NGI Weekly Gas Price Index | Markets | NGI All News Access

Early February Cold Snap Too Brief to Meaningfully Move Weekly NatGas Spot Markets

A cold blast that swept across the country during the first week of February was enough to revive natural gas spot prices on the West Coast and in parts of Texas, but the frigid air proved too fleeting to meaningfully impact more premium markets.

NGI’s Weekly Spot Gas National Avg. rose 2.0 cents to $1.770.

Gains in California were led by the SoCal Border Avg., which jumped 24.5 cents week/week to $2.14.

Transwestern San Juan in the Rockies rose 13.5 cents to $1.680, although several pricing hubs posted increases of less than a dime.

Permian Basin pricing steered clear of negative territory between Feb. 3 and 7, with Waha hitting an intraweek high of $1.710 on the way to an 83.5-average, which was 56.0 cents higher on the week.

Prices on the East Coast were mixed as a reinforcing blow of Arctic air was forecast to hit the region over the weekend. Transco Zone 6 NY tumbled 18.0 cents week/week to $1.780, while the pipeline constrained Algonquin Citygate jumped 19.5 cents to $2.300.

With hopes for any semblance of lasting cold fading by the day, production declines and strong liquefied natural gas (LNG) demand kept Nymex futures relatively well-supported for the first week of February. The March contract rose 3.9 cents from Monday to settle Friday at $1.858. April climbed 3.0 cents during that time to $1.892.

Lower 48 production dropped into the upper 80s Bcf on Thursday and but bumped up slightly to sit near 90.0 Bcf by Friday, according to Bespoke Weather Services. Some of the recent declines are likely due to pipeline maintenance and freeze-offs, with pipelines in the Rockies warning early in the week of a strong cold front moving into the area.

In the East, production during the week fell to the lowest daily volume for the region since mid-August, down to 31.85 Bcf/d, according to Genscape Inc. So far this February, East production is averaging just a tick over 32 Bcf/d, which lags January’s output by more than 0.44 Bcf/d.

While some of the recent production declines may be temporary in nature, a much more structural decline could lie ahead. The coronavirus has thrown the energy market for a loop, leading to heightened volatility as the oil and gas industry try to assess the potential impact the outbreak could have on demand.

In early January, the West Texas Intermediate (WTI) benchmark price had topped $65/bbl. Since then, the price has plummeted, with trading on Monday slipping below the $50/bbl mark for the first time in 13 months. The March contract settled then Tuesday at $49.61/bbl, but moved back above $50/bbl on Wednesday and remained there on Friday.

Nevertheless, the decline prompted Genscape to reduce its production growth forecast for 2020 by nearly 1.4 Bcf/d compared to the firm’s previous forecast update six weeks ago. Production expectations for 2021 were reduced by more than 2.3 Bcf/d versus the previous forecast and now represent a year/year decline.

The coronavirus also has stoked fears on the LNG front. Although demand currently remains strong as feed gas deliveries to U.S. export terminals hover above 9 million Dth, any long-term demand destruction from the coronavirus outbreak threatens to shut-in U.S. exports.

At least one Chinese buyer, state-run China National Offshore Oil Corp. (CNOOC), has rejected some contracted shipments of LNG as efforts to contain the coronavirus disrupt shipping traffic and demand, and on Friday, at least LNG vessels headed to China were reportedly diverted or are idling offshore.

Although Total SA and Royal Dutch Shell plc rejected CNOOC’s force majeure, the broader implications of the Chinese buyer’s decision are “startling,” according to EBW Analytics Group. “The force majeure decision may be the first of many for Chinese LNG importers who physically cannot receive additional cargoes due to full storage tanks. A cascade of force majeures could further depress Asian LNG prices, close already-narrow arbitrage windows and eventually prompt U.S. feed gas cuts.”

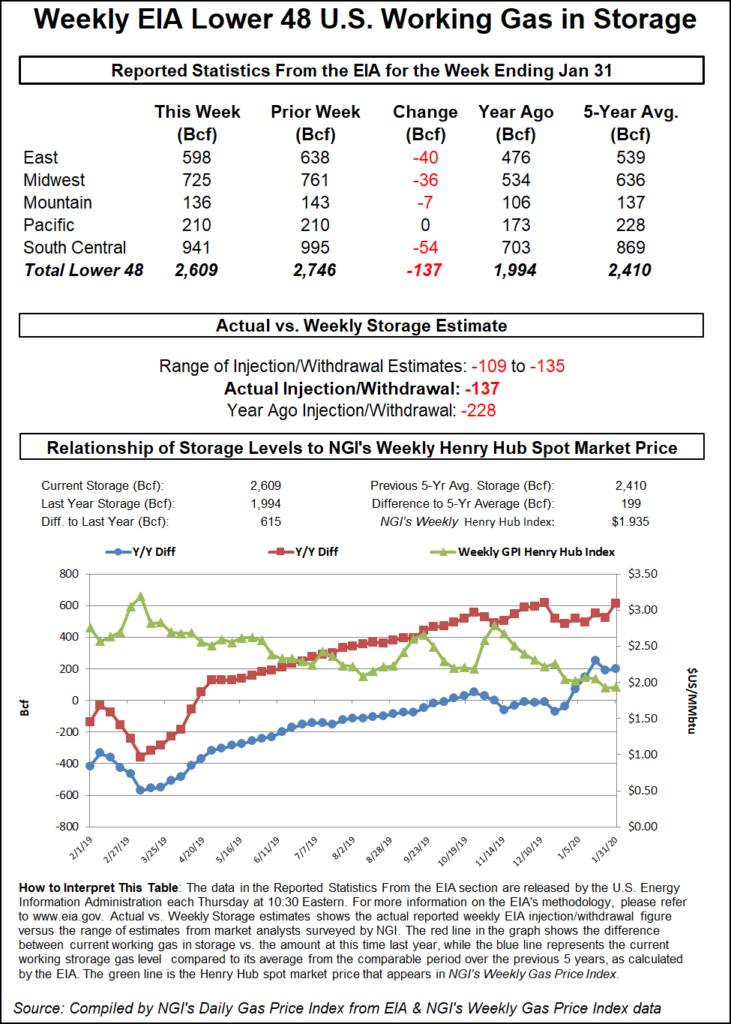

Meanwhile, U.S. storage facilities don’t have much wiggle room when it comes to taking in more supply. On Thursday, the Energy Information Administration reported that storage inventories fell by 137 Bcf for the week ending Jan. 31. Although considered a bullish statistic compared with projections ahead of the report, the draw expanded the year/year overhang to a whopping 615 Bcf and the surplus to the five-year average to 199 Bcf.

With prospects for strong winter demand unlikely, inventories are on target to end the winter season — and start the injection season — with more than 2.8 Tcf in storage, and some estimates are closer to 2.9 Tcf.

With the mercury rising to comfortable levels following a midweek winter storm, spot gas prices were relatively steady Friday for gas being delivered through Monday. Gains and losses were capped at a few pennies across most of the country, while the majority of big movers were concentrated in the Northeast, where a storm dropped copious amounts of rain from Virginia to New York beginning Thursday night.

An all-out snowstorm was forecast for the northern tier of the Northeast into Friday night, according to AccuWeather meteorologist Bernie Rayno.

Snow was beginning to fall in earnest across the upper Ohio Valley early Friday, with snowfall rates predicted to be 1 inch/hour or higher, the forecaster said. This band of heavy snowfall was expected to continue pivoting northeastward throughout Friday.

“A general six to 12 inches of snow will fall in the swath from parts of northwestern and north-central Pennsylvania to central and northern Maine, but a 12- to 18-inch band is in store farther over the northern tier of the Northeast where an AccuWeather Local StormMax of 24 inches is likely,” Rayno said.

In the wake of the storm, some colder air was forecast to spill into parts of the interior South and along coastal areas of the mid-Atlantic and southern New England. However, since the next storm is forecast to take a northerly track across the Great Lakes this weekend and then over the St. Lawrence Valley on Monday, any substantial snow from it will tend to be limited to the northern tier of the Northeast, according to AccuWeather.

Interestingly, Transco Zone 6 NY spot gas prices appeared unimpressed, falling 1.5 cents to average $1.840 for delivery through Monday. In New England, Algonquin Citygate jumped 51.5 cents to $2.950.

Prices were also mixed in Appalachia, but day/day changes were limited to less than a nickel in most markets.

The majority of pricing hubs throughout the Southeast and Louisiana traded in the black on Friday, but only by a couple of pennies.

Only a handful of markets in the Midcontinent posted larger gains, including NGPL Midcontinent, which climbed 8.5 cents on Friday to $1.610.

Texas was a sea of red, with losses in the western part of the state coming in at more than a dime across the region. El Paso Permian fell 12.5 cents to average 38.0 cents for gas delivery through Monday.

Other points along the El Paso Natural Gas System in the Rockies also softened day/day, while most other market hubs in the region climbed a few pennies.

In California, SoCal Border Avg. fell a hefty 18.5 cents to $1.785, while Malin slipped only 1.0 cent to $1.770.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |