NGI Mexico GPI | Markets | NGI All News Access

Bullish EIA Storage Miss Not Enough to Rally Natural Gas Futures

Despite a larger-than-expected withdrawal in the latest government storage report, one that pointed to continued tightness in the market, natural gas futures failed to catch a bid Thursday, ultimately settling slightly lower on the day. The March Nymex contract slid 1.8 cents to $1.826/MMBtu, while April settled at $1.856, also down 1.8 cents.

In the spot market, with a cold front moving in, hubs along the East Coast posted hefty day/day gains, helping to push NGI’s Spot Gas National Avg. 9.5 cents higher to $1.900.

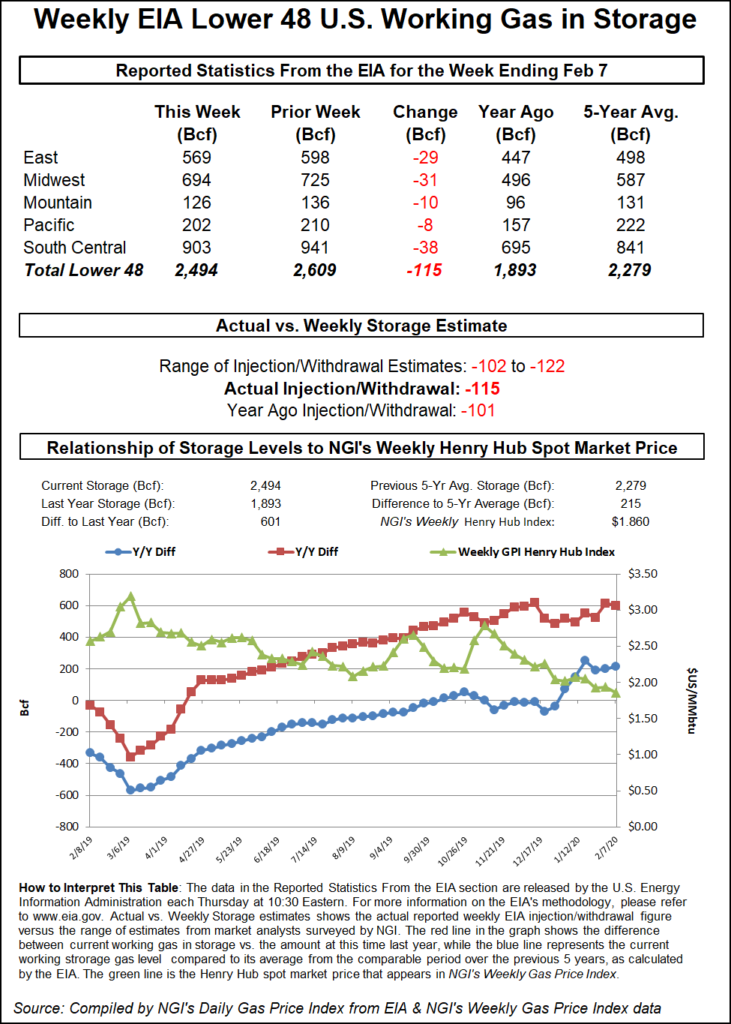

The Energy Information Administration (EIA) Thursday reported a 115 Bcf weekly withdrawal from U.S. natural gas stocks, to the bullish side of expectations, but the print elicited a tepid reaction from the market.

The 115 Bcf figure, reported for the week ending Feb. 7, compares with last year’s 101 Bcf withdrawal and a five-year average draw of 131 Bcf. Consensus had settled around a pull of 110 Bcf, but futures traders seemed unimpressed by the larger-than-expected net change in this week’s print.

As the print crossed trading screens at 10:30 a.m. ET, the March Nymex contract briefly popped to as high as $1.869/MMBtu but sold off over the next 10 minutes, dropping back down to around $1.843-$1.849, off a penny or two from the pre-report trade.

Prior to the report, estimates had been pointing to a withdrawal in the neighborhood of 110 Bcf. A Bloomberg survey of nine market participants had shown a range of withdrawals from 102 Bcf to 112 Bcf, with a median draw of 108 Bcf. A Reuters poll had landed on a 110 Bcf pull, while a Wall Street Journal poll had averaged a 109 Bcf draw. NGI’s model had projected a withdrawal of 113 Bcf.

Total working gas in underground storage stood at 2,494 Bcf as of Feb. 7, 601 Bcf (31.7%) higher than year-ago stocks and 215 Bcf (9.4%) higher than the five-year average, according to EIA.

By region, the South Central saw the largest weekly withdrawal at 38 Bcf, including 26 Bcf pulled from nonsalt and 12 Bcf from salt stocks. The Midwest withdrew 31 Bcf week/week, while the East withdrew 29 Bcf. In the Mountain region, 10 Bcf was pulled from inventories, with the Pacific seeing a net pull of 8 Bcf for the week, according to EIA.

The 115 Bcf print from EIA this week marks “a third consecutive strong number, again quite tight when adjusting for weather,” Bespoke Weather Services said. The pull brings “the end-of-season in our model down a little to 1.85 Tcf, although this week’s data appears to be a little weaker than we’ve seen the last three weeks. Still, it is a supportive balance if we just had more cold.”

As for the latest weather data, the midday Global Forecast System was “very little changed,” according to NatGasWeather. The forecaster noted “two nice cold shots” expected to move across the northern part of the country over the next 10 days, although with “mild breaks in between and after.

“Overall, the pattern is still quite a bit colder than what the weather data showed at the start of the week, and likely the primary reason prices bounced off early week multi-year lows,” NatGasWeather said. “So now it’s up to the natural gas markets to decide if the coming cold shots are enough to retake $1.90” for the March contract. “It would help if the Feb. 22-26 period looked a little colder, but the balance is much tighter, evidenced by” EIA’s reported withdrawal coming in only 16 Bcf shy of the five-year average despite “much lower than normal” heating degree days (HDD) during the period.

Things were relatively quiet in the futures market Thursday, but in the spot market, an injection of frigid air into the Lower 48 this week helped to send prices surging along the East Coast. Algonquin Citygate jumped $1.250 to average $3.745, while Transco Zone 6 NY picked up 62.0 cents to $2.440.

Prices also strengthened farther upstream in Appalachia, where Dominion South added 9.0 cents to $1.710. In the Southeast, Transco Zone 5 rallied 63.0 cents to $2.535.

“An Arctic cold front is already progressing through the Northern Plains and Upper Midwest and will continue to drop south and east, bringing cold and drier conditions in its wake,” the National Weather Service said Thursday. “Temperatures will be about 10-20 degrees below average from the Northern and Central Plains Thursday and into the Ohio Valley and Interior New England/Lower Great Lakes by Friday.

“The cold surge does drop temperatures below normal across the Southern Plains, but only about 5-10 degrees, as the coldest air is directed more east and south by later Thursday.”

The cold front moving over the Midwest and East Thursday was expected to raise demand and introduce the potential for production curtailments due to freeze-offs, according to Genscape Inc.

The firm’s meteorologists predicted peak cold in the Midwest for Friday at 52.1 HDD, 17.3 HDD above 10-year norms. In the East region, Genscape’s forecasters were calling for cold to peak at 31.3 HDD on Saturday, 7.8 HDD colder than 10-year norms.

Meanwhile, Texas Eastern Transmission (Tetco) experienced an unplanned outage at its Lilly, PA, compressor Wednesday, a development that could lend additional upward pressure on spot prices in the Northeast amid the colder temperatures, Genscape analyst Josh Garcia said.

“The unplanned outage dropped operational capacity at the compressor from 2.98 Bcf/d to 2.82 Bcf/d, a 150 MMcf/d drop day/day,” Garcia said. “While this did not immediately cut flows, the Lilly compressor now has a 98.5% utilization rate, and demand is expected to rise even more” by Friday. “This has the potential to add volatility to Northeast prices, although Tetco has a good track record of quick repairs for their minor unplanned outages.”

Elsewhere, Midwest prices saw very little movement despite the colder temperatures. After picking up more than a dime the previous day, Chicago Citygate eased 3.0 cents to $1.795 Thursday. Dawn added 0.5 cents to $1.780.

“The Dawn Area Storage Hub set a record five-year high earlier this winter, topping out at 273 Bcf of working gas in storage at the beginning of November,” Genscape analyst Anthony Ferrara wrote in a note to clients Thursday. “Even though relatively large withdrawals in November and December drew levels down nearing the five-year average, mild weather since then has allowed storage levels to remain near or above the five-year high.”

As of Wednesday (Feb. 12), Dawn storage stood at 164 Bcf, nearly 40 Bcf higher than the five-year average, Ferrara said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |