NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Pare Gains as Weather Data Warms; Cold Snap Keeps Cash Supported

The momentum that weather models garnered over the last few days sputtered on Wednesday, with natural gas futures prices retreating a bit after warmer revisions to the long-range outlook. The March Nymex gas futures contract closed the session at $1.955, down 2.6 cents from Tuesday’s close. April was unchanged at $1.971.

However, spot gas prices continued to climb as chilly conditions have returned to much of the United States, including the Midwest, where highs near zero were expected in some areas. NGI’s Spot Gas National Avg. climbed 6.0 cents to $1.915.

[NGI’s natural gas price indexes have included price reporter as well as ICE trade Data since 2008.]

After trending a bit milder overnight, the Global Forecast System (GFS) data trended even warmer in its midday run on Wednesday, losing another 10 heating degree days (HDD) and now sitting nearly 20 HDDs lower than it was in the previous 24 hours, according to NatGasWeather. “So this could be the reason if the natural gas markets wanted a few cents back,” the forecaster said.

The data still shows a rather strong cold shot the next few days and then cold versus normal over much of the country Feb. 27-March 2, “just not quite as impressive in recent runs,” NatGasWeather said. Also of concern is if the blustery conditions can last for March 3-5, although the overnight data and midday GFS were not as frigid. “Essentially, the latest GFS also suggests cold could fade after March 2-3,” the firm said.

However, it’s the European model that the gas market views as the more reliable dataset, and it showed very little change overnight, according to Bespoke Weather Services. Nevertheless, the durability of the cold pattern is still “somewhat questionable” given an upper level pattern in the higher latitudes that is “just marginal” in terms of favorability for colder intrusions into the United States, the firm said.

“With this in mind, it is possible that the models are a little too cold in the 11- to 15-day, or that the pattern tries to warm up after the first week of March, although right now, models do not show any notable rewarming yet,” Bespoke said.

For now, it appears that traders are content to leave positions relatively intact. The March Nymex contract traded in a tight range between $1.945 and $1.978, the rest of the futures curve moved just fractionally higher day/day.

The only “real fireworks” occurred into the close, according to Bespoke, with a large move down in the March/April spread, possibly due to some stop outs. “That spread actually had a larger daily trading range than the March contract, something you do not see very often,” Bespoke said. “In terms of where prices go next, we are still looking for clues in the weather pattern, but recent runs have been rather inconclusive.”

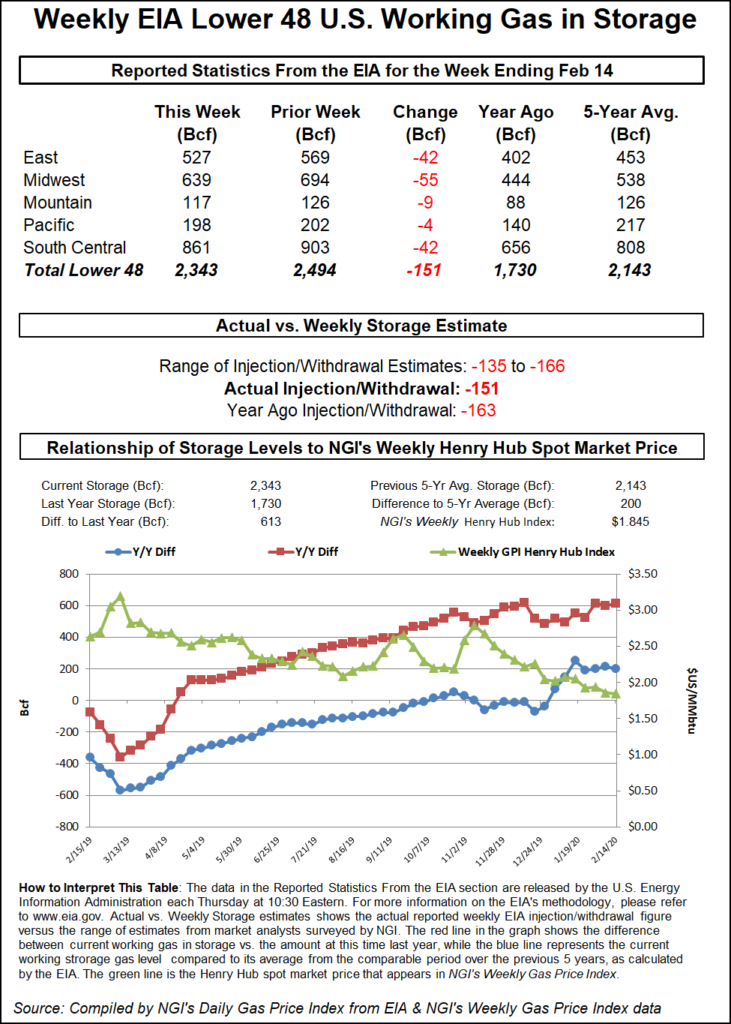

As always, Thursday’s government storage data could provide some additional momentum if the reported withdrawal once again surprises, but even then, it’s not likely. Estimates ahead of the Energy Information Administration’s (EIA) report point to a withdrawal in the mid- to high 140 Bcf range.

A Bloomberg survey projected withdrawals as low as 138 Bcf and as high as 158 Bcf, while a Wall Street Journal poll had estimates as low as 135 Bcf. Reuters polled 19 analysts, who estimated withdrawals as high as 166 Bcf. NGI’s model pegged the storage draw at 149 Bcf, which would compare with the 163 Bcf withdrawn in the similar year-ago period and the five-year average draw of 136 Bcf, according to EIA.

Despite the unusually warm winter so far, the market has been inundated with larger-than-expected withdrawals, but with little reaction from the market. Not even tight supply/demand balances have proven enough to meaningfully — and sustainably — raise prices. And now, balances are starting to loosen.

On the export front, feed gas deliveries to U.S. LNG export terminals have receded in the past 10 days, primarily due to poor weather along the Texas/Louisiana coast, according to Genscape Inc.

Aggregate feed gas deliveries to U.S. terminals set a record high at 9.25 Bcf/d on Jan. 31, the firm said. From that date through Feb. 9, volumes averaged nearly 8.9 Bcf/d, but on Feb. 10, they fell to 7.4 Bcf/d and have averaged just 7.6 Bcf/d since.

“Foggy conditions reportedly persist along the coast between the Houston Ship Channel and Lake Charles, which is primarily affecting operations at Sabine Pass and Cameron,” Genscape said.

Current feed gas volumes to both facilities remain suppressed: since Feb. 10, Cameron has been receiving an average 702 MMcf/d, a 643 MMcf/d reduction compared to its prior 14-day average. The company has indicated it continues the commissioning process for the second production unit at the Hackberry, LA, facility. Simultaneously, Sabine Pass has been receiving 3.55 Bcf/d, a 549 MMcf/d reduction.

Meanwhile, pipeline exports to Mexico have been relatively steady over the past two weeks. Genscape estimates Wednesday’s cross-border flows at 5.4 Bcf/d, in line with the past seven-day average and roughly 0.2 Bcf/d above the month-to-date average.

The firm expects volumes to continue posting very moderate increases into March based on “simple seasonality.

“We are still modelling a structural increase later in March with the anticipated in-service of the Wahalajara pipeline, which will enable Mexico to replace LNG with lower-cost supply from the Permian,” Genscape senior natural gas analyst Rick Margolin said. “We also believe Wahalajara will ultimately enable Permian gas to push into Central Mexico and displace some South Texas exports to that area.”

However, there is significant risk to that dynamic based on downstream infrastructure developments, in addition to timing risk associated with Wahalajara itself, according to Genscape.

Looking a bit further out, the firm expects the new Samalayuca-Sasabe pipeline to enter service in May and while it is not expected to increase total U.S. exports to Mexico, it should be “modestly bullish” for the Permian by creating a direct route for Permian-to-Mexico volumes currently being transported via Arizona, and creating space for incremental Permian molecules to go westward to and/or past Arizona, Margolin said.

With it being too little too late for winter to revive the struggling gas market, and balances becoming less supportive over the past couple of weeks, it’s going to be up to production to do the heavy lifting in getting the market back on track, according to NGI’s Director of Strategy & Research Patrick Rau.

“We’ve got to get production or capital expenditure spending back to maintenance levels. That’s the long and short of it. It’s got to be a production response. We’re past the throes of winter. You can’t rely on weather at this point. It has to come from production.”

TC Energy Corp. management said natural gas producing customers in the Appalachian Basin are taking corrective measures amid low prices and oversupply of the molecule. On a call to discuss quarterly earnings last week, TC President of U.S. natural gas pipelines said that “out of the Appalachian Basin, we’re finally starting to see the producers tap the brakes and that production has declined.”

Gas production from the Appalachian region has fallen to about 31.8 Bcf/d in February from slightly more than 33 Bcf/d in November, a decline of about 5%, he said.

With temperatures plunging across the eastern half of the country, spot gas prices mounted additional gains in Wednesday trading.

The Northeast posted the largest increases as a broad region of Arctic high pressure that pushed down across the north-central United States on Wednesday was forecast to spread east-southeastward, encompassing much of the central to eastern United States through Thursday, according to the National Weather Service (NWS). This high is expected to keep temperatures below average for that part of the country, with exception of central and south Florida, “where above-average temperatures will persist through the balance of the week.”

The cold blast is expected to be brief as temperatures are forecast to begin climbing back to above-average levels by Friday across the northern Plains and Upper Midwest, the NWS said. “This warming trend will then translate eastward this weekend across the Great Lakes and Northeast.”

In the short term, however, the cold air filtering south may support accumulating snowfall late Thursday through early Friday from the southern Appalachians, eastward across much of North Carolina, northern South Carolina and southern Virginia, where locally several inches of snow is expected, the NWS said.

With another couple of days of cool temperatures, Algonquin Citygate cash shot up 37.5 cents to $2.780. Transco Zone 6 NY jumped 31.0 cents to $2.330.

The majority of Appalachia pricing hubs rose less than a dime, but ongoing pipeline work on Texas Eastern Transmission boosted spot gas prices at Texas Eastern M-3, Delivery by a much more pronounced 37.0 cents to $2.275.

In the Southeast, Dominion Energy Cove Point jumped 19.5 cents to $2.270, while most other gains in the region and over into Louisiana were capped at less than a dime. Spot gas across the Midcontinent also shifted around a dime or so day/day.

In Texas, prices landed in the black across the majority of pricing hubs in the state, but it was a sea of red in the West Texas portion of the Permian Basin. El Paso Permian next-day gas fell 4.0 cents to average 63.0 cents, although volumes remained robust at more than 850,000 MMBtu/day being traded.

Cash prices also declined slightly in California, where PG&E Citygate slipped 2.5 cents to $2.675.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |