Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

4Q2019 Earnings: Oasis Revamps Compensation to Tie to ESG, Moderates Lower 48 Growth

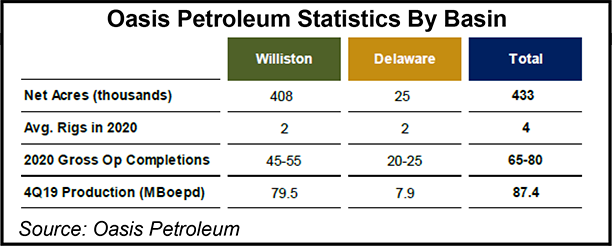

Houston independent Oasis Petroleum Inc. plans to keep its main focus on the Williston Basin’s Bakken Shale this year, an area that is to draw the most capital spending and drilling.

The exploration and production company splits its focus, with expanding development in the Permian Basin’s Delaware sub-basin. However, the bulk of 2020 capital expenditures (capex) are to be trained in North Dakota, long its bread-and-butter play.

Of the Williston, CEO Thomas Nusz said the “cornerstone asset continues to generate strong free cash flow, driven by well productivity, a high oil mix and access to Gulf Coast pricing.”

During the fourth quarter conference call, Nusz and his executive team shared the company’s results and the outlook for 2020.

“The team had a strong fourth quarter as we were able to power through some difficult weather and get our wells online while preserving the cost reductions seen in the third quarter,” he said. “This remarkable asset is expected to generate significant free cash flow in 2020.”

In the Permian Delaware sub-basin, where Oasis has been working for about two years, “we’re really excited to enter full-field development in 2020, which will drive repeatable, capital-efficient growth. Drilling times and well costs have come down significantly, which should drive capital-efficient development plan this year and beyond.”

The company’s “measured development pace” in the Delaware “has allowed us to secure quality service support at attractive prices,” as well as “gain clarity and availability to takeaway capacity” and “significantly advance our subsurface knowledge, including parent-child relationships…”

The company now is configuring blocks for a 1,280-acre development in the Delaware, and it is securing “complementary, small bolt-on acreage acquisitions, adding about 1,800 net acres in 2019, which increases our footprint to 25,000 net acres, increases our working interest and provides for optimizing longer laterals,” said the CEO.

Natural gas capture from flaring in the Permian also is going well, with the company capturing more than 98% in the final three months of 2018, Nusz said.

In January Oasis also announced changes to executive compensation, including long-term incentive, aka LTI, payments to benchmark them to “broader market performance and updating our corporate scorecard metrics to emphasize returns” on environmental, social and governance, better known as ESG, metrics, a topic about which many energy company management teams have discussed during the quarterly conference calls.

“These changes to the scorecard focus on cash flow and cash margin, corporate returns and capital efficiency, strategic initiatives and an environmental and safety modifier,” Nusz said.

The Oasis team, he said, rose to the challenge and drove significant cost savings and efficiencies in the latter half of 2019.

“These efforts positioned our 2020 plan to be more capital efficient, especially when we factor in lower well costs and improved cycle times in the Delaware Basin. Oasis is in a compelling position to grow modestly while generating free cash flow and continuing to pay down debt.”

During the fourth quarter, Oasis produced 87,400 boe/d, 2% higher than the guidance issued in November, with oil output at 60,100 b/d and natural gas production of 163,762 Mcf/d. In 4Q2018, total output was 88,715 boe/d, with oil production of 62,816 b/d and gas output of 155,381 Mcf/d.

Overall costs fell during 2019, with lease operating expenses 7% under original guidance at an average of $6.95/boe.

The plan for 2020 is “moderate growth, free cash generation and debt reduction,” and management expects to be free cash flow positive if West Texas Intermediate oil prices average $50/bbl.

Capex is set at $685-715 million, versus $598 million total spent last year, which was 5% under the original plan. About 55-65% of capital spend this year is to be directed to the Williston, with 35-45% for the Permian.

Total production in 2020 is forecast at 82,500-86,500 boe/d. Under the 2020 program, 45-55 gross operated wells are slated to be completed in the Williston, with 20-25 in the Delaware.

Total volumes through the first three months are forecast at up to 79,000 boe/d with an oil cut of close to 69%. Up to 90% of oil production through June is hedged at an average floor price of $55.46/bbl.

The realized oil price in 4Q2019 was $53.66/bbl, with natural gas prices averaging $2.77/Mcf. During 4Q2018, Oasis fetched an oil price of $55.12, while gas averaged $1.81.

Oasis lost $76.4 million (minus 24 cents/share) in the fourth quarter versus year-ago profits of $222 million (71 cents). In 2019, the company lost $128 million (minus 41 cents/share), and in 2018, losses totaled $35 million (minus 11 cents).

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |