Bullish EIA Storage Figure Sparks Rally for Natural Gas Futures

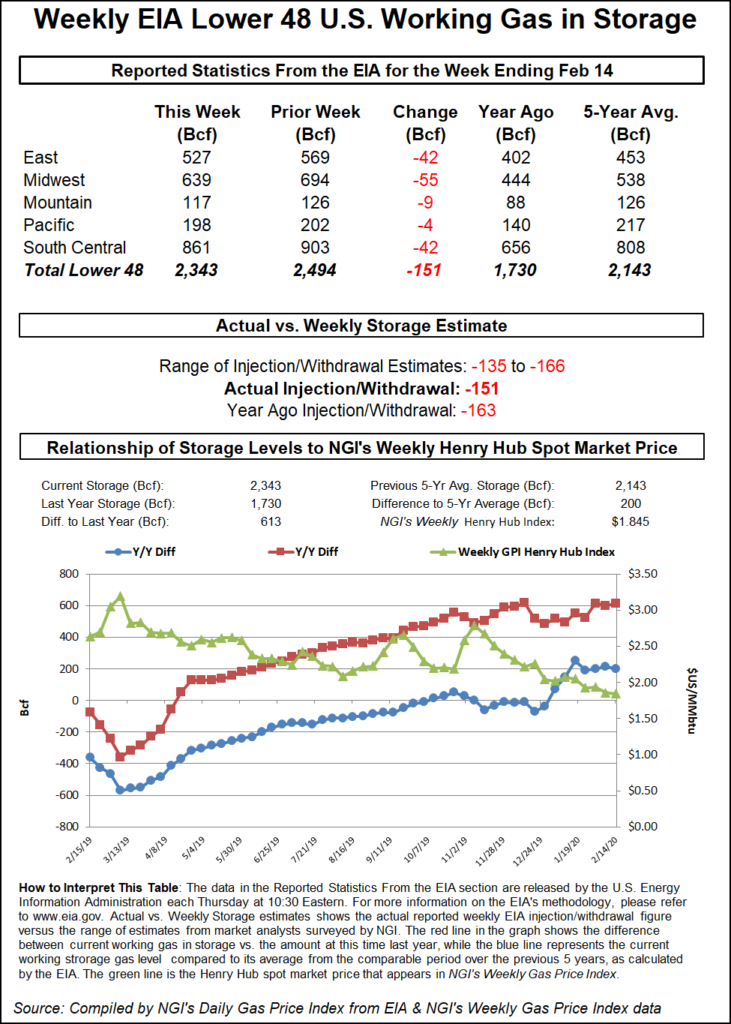

The U.S. Energy Information Administration (EIA) once again surprised to the bullish side, reporting a larger-than-expected 151 Bcf withdrawal from natural gas storage inventories for the week ending Feb. 14 and providing Nymex futures a bump late Thursday morning.

The reported withdrawal was close to NGI’s estimate of a 149 Bcf draw, but it came in several Bcf higher than most projections. Ahead of the EIA report, a Reuters survey and one by Bloomberg each showed a median draw of 146 Bcf. A Wall Street Journal poll averaged a 147 Bcf pull. The EIA’s 151 Bcf figure compares with the 163 Bcf withdrawn in the similar year-ago period and the five-year average draw of 136 Bcf.

Nymex futures were trickling lower ahead of the report, but then caught a bid once the latest storage data was issued. In the minutes leading up to the EIA’s 10:30 a.m. ET report, the March contract was trading at $1.946/MMBtu, down nine-tenths of a cent from Wednesday’s close. The prompt month then bounced to $1.959 as the print crossed trading desks and by soon after 11 a.m., it was trading at $1.994, up 3.9 cents day/day.

Bespoke Weather Services gave the report a “slightly bullish” rating, especially since it viewed the risk being for a smaller draw. It is the fourth consecutive strong number, according to the firm, and once again is “quite tight” when adjusting for weather. “It is a supportive balance if we can hold normal to colder than normal into March.”

Whether cold temperatures have any staying power has been the question all winter, but so far weather has fallen short. The latest weather models trended warmer overnight, although forecasts continued to show several blasts of frigid air making their way into the United States over the next couple of weeks.

Futures prices continue to flirt with the $2 mark, a level that “will be interesting,” according to Donnie Sharp of Huntsville Utilities. Speaking on Enelyst.com, an energy social media platform hosted by The Desk, Sharp said the market “usually doesn’t stay down here for very long.”

He noted that Henry Hub cash was trading around $1.98 for Friday’s gas delivery, while the March Nymex contract “is fluttering at $1.966. I still feel like one more shot for the $1.60 range, but time will tell.”

Enelyst managing director Het Shah said trading action appeared to cluster around a range from $1.80 to $2.00, but he sees balances tight for the summer at such low price levels. “I see a knee-jerk reaction higher once we see insane power burns in April/May.”

It was stronger-than-expected power burns in the Midwest that led to a big miss in that region for the reporting period ending Feb. 14. The region experienced some of the coldest temperatures on record, withdrawing a larger-than-expected 55 Bcf from storage, according to EIA. The East pulled 42 Bcf out of storage, as did the South Central region, including a 29 Bcf draw from nonsalt facilities and a 12 Bcf draw from salts. The Mountain and Pacific regions each withdrew less than 10 Bcf, EIA data show.

Working gas in storage stood at 2,343 Bcf, 613 Bcf above last year and 200 Bcf above the five-year average, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |