NGI All News Access | Coronavirus | LNG Insight | Markets

LNG Recap: China to Offer Tariff Exemptions; Global Gas Outlook Dims Further

China said Tuesday it would offer tariff exemptions for hundreds of U.S. goods, including crude oil and liquefied natural gas (LNG), as part of efforts to ease trade tensions.

The country plans to accept applications from Chinese buyers starting early next month. The exemptions would last for a year if granted and allow importers to avoid tariffs that were kept in place after a trade deal with the United States was signed last month. China agreed to buy $200 billion worth of U.S. goods over the next two years, including more than $50 billion of energy products, but the first phase trade agreement preserved China’s 25% tariff on LNG imports and its 5% tariff on crude imports.

Tuesday’s announcement is expected to help China execute the first phase deal. While demand for energy products has weakened in recent weeks with the coronavirus outbreak, China is the world’s largest crude importer and second largest LNG importer. Most of the country’s oil is supplied by the Middle East, but the market is seen as a major outlet for growing volumes of U.S. LNG.

“We look forward to both sides returning to normalized trade relations as this will provide certainty to project developers, ensure U.S. LNG’s global competitiveness, and provides growth and market stability for American consumers,” said the Center for LNG’s Charlie Riedl, executive director.

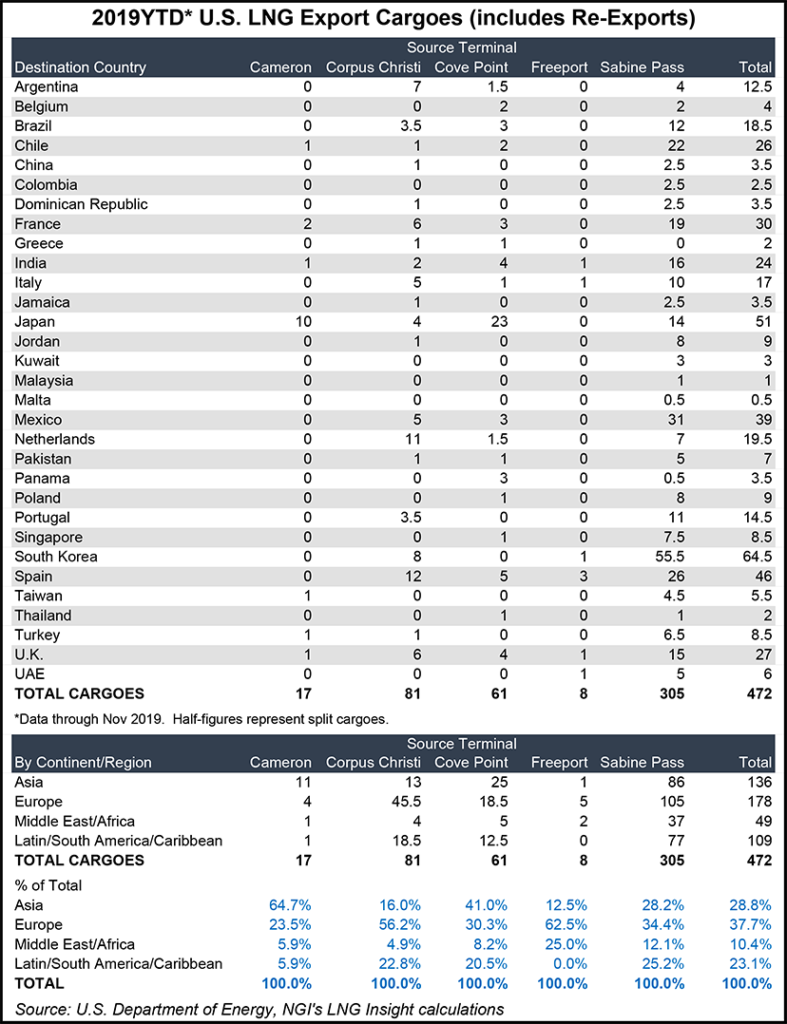

U.S. LNG exports to China have declined markedly since the tariffs went into effect in 2018 and were increased last year. Tuesday’s announcement came as the global gas outlook has continued to weaken. Feed gas deliveries to U.S. export terminals hit their lowest point in months last week as maintenance and weather combined to upend flows.

Deliveries declined after hitting record highs last month of well above 9 Bcf/d that had been sustained. But intake began to soften during the second week of February as maintenance at the Sabine Pass and Cameron liquefied natural gas (LNG) facilities got underway. They dropped by more than 460 MMcf day/day on Friday to only 7.6 Bcf, according to NGI’s U.S. LNG Export Tracker. Genscape Inc. also noted that deliveries to the Cove Point pipeline system switched from an intake of more than 700 MMcf/d to a net sendout of more than 100 MMcf/d on Friday as temperatures near Lusby, MD, plunged.

U.S. LNG exports declined during the week ending Feb. 12. Fifteen vessels, including five from Sabine Pass, three each from Corpus Christi and Freeport, and two each from Cameron and Cove Point, departed carrying 55 Bcf, according to the Energy Information Administration (EIA). That compares to the 17 vessels that left during the prior week carrying 62 Bcf.

Neither the dip in feed gas volumes or regularly scheduled maintenance at LNG terminals are enough yet to “cause structural change” in the U.S. gas market, said Enverus’ Rob McBride, senior director of strategy and analytics.

In any event, gas prices hit four-year lows last week and remain well below $2.00/MMBtu. The EIA also said last week in its latest forecast it expects prices to remain at that level this month and next before rebounding in the second quarter. The agency expects Henry Hub to average just $2.21 this year.

The situation is no different overseas as a global gas glut and the coronavirus outbreak in China have combined to push prices lower. Spot prices in Northeast Asia were around $2.90 on Tuesday, while those in Northwest Europe were even lower at $2.65.

Energy Aspects analysts said last week they expect Japan Korea Marker spot prices to remain at record lows over the coming months, trading near parity with the Dutch Title Transfer Facility (TTF) because of the ongoing impact of the outbreak on Chinese gas demand.

Chinese gas imports are currently down 17% compared with the same time last year, data intelligence firm Kpler said on Friday. Ship diversions and floating storage have increased dramatically over the last week, “signaling limited room in the market to absorb the distressed cargoes,” Kpler added. Fourteen vessels that were initially expected to deliver LNG in the Far East are now headed for different regions, while 21 vessels were floating with the super-chilled fuel near Western Australia, the Middle East and across Asia.

Some of the diverted ships were headed to Europe, Kpler said, where storage inventories remain high.

At current withdrawal rates, European storage inventories are expected to be 2 Tcf at the end of March, according to Tudor, Pickering, Holt & Co. (TPH) estimates. That would represent an 85% surplus to the five-year average at the end of injection season.

“Assuming a typical pace of injections, storage would reach capacity at the end of August with 10 weeks of injection season still to go,” TPH analysts said Tuesday.

While that raises the specter of U.S. shut-ins, TPH also noted that the forward strip for gas prices in Northwest Europe is still in the money by an average of 12 cents/MMBtu through injection season, suggesting prices “may need to drop further to disincentivize U.S. spot cargoes.”

Beyond the possibility of shut-ins, the global gas glut is threatening the next round of LNG export projects in North America. Australia-based Woodside Energy Ltd. said last week it recorded a $720 million impairment in fiscal 2019 results related to Kitimat LNG assets in Western Canada.

Woodside said the “impairment reflects increased uncertainty, particularly in the timing of the development” of the project “following sustained depressed gas market conditions in Western Canada.” Woodside is developing the still unsanctioned 2.7 Bcf/d export project with Chevron Corp. in British Columbia. Chevron said late last year it was searching for strategic alternatives for the project.

In the United States, more than 20 announced projects totaling roughly 35 Bcf/d are looking to catch the second wave of gas exports over the next decade. The U.S. Department of Energy issued long-term orders last week authorizing exports of domestically produced LNG from four new projects in Texas.

“The biggest challenge today that I see from this supply glut is for any developer of LNG that hasn’t reached” a final investment decision yet, McBride told NGI. “It will be very difficult to secure the long-term offtake agreements needed to obtain financing.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |