NGI The Weekly Gas Market Report | Infrastructure | LNG | LNG Insight | Markets | NGI All News Access

Global LNG Demand to Double by 2040, but Supply/Demand Balance Unlikely Till Mid 2020s, Says Shell

The long-term outlook for global natural gas continues to be positive through 2040, but if European gas prices fall much lower this year, U.S. export facilities may face shut ins, Royal Dutch Shell plc executives said Thursday.

The European-based major published its fourth annual outlook for global liquefied natural gas (LNG), offering an indepth forecast over the next two decades. Shell’s Maarten Wetselaar, who directs Integrated Gas and New Energies, and Shell Energy’s Steve Hill, executive vice president, offered some insight during a 90-minute webinar in which they shared their views on prices, future sanctioning prospects and contract trends.

According to Shell, by 2040 global LNG demand is forecast to double to 700 mmt as gas plays an ever increasing role in the energy transition to lower carbon fuels and renewables. Last year consumption grew by a record 12.5% to 359 mmt, bolstering the role of gas in what Wetselaar said would be a decades-long transition.

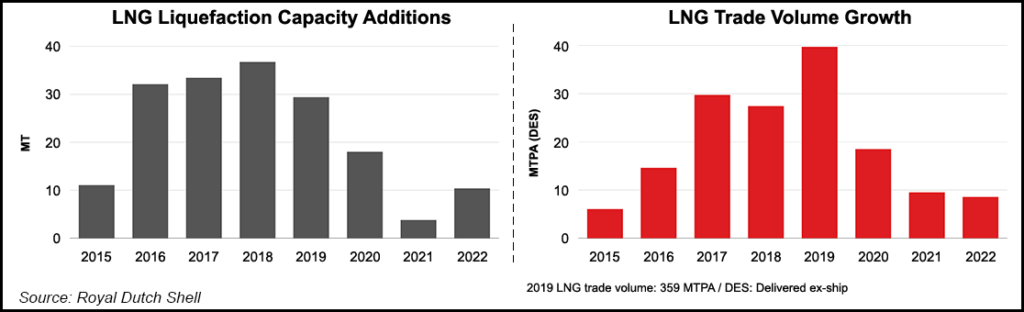

The industry also eclipsed previous capacity records during 2019 as 40 mmt of additional export supply became available and consumed. In addition, there were record investments announced last year for new capacity, with 71 mmt in liquefaction capacity sanctioned, but final investment decisions (FID) in the near term should be much slower, Wetselaar said.

“The global LNG market continued to evolve in 2019 with demand increasing for LNG and natural gas in power and nonpower sectors,” said Wetselaar. “Record supply investments will meet people’s growing need for the most flexible and cleanest-burning fossil fuel.”

However, “weak market conditions” for gas are forecast to continue, in part as record supply ramps up. In addition, two successive warm winters and the recent coronavirus outbreak are having consequences on near-term demand.

“We expect equilibrium to return,” likely around 2026, said Wetselaar, “driven by a combination of demand growth and a fall off in new supply coming on-stream until the mid-2020s.”

This past year Europe absorbed “massive amounts of LNG, and it has some ability to absorb more, as coal-to-gas switching flexibility hasn’t been completely utilized, but we are in a position now where the European gas market…has a limit as to how much more LNG it can absorb,” he said.

“In terms of the pricing dynamics, and we don’t have any specific price forecast to put out, obviously we are coming toward the end of the winter and it’s hard to see a big change in dynamics in the next couple of months” to reduce gas supplies.

“As we get into the second half of the year, we then expect to back in a world where LNG demand will be growing faster than LNG supply.”

If there were to be a “much lower price for gas in Europe, then we’d be in a world of potential LNG shut ins,” with U.S. projects taking the biggest impact.

Even with a global market oversupplied and some buyers working to renegotiate contracts, Wetselaar said he was confident in Shell’s contracting across the worldwide portfolio.

“The bigger the spread between term prices and spot prices, the more tension you are going to get that you have to deal with because it becomes harder and harder for the term buyers to be able to manage that situation,” he said. “But ultimately, the industry has a tremendous track record for long-term contracts to be performed and we expect that’s going to continue.”

Qatar Petroleum, the No. 1 LNG supplier, is slated to sanction four megatrains this year, and Wetselaar said, “I don’t think there’s any probability of them not building those four trains.” The state-owned producer is “deep” into preparing the feed gas and working on contracts, “and we think for all intents and purposes that it’s going to happen.”

If Qatar were to issue a positive FID for the trains, it would be a “strong start” for LNG capacity sanctioning this year. Historically, there have been a lot of LNG projects on the drawing board, but “what’s actually made it across the line has been different. But of course, if this year plays out in a very linear fashion, and everything that looks promising gets FID’d, then clearly we’re looking at a long market in the second half of the 2020s.”

Even if Henry Hub gas prices were to remain stagnant at around $2/Mcf, the Shell-led LNG Canada greenfield export project in British Columbia, now underway, remains a good bet for the longer term, Wetselaar said.

“Let’s see first how we get through the summer,” he said of the low U.S. gas prices. “The Canada situation is not totally delinked from the U.S. situation.” When Shell reviewed Canadian returns and prices for LNG Canada before it was FID’d, “we certainly weren’t counting on the Canadian gas prices being below $1.00…

“So, if indeed the scenario plays out that North American gas prices stay as low as they are right now, the project still will get a significant boost on its own upstream and remain competitive versus the U.S. The advantage has to do with freight and upstream gas costs, which we believe are lasting.”

If in fact LNG Canada were onstream today, “we would be happily producing.”

The biggest LNG growth market last year was in Europe, as low prices enabled more coal-to-gas switching in the power sector, Wetselaar said. In addition, imports into Europe, mostly from the United States, displaced declining domestic output, as well as pipeline gas imports.

Meanwhile, new spot trading mechanisms and a “wider variety of indices used for long-term contracts” point to LNG becoming an increasingly flexible commodity, said the Shell executives.

Beyond Europe, Asia only saw a modest increase in LNG imports last year versus 2017 and 2018 because of mild weather and increasing electricity generation from nuclear power in Japan and South Korea, which are two of the three largest global importers.

LNG imports in China climbed by an estimated 14% year/year, as the country worked to improve urban air quality. However, Shell sees increasing demand growth in the Asia Pacific region beyond China and India, traditionally the two countries pulling much of the recent demand.

For example, Bangladesh, India and Pakistan together imported 36 mmt during 2019, an increase of 19% from 2018. Emerging growth countries in the region are expected to consume increasing amounts of gas, Wetselaar said.

Overall, Asia is forecast to remain the dominant region for LNG consumption in the decades to come, with South and Southeast Asia generating more than half of the increased demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |