Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

‘Staggering’ Debt Has North American E&Ps, Especially Natural Gas-Weighted, Risking Default

With a “staggering level” of debt maturing in the 2020-2024 time frame and limited access to credit, North America’s exploration and production (E&P) companies, particularly natural gas-focused operators, face an increased risk of default, according to new research from Moody’s Investors Service.

North American E&Ps have around $86 billion of rated debt set to mature in 2020-2024, Moody’s analysts led by Sajjad Alam and Steven Wood wrote in a report published Wednesday. Of this total, 62% is speculative-grade debt, with the remainder investment-grade. Around 57% will come due through 2022, which figures to “put significant stress on speculative-grade companies,” the Moody’s analysts said.

Natural gas-weighted E&Ps and “lower quality” operators will encounter difficulties getting access to capital in 2020, according to Moody’s.

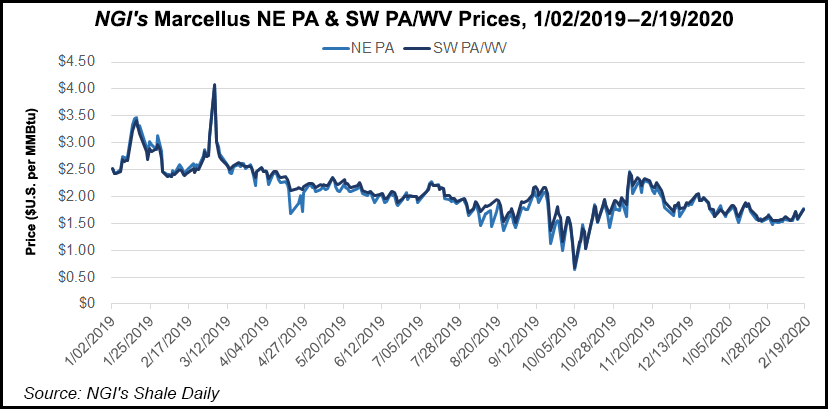

“Despite our expectation of a generally low interest rate environment globally, such companies face greater risk because of continuing overproduction, depressed natural gas prices and widespread investor risk aversion toward the E&P sector,” Alam and Wood wrote.

North American natural gas producers including Antero Resources Corp., EQT Corp. and Chesapeake Energy Corp. have “significant maturities” over the next half decade and face a “particularly challenging” outlook for refinancing, according to Moody’s.

On a call to discuss quarterly earnings last week, Antero management indicated the company has more than $2 billion of debt scheduled to mature by 2022. It plans to divest up to $1 billion worth of assets in 2020 and is targeting $520 million in overall savings during the same time.

“While these companies have already taken some measures to address maturities, more needs to be done,” the Moody’s analysts said. “Refinancing costs will remain sky-high for these producers without a sharp rebound in gas prices, which seemed improbable as of early 2020, based on futures market price indications.

“Debt investors studying the refinancing prospects of these E&P companies have already begun pushing their debt prices to distressed levels, effectively cutting them off from raising capital.”

Speculative-grade maturities will exceed investment-grade by nearly two-to-one in 2022, the analysts said.

“But investment-grade companies will have to address a much higher proportion of maturities in the first three years compared to speculative-grade companies, giving weaker companies slightly more time to refinance,” Alam and Wood wrote. “Roughly 66% of investment-grade maturities will occur during 2020-22, while 81% of speculative-grade maturities are back-end loaded over 2022-24.”

The 10 North American E&Ps with the highest total of maturities during the 2020-2024 time frame have $42 billion due by 2024, nearly half of the amount due across the entire sector, Moody’s said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |