favor of more capital discipline. All of Appalachia’s leading unconventional producers have announced cuts to their budgets this year.

In Ohio, unconventional production, primarily from the Utica Shale, increased by about 8% year/year to 2.6 Tcf, according to the Ohio Department of Natural Resources (ODNR). That pales in comparison to the 41% year/year increase between 2017 and 2018. Oil production was far stronger in the state last year as some operators flocked to more lucrative liquids-rich acreage. Oil production for 2019 came in at 24.8 million bbl versus the 19.7 million bbl reported in 2018.

Growth rates were similar during the fourth quarter, when natural gas increased 3.2% year/year to 684.8 Bcf. Oil volumes were up 17% to 6.8 million bbl. Ohio law does not require separate reporting for natural gas liquids or condensate, which is included in the oil and gas totals.

ODNR’s fourth quarter report listed 2,523 horizontal shale wells, of which 2,452 reported oil and gas production. The average amount of oil produced per well was 2,774 bbl, while the average amount of natural gas produced per well was 279.3 MMcf.

There are 2,719 Utica wells drilled in the state and 3,200 permitted, according to the latest ODNR data. Operators have also drilled 51 wells into the Marcellus and permitted another 77 of those wells.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |