NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weekly Natural Gas Prices Brush off Fleeting Cold as Futures Plunge Toward $1.60

Despite another glancing blow of crisp air across the Lower 48 this week, natural gas prices failed to maintain momentum and ended the Feb. 24-27 period sharply lower week/week. NGI’s Weekly Spot Gas National Avg. for the four days through Thursday tumbled 13.5 cents to $1.685. Friday trading was not included as it was for March gas delivery.

Prices began strengthening midweek as a weather system that sent overnight temperatures in Texas below zero was set to head eastward by Thursday. However, forecasts noted that the system wasn’t as cold as weather data had once projected and also was expected to move out more quickly, leading to a dramatic sell-off to end the week despite blizzard conditions in much of upstate New York.

“Mild conditions will return across most of the United States late this weekend and next week,” with widespread highs of 40s to 60s across the northern part of the country and 60s to 80s across the southern states for very light national demand, according to NatGasWeather.

With warmer weather on tap, Algonquin Citygate prices plunged 37.5 cents week/week to average $2.02. Transco Zone 6 NY tumbled 34.0 cents to $1.780.

Steep losses also were seen across Appalachia, where Texas Eastern M-3, Delivery prices dropped 27.5 cents week/week to $1.705, and in the Southeast, where Transco Zone 5 prices lost 28.5 cents on the week.

Declines across the rest of the country were capped at around 15 cents week/week, with prices in the Midcontinent falling to the $1.50s and Permian Basin pricing sliding back to zero. Waha fell 11.0 cents week/week to average 26.0 cents.

Natural gas futures, which briefly rallied back above $2 on Feb. 20, took a dramatic turn during this week as warmer weather models threw cold water on bulls’ hopes for higher prices.

The weather data overnight Thursday trended further milder as the American model lost more than 10 heating degree days (HDD) and the already warmer European model lost another 3-4 HDDs, according to NatGasWeather. Both are now “quite bearish” with the pattern through the middle of March, with only “glancing shots” of cold air expected across the far northern United States and mild to warm over the rest of the country.

“Bulls just can’t get a break this winter season with weather patterns trending milder in time in almost every instance where cold teases it might last more than several days,” NatGasWeather said. “It certainly helps the supply/demand balance has tightened considerably, but to fully cash in, weather patterns need to cooperate, and they simply haven’t all winter.”

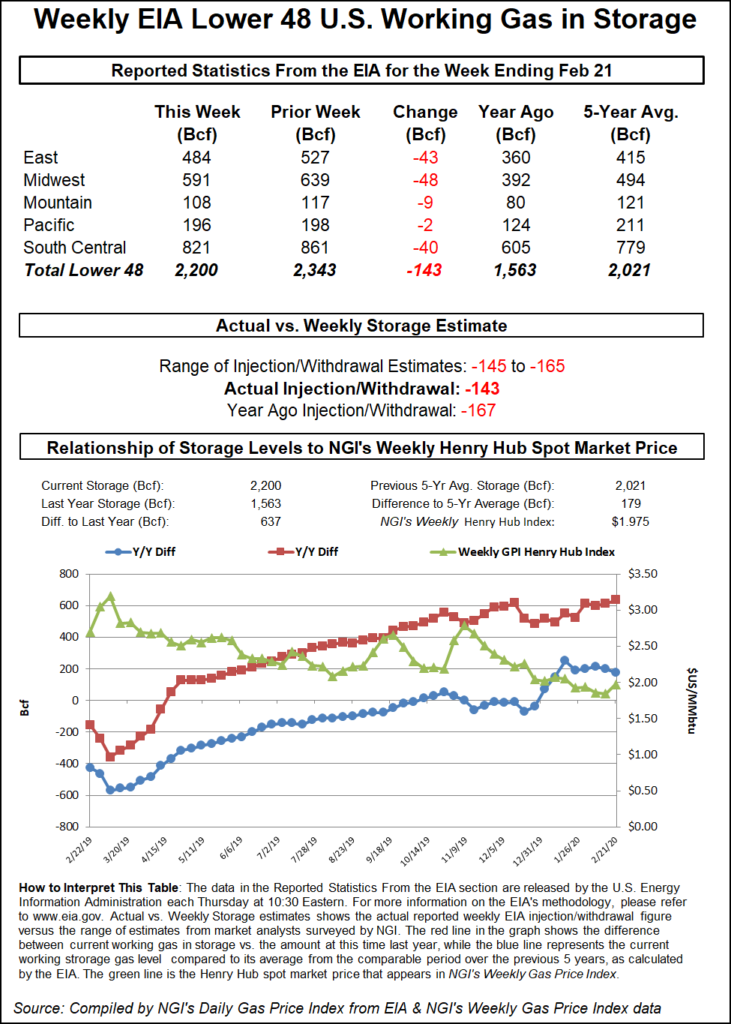

The upcoming span of mild weather is set to expand an already hefty storage overhang. The latest data from the Energy Information Administration (EIA) delivered a gut punch to the market when, after several weeks of reporting tighter data, the agency said the market withdrew a paltry 143 Bcf from storage inventories for the week ending Feb. 21. The much smaller-than-expected draw led to a wave of volumes being traded as prices had already fallen around 9 cents early Thursday, before the EIA report was released.

The April Nymex contract then plunged as low as $1.719 before trimming its losses ahead of the close. Friday, however, brought about renewed selling interest as traders had time to digest the storage data and the latest weather outlooks.

Tudor, Pickering, Holt & Co. analysts said that relative to the five-year average, total U.S. inventories currently sit at a 9% surplus. However, digging deeper, the Midwest and East regions are showing the highest storage levels at 20% and 17%, respectively, above the five-year average. The Mountain region is the lowest, sitting 10% below the five-year average, according to the firm.

Year to date, cumulative degree days are tracking 9% below historical norms, while cumulative draws from storage screen stronger at 5% below, analysts said. “Looking ahead to next week, we’re currently modelling a draw of around 92 Bcf, relative to five-year norms of 115 Bcf, which would inflate the surplus to the five-year average back to 10%, from 9% currently.”

With the withdrawal season rapidly drawing to a close, the effect of this shift is to nearly guarantee that end-of-season storage will be well above 1,900 Bcf, according to EBW Analytics Group. Economic activity is likely to be far below normal levels over the next few months in the largest global liquefied natural gas (LNG) import markets (Japan, China, South Korea and Europe) and near-term demand is set to plummet in the United States, the firm noted, likely sending prices sharply lower over the next few weeks.

The April Nymex gas contract settled Friday at $1.684, down 6.8 cents from Thursday’s close.

As March is set to begin, EBW examined historic price behavior of front-month Nymex gas during the month. Since 2015, average monthly returns have seen an 8-cent (4.1%) increase in prices from March 1 through the end of the month. Notably, 2016 and 2017 sported increases above 13%, greater than the largest decline of 6.9% that occurred only once, in 2019.

“Although 2016 and 2017 represent the best analog years to 2020, with storage in both years exiting March considerably above the five-year average 2,000 Bcf, we note considerable differences for 2020, including the need for low Henry Hub pricing to keep LNG exports flowing,” EBW said. “Still, the potential for greater upside than our most-likely scenario suggests cannot be entirely ruled out.”

Perhaps one of the greatest unknowns in the market is the impact of the coronavirus. Fears over the outbreak continued to assail financial and energy markets during the week as the spread of the virus raises the prospect of slowing global economic activity.

Stocks continued to plunge, and crude followed suit. West Texas Intermediate front month futures had dropped below $44/bbl early Friday before bouncing a bit, while Brent crude broke below $50.

Societe Generale Cross Asset Research (SGCAR) analysts reaffirmed their forecast for Brent to average $56.25 in 2020, which it says is “moderately bullish” in the light of the recent drop in prices. However, the analysts lowered their projections for the first half of the year due to the Covid-19 impact.

“We expect demand to slump 2.8 million b/d in 1Q2020, with China accounting for 1.7 million b/d of that,” said the analyst team led by Michael Haigh.

Over the second half of the year, as virus impacts dissipate, oil demand should recover and return to trend growth, according to SGCAR, which is projecting demand to increase 1.7% year/year in 4Q2020. The analyst team, which includes Florent Pelé, noted that it does not expect demand to make up for the loss in 1H2020, “or only very marginally.

“Our upwardly revised forecast for 2H2020 of $57.50 (+$1.50 versus previous forecast) is based on lower supply rather than a catch-up in demand.”

After temperatures plummeted below freezing overnight, a warm-up on Thursday sent spot gas prices tumbling across Texas. Overnight lows in the upper 20s were expected to rise throughout the day to reach highs in the 60s. Even milder weather was in store over the next few days.

Katy dropped 16.0 cents to $1.710 for gas delivered through Saturday.

Waha was down 13.5 cents to average 22.0 cents.

Spot gas prices across the western United States fell similarly, with the Rockies’ Cheyenne Hub tumbling 17.5 cents day/day to $1.480 and the SoCal Border Avg. falling 14.5 cents to $1.665.

More significant decreases were seen in parts of the Midcontinent, where ANR SW fell 22.0 cents to $1.475 for gas delivery through Saturday.

Midwest prices also were down by the double-digits, as were prices throughout Louisiana and the Southeast.

Appalachia also ended the day in the red, but losses were not as pronounced. Transco-Leidy Line cash slipped 5.0 cents to $1.540.

A handful of Northeast markets posted the only gains on Thursday amid lingering chilly air in the region. Algonquin Citygate rose 13.5 cents to $2.240 for gas delivered through Saturday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |