NGI All News Access | E&P | Infrastructure

U.S. Natural Gas Rig Count Unchanged as Oil Activity Picks Up

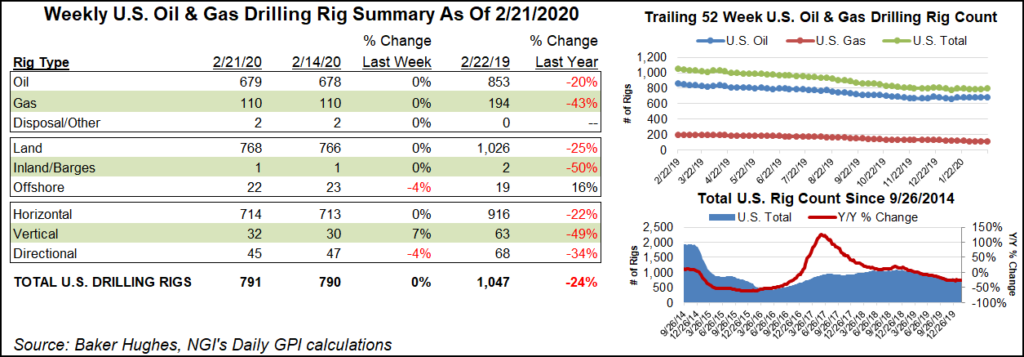

The U.S. natural gas rig count finished unchanged at 110 during the week ended Friday, while a small uptick in oil-directed drilling nudged the overall domestic count slightly higher, according to numbers from Baker Hughes Co. (BKR).

The addition of one oil-directed rig during the week sent the combined U.S. count one unit higher to 791. That’s down 256 units from the 1,047 rigs active in the year-ago period.

Land drilling increased by two units overall, while the Gulf of Mexico dropped one rig to end at 22 (19 a year ago). Two vertical units and two horizontal units were added during the week, partially offset by the loss of two directional rigs.

Canada’s rig count fell 11 units to 244 during the week, including the departure of three oil-directed rigs and eight gas-directed. The Canadian count ended the week up 32 rigs year/year from the 212 active rigs in the year-ago period.

The combined North American count finished at 1,035, down from 1,259 a year ago.

BKR didn’t report any major week/week changes among the major basins. The Permian added one rig to up its total to 409, down from 473 at this time last year. The gassy Haynesville added a rig to reach 42, down from 57 a year ago. One rig departed in the Denver Julesburg-Niobrara, dropping it to 19 rigs, versus 32 a year ago, according to BKR.

Among states, Alaska added three rigs to grow its total to 12 for the week, down slightly from 13 in the year-ago period. New Mexico added two rigs on the week, while two rigs departed overall in Colorado. Oklahoma added a rig week/week, while California, Louisiana and Wyoming each dropped one.

The rig count has stabilized in recent weeks, but there could be financial uncertainty ahead for the North American exploration and production (E&P) sector, according to research published earlier in the week by Moody’s Investors Service.

North American E&P companies, especially gas-focused operators, face higher risk of default due to a “staggering level” of debt maturing in the 2020-2024 time frame and limited access to credit, according to Moody’s.

North American E&Ps have around $86 billion of rated debt set to mature in 2020-2024, Moody’s analysts led by Sajjad Alam and Steven Wood wrote in a report published Wednesday. Of this total, 62% is speculative-grade debt, with the remainder investment-grade. Around 57% will come due through 2022, which figures to “put significant stress on speculative-grade companies,” the Moody’s analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |