NGI Mexico GPI | Markets | NGI All News Access

Mexico Natural Gas Prices Hit 5-Month Low in January

Mexico’s IPGN monthly natural gas price index dipped below the $3 threshold for the first time in five months during January, averaging $2.920/MMBtu, down from $4.375/MMBtu in January 2019.

The IPGN, which the Comisión Reguladora de Energía (CRE) began publishing in August 2017, compiles prices reported by natural gas marketers during the preceding month, and is meant to serve as a reference until the Mexican market obtains enough liquidity and transparency for third-party price indexes to take over.

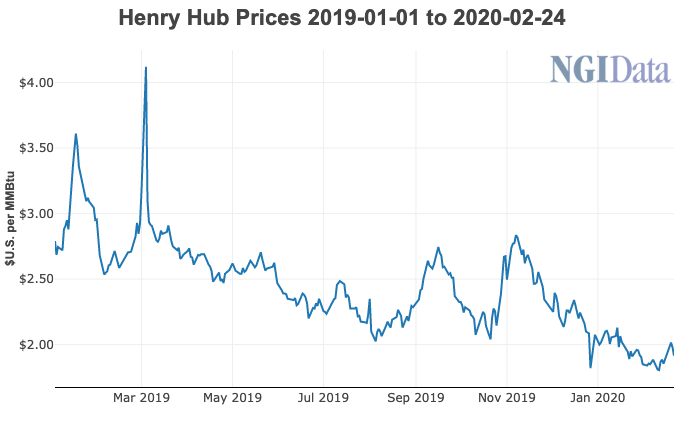

Given Mexico’s dependence on gas imported via pipeline from the United States, gas price movements in Mexico tend to closely track those north of the border.

The Henry Hub spot price averaged $2.02/MMBtu in January 2020, down 35% year-over-year (y/y), amid oversupply of the molecule, mild winter temperatures in North America, and insufficient takeaway capacity for excess gas production, particularly in the onshore Lower 48.

The January IPGN, meanwhile, was down 33.2% y/y.

The Energy Information Administration’s February Short-Term Energy Outlook (STEO) forecast the Henry Hub spot price to average $2.21/MMBtu in 2020, down from $2.56/MMBtu averaged in 2019.

In a further indication of an oversupplied market, the outlook projects that Lower 48 working natural gas in storage will end the 2019-2020 winter heating season at 1,935 Bcf, 12% above the previous five-year average.

CRE used 261 transactions reported by 24 companies for a total volume of 6.09 Bcf/d to calculate the January 2020 IPGN.

This compares to 286 transactions from 23 companies for 6.28 Bcf/d in the similar 2019 month.

U.S. pipeline gas exports to Mexico averaged 5.29 Bcf/d in November 2019, up from 4.68 Bcf/d in November 2018.

Further growth in gas offtake from the United States has been constrained by delays to last-mile pipeline projects in Mexico. These include TC Energy Corp.’s Tula-Villa de Reyes and Tuxpan-Tula pipelines, as well as Fermaca’s Waha-to-Guadalajara pipeline system.

Increased flows of gas in recent years from the United States to Mexico have been driven by declining gas production from national oil company Petróleos Mexicanos (Pemex).

However, both Pemex and the country’s private sector upstream operators posted y/y natural gas production growth in January.

Natural gas production in Mexico averaged 3.89 Bcf/d in January, up from 3.59 Bcf/d in the similar 2019 month, according to data from upstream regulator Comisión Nacional de Hidrocarburos (CNH).

Output from Pemex rose 7% y/y to 3.67 Bcf/d, while gas production from private sector operators expanded 39.2% to 228.9 MMcf/d.

Crude oil production by Pemex and private sector operators averaged 1.68 million b/d and 48,967 b/d in January, y/y increases of 5.5% and 53%, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |