Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

4Q2019 Earnings: Ascent Forecasting Stronger Appalachian Natural Gas Output, Less Spending

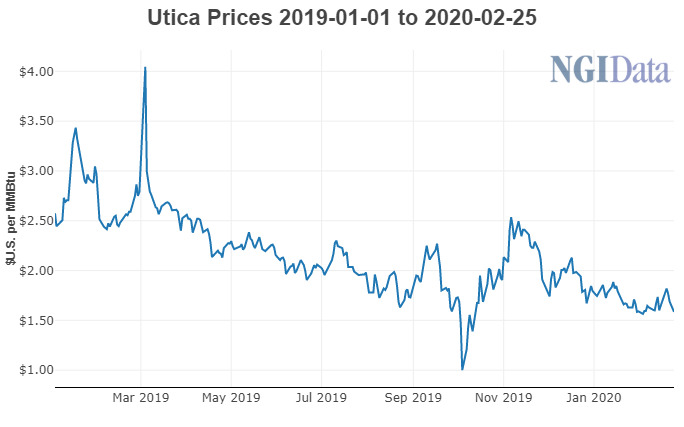

Ohio pure-play Ascent Resources Utica Holdings LLC, the state’s largest natural gas producer, plans to slash capital spending significantly this year as it battles low commodity prices across the Appalachian Basin.

The privately owned company has a capital expenditure (capex) plan of $700-800 million for the year, compared with $1.3 billion in 2019 and $2.8 billion in capex in 2018. The company generated positive free cash flow (FCF) of $17 million for the first time ever in 4Q2019 and is forecasting FCF again this year at current commodity prices and activity levels.

Ascent, which operates solely in the Utica Shale, expects production volumes to increase to an average of 2-2.3 Bcfe/d in 2020. The company produced 1.97 Bcfe last year, up 45% from 2018, reflecting what CEO Jeff Fisher said is “the strength of the southern Utica and the talents of our team to develop this prolific asset.”

Ascent exited 2019 producing 2.3 Bcfe/d. Last year’s production consisted of more than 1.7 Bcf/d of natural gas, 13,134 b/d of oil and 23,795 b/d of natural gas liquids. Total year/year net liquids production increased 116% in 2019.

Ascent also released its first environmental, social and governance report highlighting sustainable business practices and corporate responsibility, as the industry continues to face more pressure to curb climate change. Ascent provided performance results related to greenhouse gas emissions, health and safety, and social engagement.

The company reported 2019 net income of $466 million, up from a net loss of $4 million in the year-ago period. Fourth quarter net income was $65 million, compared with $124 million in the year-ago period.

In other news, another Appalachian pure-play, Montage Resources Corp. said Tuesday production volumes also increased significantly in 2019. The company reported full year production of 547.8 MMcfe/d from production of 343.2 MMcfe/d in 2018. The company was formed in a merger between Eclipse Resources and Blue Ridge Mountain Resources.

Fourth quarter production averaged 623.4 MMcfe/d, compared with 404.5 MMcfe/d in the year-ago period. CEO John Reinhart said unscheduled third-party maintenance impacted fourth quarter volumes.

“The company also took the opportunity with the natural gas price pullback in the fourth quarter to systematically shut-in some production in order to complete a number of production enhancement workover projects,” he said.

Montage has already slashed its 2020 capex to a range of $190-210 million. The company, scheduled to report full quarterly results on March 5, said it spent $361 million in 2019.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |