NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

New Fortress on Track with Mexico LNG Import Plant for Baja California Sur

U.S. firm New Fortress Energy (NFE) is advancing construction of a liquefied natural gas (LNG) receiving and regasification terminal in the port of Pichilingue, Baja California Sur, Mexico.

First gas is expected in the third quarter, the company said in a recent presentation, while the project will reach run rate in the fourth quarter. When complete, the facility will be Mexico’s fourth LNG import option.

Pichilingue is located just north of La Paz, the state capital.

The terminal would introduce natural gas supply to Baja California Sur for the first time, allowing power plants in the region to use the molecule in lieu of fuel oil. The state, which encompasses the lower half of the peninsula, now lacks gas infrastructure.

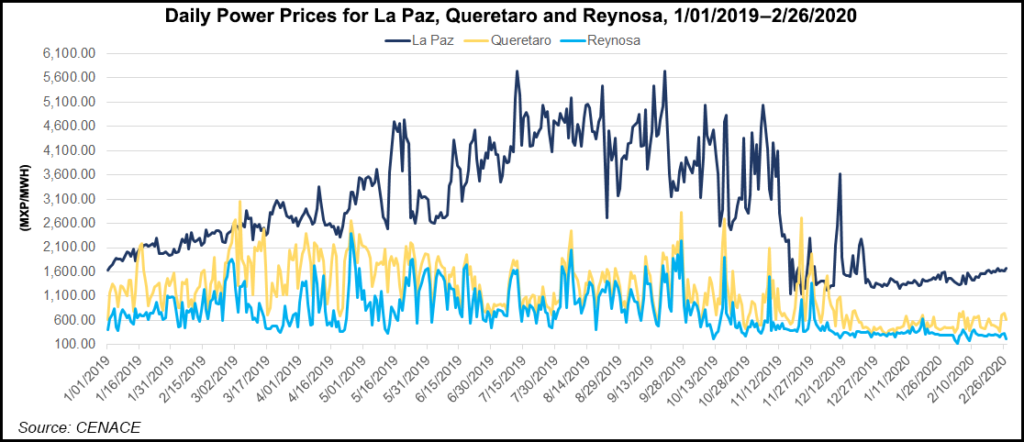

Baja California Sur is also cut off from the national Mexican power grid and as a result sees some of the highest power rates in Mexico, along with periodic power disruptions.

The NFE project comes with a 105 MW gas-fired power plant and truck-loading bays for the supply of LNG to local hotel and industrial customers.

“The LNG terminal at Pichilingue port is an important infrastructure project that will undoubtedly bring significant benefits to Baja California Sur,” said José López Soto, director of Port Authority Administration of Baja California Sur.

Marine work has been underway at the site of the terminal. With all the necessary permits obtained for onshore construction of the power plant, additional equipment, materials and workers are to be deployed to the site to expedite completion of the project, the company said.

“With the project well underway, we are closer to introducing more affordable and cleaner energy for Baja California Sur,” said CEO Wes Edens. “We have witnessed how LNG supply can become a catalyst for energy diversification and economic development and look forward to seeing similar results.”

The facility has committed volumes of 0.5 million gallons per day, or 41.3 MMcf/d, with potential to double those volumes.

Elsewhere in Mexico, LNG imports from its two active terminals — the 700 MMcf/d Altamira facility on the Gulf Coast and the 500 MMcf/d Manzanillo on the Pacific – are expected to dry up as pipeline infrastructure comes online, providing access to basins in the southern United States with cheaper options for natural gas.

NFE has a similar import facility in Jamaica that began operations in 2016. Since then, committed volumes at its Jamaica terminal have increased fourfold, according to the company. Another project in Puerto Rico is set to ramp this quarter, and the company is in talks with more than 100 customers in Jamaica, Puerto Rico and Mexico for gas delivery.

Earlier in February, NFE also announced a project involving a 300 MW gas-fired power plant from an LNG facility planned for Puerto Sandino, Nicaragua.

In the region, AES Panama has an LNG reception terminal near the mouth of the Panama Canal, and other natural gas infrastructure is starting to be developed in Central America, where natural gas to date has been mainly nonexistent.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |