Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

U.S. Rig Count Steady Overall as Markets Fixate on Coronavirus

During an anxious week for crude markets, overall drilling activity in North America remained steady, according to data from Baker Hughes Co. (BKR).

The U.S. rig count fell one unit to finish the week ended Friday (Feb. 28) at 790, down from 1,038 rigs at this time last year. Total domestic oil-directed rigs fell one unit to 678, while natural gas-directed rigs were unchanged at 110.

Land drilling eased by one unit week/week, while the Gulf of Mexico continued to run 22 rigs, flat year/year. Six horizontal rigs packed up during the week, partially offset by the addition of four vertical units and one directional.

The Canadian rig count dropped four units overall to end the week at 240, up from 211 in the year-ago period. Six oil-directed rigs departed in Canada, partially offset by the addition of two natural gas-directed.

The combined North American rig count finished at 1,030, down five units week/week and down 219 rigs from the 1,249 active a year ago.

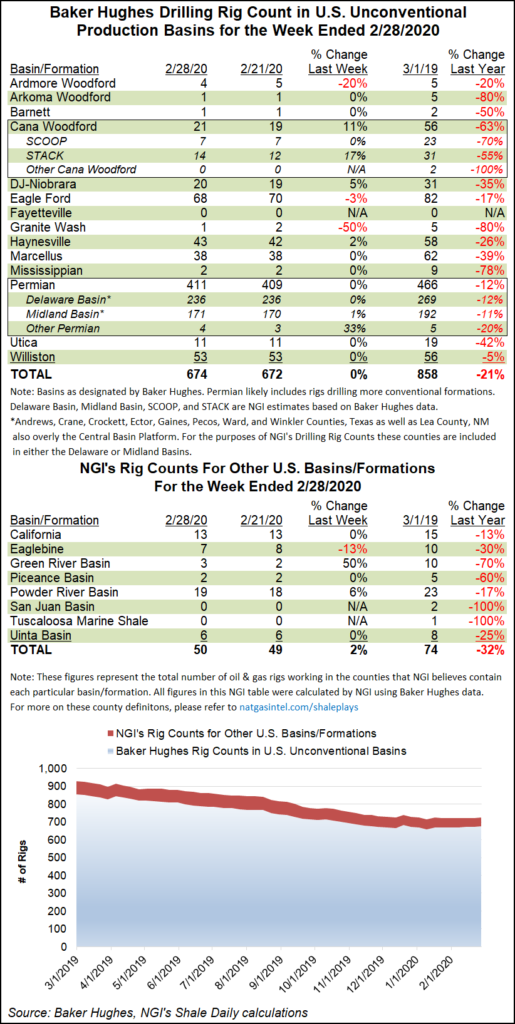

The week saw some shuffling among major plays. The Permian Basin added two rigs to up its total to 411, down from 466 a year ago. The Cana Woodford also added two rigs to reach 21, down from 56 at this time last year. The Eagle Ford Shale, on the other hand, dropped two rigs to fall to 68, versus 82 a year ago.

The Denver Julesburg-Niobrara added a rig, while the Ardmore Woodford and Granite Wash each dropped a rig.

Among states, Texas gained four rigs overall for the week, while Wyoming added two and Colorado added one. On the opposite side of the ledger, Oklahoma dropped three rigs week/week, while Louisiana and Alaska each dropped two, according to BKR.

The coronavirus captured the attention of energy traders during the week. Fears that the outbreak will hamper economic activity sent crude futures into a tailspin and threatened to upend 2020 plans for oil and gas operators. After selling off throughout the week, crude prices continued to take a beating Friday, with April West Texas Intermediate futures down $2.70 to $44.39/bbl on the New York Mercantile Exchange as of around 2 p.m. ET.

Global exploration and production investments may take a substantial hit this year because of the coronavirus, as staffing and supply shortages at key construction yards in Asia and beyond delay project deliveries by up to a year.

The global markets were poised to extend the worst losing streak since the 2008 financial crisis, with the virus, officially dubbed Covid-19, forecast to pound productivity levels this year.

“Our current assessment forecasts that Covid-19 could result in global E&P investments falling by around $30 billion in 2020 — a significant hit to the industry,“ said Rystad Energy’s Audun Martinsen, head of oilfield service research.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |