NGI Mexico GPI | Markets | NGI All News Access

‘Rare’ Colder Shift in Weather Models Drives Gain for Natural Gas Futures

Natural gas bulls finally got a bit of supportive news Wednesday as weather models trended much chillier with a cold blast set to hit the United States next week. The more frigid outlook sent the March Nymex gas futures contract 5.6 cents higher day/day to settle at $1.844/MMBtu, near the high end of its trading range. April climbed 5.1 cents to $1.874.

Spot gas also strengthened considerably as a cold weather system is forecast to drop into the Northern Plains before sweeping across the East later this week, boosting demand along the way. NGI’s Spot Gas National Avg. jumped 12.0 cents to $1.805.

Weather models on Tuesday had become less bearish with a series of winter storms set to hit the country over the next couple of weeks. Both the American Global Forecast System (GFS) and European models then continued their colder move overnight, “something that has been rather rare this season,” according to Bespoke Weather Services. The change was led by the European ensemble, which added more than 10 gas-weighted degree days.

The midday GFS trended even more frigid with next week’s cold shot, adding another 10 heating degree days (HDD), and the good news just kept coming when the afternoon run of the European dataset gained another 18 HDDs, NatGasWeather said. Most of the colder trends were for next week, especially with the blast sweeping across the central United States mid-week, and then across the Great Lakes and Northeast at the end of the week.

“Clearly, the natural gas markets are happy to see the weather data trend colder with prices solidly higher” on Wednesday, the forecaster said.

The March Nymex contract opened Wednesday’s session at $1.790 and jumped to an intraday high of $1.855 before settling about a penny below that level.

The latest European model so far is still rather mild with the set-up Feb. 22-25, but that period and others where milder breaks are forecast also have trended “a little less impressive,” according to NatGasWeather.

Bespoke said the change occurred in response to a weaker trough around Alaska next week, which it believes has a better chance of coming to fruition since the change is in the six- to 10-day period, not further out in the 11- to 15-day, “where models have been too cold consistently.” The danger is that the firm still does have a trough around Alaska, as well as Greenland, which are the signals that have kept warmth in place this season.

“In our view, this makes the forecast a difficult one, and we prefer neutrality right here,” especially with the Energy Information Administration (EIA) issuing its weekly storage inventory report on Thursday. Bespoke’s final estimate was for a withdrawal of 112 Bcf.

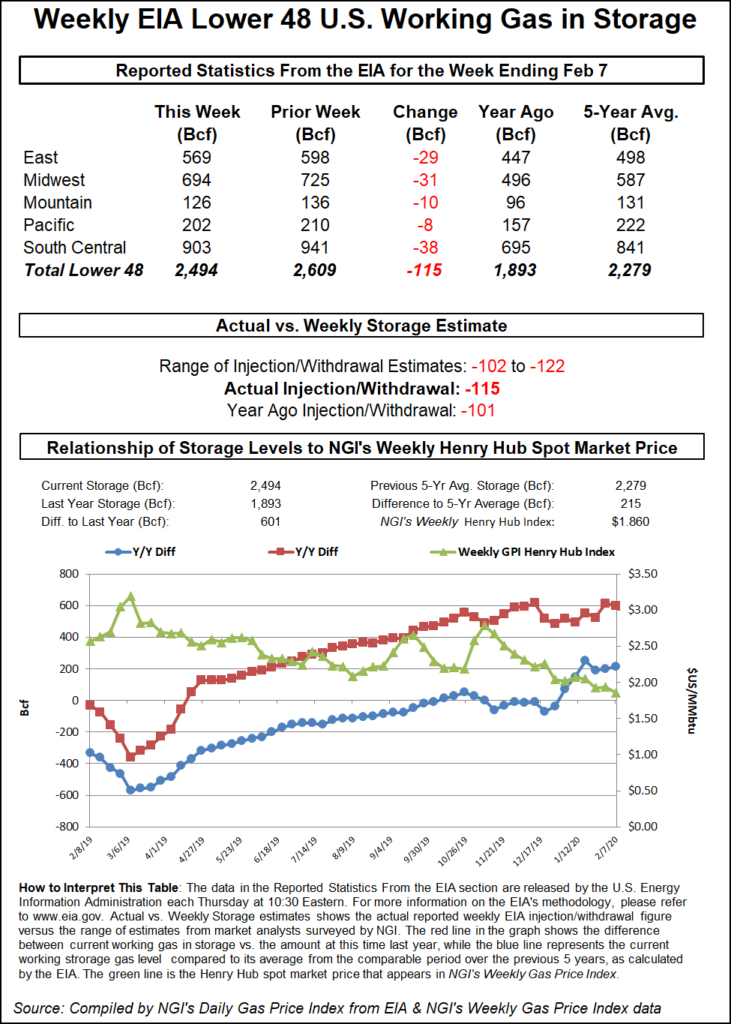

That’s in line with other estimates circulating in the market. A Bloomberg survey of nine market participants showed a range of withdrawals from 102 Bcf to 112 Bcf, with a median draw of 108 Bcf. A Reuters poll included a much larger pull of 122 Bcf and a median of 110 Bcf, while a Wall Street Journal poll averaged a 109 Bcf draw. NGI’s model projected a withdrawal of 113 Bcf.

Those estimates proved to be a little too low. The EIA on Thursday delivered another reported 115 Bcf draw for the week ending Feb. 7, which compares with last year’s 101 Bcf withdrawal and the five-year average draw of 131 Bcf.

Bespoke said the figure was the “third consecutive strong number; again quite tight when adjusting for weather, bringing the end-of-season in our model down a little to 1.85 Tcf, although this week’s data appears to be a little weaker than we’ve seen the last three weeks. Still, it is a supportive balance if we just had more cold.”

Spot gas prices raced higher on Wednesday, with the Northeast leading the gains as an Arctic front is moving through the Northern Plains and Upper Midwest and heading east.

Temperatures are forecast to be about 10-20 degrees below average from the Northern and Central Plains on Thursday and into the Ohio Valley and Interior New England/Lower Great Lakes by Friday, according to the National Weather Service (NWS). Lower temperatures also were expected across the Southern Plains, but the coldest air is directed more east and south by later Thursday, the forecaster said.

“The active train of storms across the Gulf of Alaska will slowly drift south and start to affect the Pacific Northwest by early Thursday,” NWS said. “This will bring increased moisture into the orographic areas of the Olympic and northern Cascade Ranges.”

Lower elevations were expected to see moderate rainfall, while heavy snows were forecast to “bleed over” the Northern Rockies and Blue Ranges by Friday, according to NWS.

Prices in the constrained New England area were the most volatile, with Tenn Zone 6 200L spot gas shooting up 43.0 cents to average $2.655. By comparison, Transco Zone 6 non-NY cash rose only 5.5 cents to $1.825.

Gains across Appalachia were limited to less than a dime at the majority of pricing hubs, while Tenn Zone 4 200L moved up 10.0 cents to $1.740.

Similarly small increases were seen throughout the Southeast and Louisiana, while Midcontinent prices rose upward of 30.0 cents at several price points. Northern Natural Ventura cash was up 30.5 cents to $2.070 as the pipeline declared a system overrun limit for Friday due to the colder-than-normal temperatures.

Permian Basin pricing continued to mount gains, but outright prices remained well below the $1 mark. Waha cash jumped 24.5 cents day/day to average 79.5 cents. Other Texas markets rose less than 15 cents on the day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |