NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Weekly Natural Gas Prices Shift Only Slightly Despite Wild Swings

Despite some intraweek volatility driven in large part to a double-shot of winter storms hitting the United States, weekly spot gas prices ultimately shifted very little week/week. The NGI Weekly Spot Gas National Avg. slipped just 2.0 cents to $1.750.

The overall change in prices week to week fails to reflect the wild swings the market experienced during the Feb. 10-14 period as a weather system sent temperatures around the Midwest and Northeast plunging. The bump in demand boosted prices by more than $1 day/day across much of the Northeast, a key demand region for the gas market.

However, a subsequent storm that arrived by Friday failed to provide the same momentum for prices despite temperatures sliding well past their lowest levels of the winter so far by an average of 5 to 15 degrees, according to AccuWeather. Instead, prices crashed as the storm’s arrival coincided with the Presidents’ Day holiday weekend.

The biggest movers were on the West Coast, where SoCal Citygate weekly prices tumbled 57.5 cents week/week to $2.335. Malin, however, was down just 9.0 cents on the week to $1.740.

Losses were capped at around 15 cents in most of the Rockies, and at around 20 cents at the majority of market hubs farther upstream in the Permian Basin. Waha fell 16.0 cents week/week to average 67.5 cents.

The Midwest put up modest gains of a couple of cents on the week, while the Midcontinent rose as much as 8.0 cents.

Northeast prices were up between 10 and 20 cents across most of the region.

Weather continued to dominate futures action as well, with traders looking to long-range weather outlooks for direction but getting mixed signals, much like they have all winter.

On Feb. 10, the market returned from the weekend facing an increasingly bearish outlook for the rest of February as all weather models shed a significant amount of demand from outlooks. The March Nymex gas futures contract went on to drop 9 cents to start the week, leaving the prompt month at a four-year low. The $1.766 settlement also was the lowest February closing price for the near-month contract since at least 2001.

However, the dramatic shift to the warmer side appeared overdone as weather models uniformly trended much colder by Wednesday, although they continued to flip back and forth throughout the rest of the week. By mid-Friday, the Global Forecast System saw a cold shot set to hit the northern United States late next week trending colder, and also boosted chilly air at the end of the run for Feb. 28-March 1, according to NatGasWeather. The model still favored a rather mild break across the country Feb. 23-26 before then, however, with national demand again “becoming light.”

The March Nymex contract ultimately gained 7.1 cents from Monday to settle Friday at $1.837. April climbed 5.2 cents to $1.856.

“What could prove most important is if cold air pushes back into the United States Feb. 28-March 1, as it would make the back end of the forecast cold weighted after the weekend break,” NatGasWeather said.

For the long weekend break, due to the Presidents Day holiday, the focus will be on Feb. 23-March 2, according to the forecaster. Right now, the Feb. 23-26 set-up would need to trend colder, but the Feb. 28-March 1 is looking cold enough, it said. “Essentially, continued swings in national demand every several days into early March. Whether that’s enough to rally prices further might depend on the length of milder breaks in between and if cold holds in the maps Feb. 28-March 1.”

Weather aside, supply/demand balances have remained tight. Although demand from the liquefied natural gas (LNG) sector has softened a bit over the past week, the reduction is seen as temporary since it’s tied to maintenance and commissioning events. Meanwhile, production remains well off late-November highs and any subsequent cold weather events could result in additional freeze-offs. Power burns also have remained strong as the low price environment has incentivized demand.

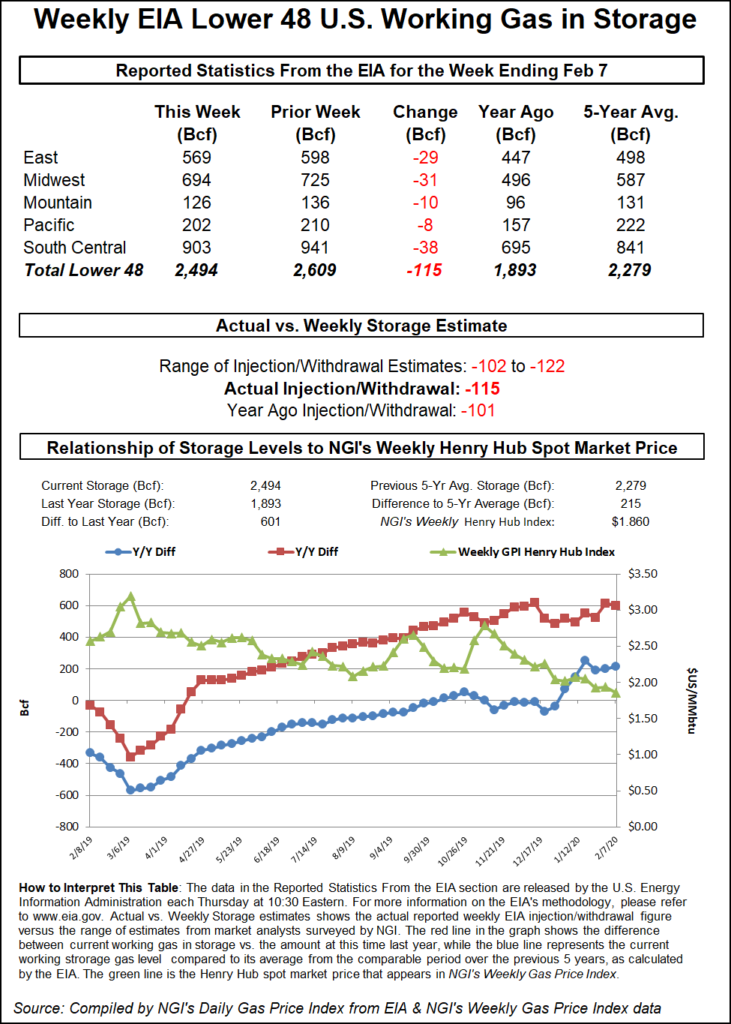

But Tudor, Pickering, Holt & Co. (TPH) analysts said continued strong power burn is proving insufficient to prevent a continued increase in the inventory surplus over the five-year average. On Thursday, the Energy Information Administration (EIA) reported that stocks fell a larger-than-expected 115 Bcf for the week ending Feb. 7, but inventories remained more than 600 Bcf above last year and 215 Bcf above the five-year average.

“…We’re expecting it to tick another percent higher” in the next EIA report, TPH analysts said, with early modeling pointing to a 134 Bcf draw.

“Despite a material uptick in residential/commercial demand for the current week” (for the EIA report on Feb. 20), “it is being partially offset by reduced feed gas demand” from LNG export terminals and gains in imports from Canada, the analysts said. “On the LNG side, Sabine Pass and Cameron are showing materially lower demand week/week, dropping total U.S. LNG utilization to 94% for the week from 104% the prior week.”

On its current track, the end of the traditional withdrawal season is on target for inventories to reach more than 1.85 Tcf, with the official start of the injection season just weeks away. Given the robust supply picture, the EIA in its latest Short-Term Energy Outlook, trimmed its 2020 price forecast to a $2.21/MMBtu average. The agency expects prices will remain below $2.00/MMBtu this month and next, but will rise in 2Q2020 as domestic production declines and gas use for power generation increases demand. Prices are expected to average $2.36/MMBtu in 3Q2020, a 21-cent decline from the agency’s previous STEO forecast, and 33 cents lower than EIA’s December STEOprognostication.

Furthermore, production cuts that have been mostly tied to freeze-offs and pipeline maintenance will likely subside once the mercury rises. IHS Markit data shows that dry natural gas production in January 2020 averaged about 95.0 Bcf/d, the third-highest monthly U.S. natural gas production on record, though down slightly from the previous two months. U.S. natural gas consumption by residential, commercial, industrial and electric power sectors also was lower year/year.

Thursday’s price surge in the spot gas market, driven largely in part to frigid Arctic air dropping into the key Northeast, proved to be fleeting as a quick return to more moderate temperatures sent prices plummeting on Friday.

Algonquin Citygate led the declines as it tumbled $1.585 to average $2.160 for gas delivery through Tuesday. Transco Zone 6 non-NY dropped 63.0 cents to $1.805.

The winter blast continued to impact the Midwest and Northeast on Friday, where lows of minus 20s to 20s were expected the next few mornings, including below-zero temperatures from Chicago to New York City and chilly 30s deep into the South and Southeast, according to NatGasWeather. However, a mild break was forecast to quickly follow across the South and East beginning late in the weekend and continuing through early in the week for a swing back to light demand. The forecaster noted, however, that a second strong cold shot remains on track to impact the Midwest and Northeast during the second half of next week, “with another round of lows reaching the minus 10s to 20s.”

Nevertheless, the rapid warmup and three-day holiday weekend sapped cash markets. Appalachia prices fell as much as 63.5 cents at Texas Eastern M-3, Delivery to average $1.765 for gas delivered through Tuesday. Other regional points fell less than 20 cents day/day, however.

In the Southeast, Dominion Energy Cove Point spot gas was down 47.5 cents to $1.900, while benchmark Henry Hub was down just 3.0 cents to $1.855.

The majority of losses through the Midcontinent and Midwest were limited to around 15 cents, while markets across much of Texas were capped at less than a dime.

In West Texas, Waha spot gas plunged 32.0 cents day/day to average 65.0 cents for gas delivered through Tuesday, while markets farther west generally fell by the single digits.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |