NGI All News Access | Coronavirus | Markets

Oil, Gas Operators Forecast to Slash E&P, Project Spending on Coronavirus Impacts

Global exploration and production (E&P) investments may take a substantial hit this year because of the coronavirus, as staffing and supply shortages at key construction yards in Asia and beyond delay project deliveries by up to a year.

The global markets were poised to extend the worst losing streak since the 2008 financial crisis, with the virus, officially dubbed Covid-19, forecast to pound productivity levels this year.

“Our current assessment forecasts that Covid-19 could result in global E&P investments falling by around $30 billion in 2020 — a significant hit to the industry,“ said Rystad Energy’s Audun Martinsen, head of oilfield service research.

Some of the investments are likely to come back in 2021, he said, but the situation is expected to worsen in March, slamming the global services industry well beyond Asia.

“As the virus has caused reduced industrial activity and travel restrictions in China and beyond, much of this year’s global expected oil-demand growth will be lost,” Martinsen said. Oil prices also could decline without supply cuts by the Organization of the Petroleum Exporting Countries and allies.

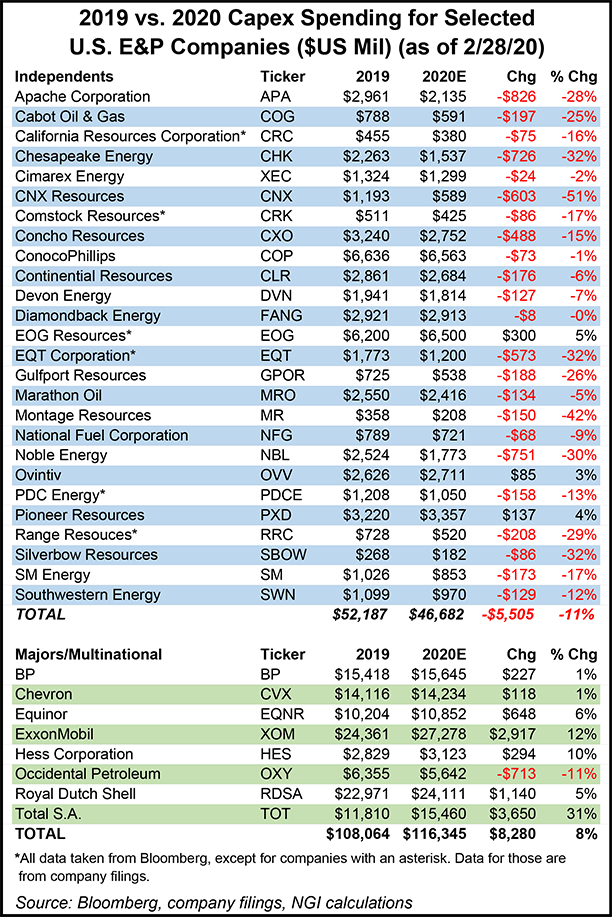

“Lower oil prices will result in oil and gas companies scaling down their flexible investment budgets, especially shale operators in the U.S. as well as some offshore E&P players.”

Federal Reserve Chair Jerome H. Powell took the unusual step on Friday of issuing a statement to assuage fears. “The fundamentals of the U.S. economy remain strong,” he said. “However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

Global oil and gas operators were keeping an eye on rapid developments.

Staff working in Chevron Corp.’s London offices reportedly were instructed to work remotely after an employee with flu-like symptoms was tested for coronavirus.

“Chevron continues to monitor the situation very closely, utilizing the guidance of international and local health authorities,” spokesperson Sean Comey told NGI. “Our primary concern is the health and safety of our colleagues, and we are taking precautionary measures to reduce their risk of exposure.

“Consequently, we have requested that our colleagues, based at our Westferry Circus office in London, work from home for the time being. It is our policy to not provide specific details related to any of our colleagues.”

ExxonMobil also “is monitoring the situation closely,” spokesperson Sarah Nordin told NGI. “We are reviewing and following the guidance from both central and local government authorities and advising our employees to follow government recommendations.

“ExxonMobil has well established processes in place to manage impacts related to infectious disease outbreaks. Our focus right now is on ensuring the safety and health of our entire workforce and to do our part to limit the spread of the novel coronavirus in the community.”

IHS CERAWeek, scheduled for the second week of March in Houston, annually draws thousands of oil and gas executives from around the world. CERAWeek is proceeding as planned, but conference organizers said attendance may be down this year.

“We are closely monitoring developments related to the Covid-19 coronavirus and will continue to do so leading up to the conference,” said CERAWeek organizers. “The Texas State Department of Health has affirmed that ”the risk for all Texans remains low.’ The Houston Health Department has also stated that there remain no known cases of COVID-19 in the city of Houston.”

However, “delegates from China will not be able to attend this year’s conference due to travel measures already in place in the United States. We are exploring solutions to provide expanded virtual engagement options for those delegates and look forward to their participation again next year.”

Given low commodity prices and the likely delay of Qatar’s planned North Field expansion to increase natural gas production, Rystad Energy cut its forecast for global capital expenditures in the Middle East, predicting about $21.3 billion of investments will get the green light this year, versus a previous estimate of $56 billion-plus.

Qatar was to sanction the first stage of the North Field project at a cost of about $35 billion, but the decision isn’t likely to be until early 2021, Rystad said. The commercial bid deadline for liquefaction facilities also has been extended.

Rystad also is estimating that of a global total of 28 floating production, storage and offloading (FPSO) vessels under construction, 22 are underway at shipyards in China, South Korea and Singapore.

The viral outbreak has led to “extensive staffing and supply shortages in these countries that will in turn delay project deliveries by at least three to six months,” according to Martinsen.

If the epidemic were to escalate, “the delays could increase to nine or even 12 months, especially taking into account the restricted time windows for heavy transport, installation and hook-up.”

The average development time for an FPSO is 36 months, which means companies could face a 30% delay.

“Although operators and contractors are looking into ways to make up for some of the time that will be lost by fast-tracking other stages of development, we anticipate first oil or gas for these projects will face clear delays,“ Martinsen said.

Of the 28 FPSOs under development, 15 are being built in China. Seven are under construction in South Korea as well as in Singapore, while six additional vessels are being constructed elsewhere.

“Many Chinese workers received a holiday extension in early February after the Chinese New Year, aimed at limiting the spread of the coronavirus disease. However, even as workers return to the yards, Rystad Energy expects projects may still have to contend with 30% to 50% fewer work hours.”

In addition, construction progress could be slowed by supply delays, as the delivery of bulk materials, modules and equipment could be hampered by transportation restrictions within and outside of mainland China.

“The plant utilization rate in China’s equipment manufacturing sector has now fallen to less than 10%,” Rystad estimated.

In addition, project management may face “severe issues as travel bans restrict contractors, engineering firms, certification companies and E&P officials from accessing shipyards. This became particularly apparent after news broke that the coronavirus had spread to the Lombardy region of Italy, the backyard of major contractor Saipem, forcing the company to ask thousands of workers to stay home until further notice.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |