NGI All News Access | Infrastructure | LNG | Markets

$2 Natural Gas Slips from Traders’ Grip Despite Supportive EIA Data; Weather Models Trend Warmer

Stubborn atmospheric conditions sapped the momentum natural gas futures had early Thursday following a larger-than-expected storage withdrawal. The March Nymex contract, which briefly soared above $2/MMBtu, went on to settle at $1.920, 3.5 cents lower day/day. April fell 4.0 cents to $1.931.

Spot gas prices also came crashing back to earth as the cold snap that had driven up demand in recent days was expected to move out of the United States beginning Friday. NGI’s Spot Gas National Avg. tumbled 10.5 cents to $1.810.

After some forecasts earlier in the week projected a late-February cold snap could extend well into March, the latest weather models fell short in sustaining the chilly outlook. The Global Forecast System (GFS) model lost 15-20 heating degree days (HDD) over the previous 36 hours, including 3-4 overnight and another 10 in the mid-Thursday run, according to NatGasWeather. However, the European model had been running colder comparatively and had given back little demand during the same period, the forecaster said.

Given the European model’s generally superior track record, traders were cautious to move the needle much on pricing, giving back only a couple cents on Wednesday once the warmer trends began showing up in the American dataset. However, the European model trended notably milder Thursday afternoon to better match the GFS, losing 11 HDDs versus Wednesday night’s run and 17 HDDs versus the previous 24 hours, according to NatGasWeather.

“What makes the pattern concerning is both the GFS and European models show cold retreating into Canada March 3-5 as milder temperatures regain ground after what is still a rather cold pattern Feb. 27-March 2, just not quite as impressively so in the latest data,” the forecaster said.

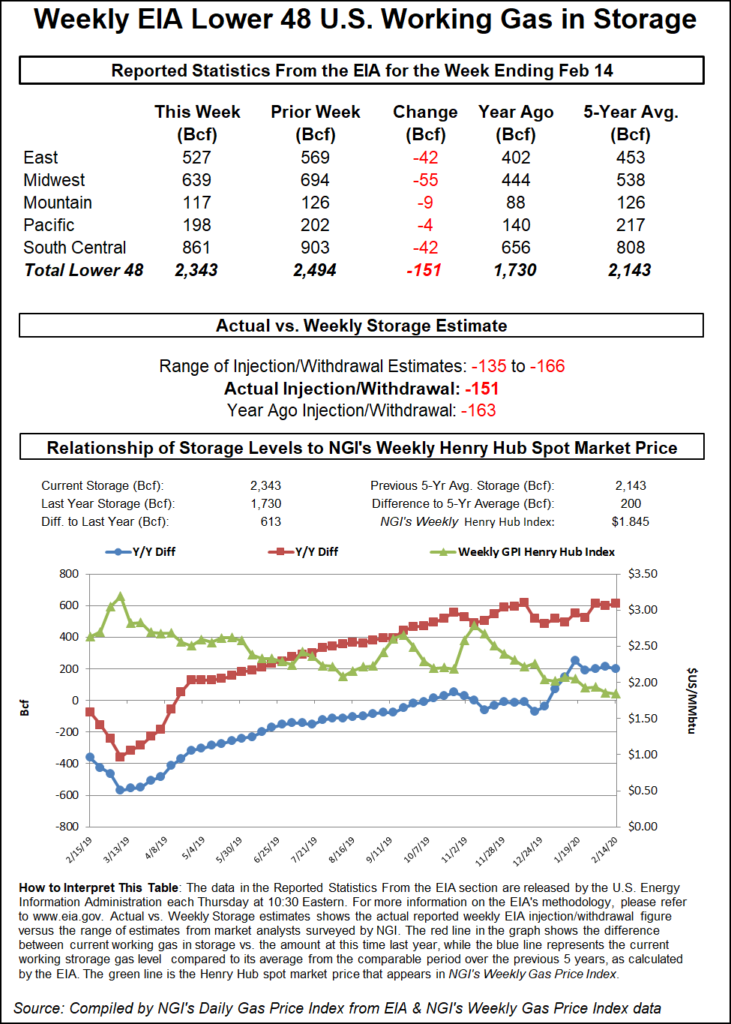

If weather would cooperate, other market drivers appear ready to assist prices in making another move higher. The March Nymex gas futures contract flirted with the $2 mark early Thursday and then glided past it following yet another bullish surprise in the latest government storage data. The Energy Information Administration (EIA) reported a 151 Bcf withdrawal from storage inventories for the week ending Feb. 14.

The figure easily topped most projections of a withdrawal in the mid- to upper 140s Bcf; it also came in higher than the 136 Bcf five-year average but fell short of the year-ago draw of 163 Bcf, according to EIA.

Broken down by region, the Midwest withdrew a larger-than-expected 55 Bcf from storage thanks to strong power burns amid near-record low temperatures during the reporting week. The East pulled 42 Bcf out of storage, as did the South Central region, including a 29 Bcf draw from nonsalt facilities and a 12 Bcf draw from salts. The Mountain and Pacific regions each withdrew less than 10 Bcf, EIA data showed.

Working gas in storage stood at 2,343 Bcf, 613 Bcf above last year and 200 Bcf above the five-year average, EIA said.

Discussing the low price environment on Enelyst.com, an energy social media platform hosted by The Desk, Donnie Sharp of Huntsville Utilities said the market “usually doesn’t stay down here for very long.” However, he believes there is “one more shot for the $1.60 range, but time will tell.”

Enelyst managing director Het Shah said Thursday’s trading action appeared to cluster around a range from $1.80 to $2.00, but he sees balances tight for the summer at such low price levels. “I see a knee-jerk reaction higher once we see insane power burns in April/May.”

The low prices have kept power burns elevated even during milder periods this winter, and U.S. exports also have remained fairly strong. However, changes may be afoot on the liquefied natural gas (LNG) front. The coronavirus has added another layer of bearish pressure to an already weak global price environment brought on by new supplies, a mild winter and brimming storage inventories.

On Thursday, reports surfaced that Cheniere Energy Inc. had received a notice from a buyer in Spain to cancel an LNG shipment. While not commenting directly about commercial agreements, Cheniere spokesperson Jenna Palfrey said the “flexibility inherent” in the sales and purchase agreements (SPA) “is a feature LNG customers worldwide highly value, as evidenced by the significant contractual support of both our Sabine Pass and Corpus Christi projects with long-term take-or-pay style contracts. The fixed-fee component of our SPAs ensures stable, reliable cash flow to Cheniere, even in a scenario where a customer elects to suspend delivery.”

LNG shut-ins may be on the horizon for U.S. facilities this year given the gloomy outlook for the global market, but the Cheniere cargo cancellation may be the first for a U.S. producer. Earlier this month, China National Offshore Oil Co. (CNOOC) issued several force majeure notices, and some were rejected by buyers; Total SA negotiated with CNOOC to deliver a cargo in February while deferring others.

A multi-day rally in spot gas prices fizzled Thursday as moderating temperatures were in store for the end of the week following a winter blast that jolted demand across the eastern half of the country.

Genscape Inc. meteorologists were forecasting daytime highs in New York City and Boston to run about 7 degrees below seasonal norms through Friday. This lifted the firm’s EIA East demand estimate to 41 Bcf/d for Thursday and to 40.9 Bcf/d for Friday, compared to the last 10-day average of 35.3 Bcf/d.

Despite ongoing operational constraints on several regional pipelines, including Columbia Gas Transmission, Tennessee Gas Pipeline and Transcontinental Gas Pipe Line, next-day prices came crashing down Thursday. Algonquin Citygate plunged 37.5 cents to $2.405, while Transco Zone 6 non-NY fell a more modest 12.0 cents to $2.180.

Losses across Appalachia were capped at around a dime for the majority of pricing hubs, but Texas Eastern M-3, Delivery tumbled a more significant 27.5 cents to $2.000.

Small decreases of less than 10 cents were seen across the Southeast and Louisiana, while declines in the Midcontinent were slightly more pronounced.

In West Texas, a force majeure issued Wednesday by El Paso Natural Gas (EPNG) resulted in a sharp move lower for prices in the region. EPNG is restricting until further notice 281 MMcf/d of Permian Basin exports through its South mainline after the pipeline identified an anomaly on the 1100 line in Hudspeth County, TX, which prompted operators to reduce operational capacity to 875 MMcf/d from 1,156 MMcf/d. Flows through “CORN LPW” have stayed close to operational capacity for the last several months, according to Genscape.

“Despite four events in the last four months disrupting material volumes through CORN LPW, Waha and El Paso Permian cash price fluctuations seem to have had different drivers throughout those periods, as there had not been notable drops affiliated with these events,” Genscape senior natural gas analyst Rick Margolin said.

That wasn’t the case on Thursday. Waha cash plunged 41.5 cents to average just 14.0 cents for Friday’s gas delivery.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |