NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Supply/Demand Balances Still Tight, but Natural Gas Price Inflection Point Unclear

Natural gas forward market trading got off to a choppy start in February as fundamentals barely budge, with persistently warm weather continuing to bump up against lower production and strong exports.

Forward prices for both the March and April contracts averaged 2 cents higher from Jan. 30-Feb. 5, while the summer strip (April-October) fell a penny on average, according to NGI’s Forward Look. The winter 2020-2021 strip (November-March) was down an average 2 cents.

Futures action wasn’t much more exciting. The March Nymex gas contract shifted more than 5 cents on only one day during the Jan. 30-Feb. 5 period, ultimately leaving the prompt-month contract 3 cents higher over that time at $1.861. April landed at $1.887, the summer strip at $2.03 and the winter 2020-2021 package at $2.42.

“The front of the curve continues to rhyme with the pricing dynamics seen in 1Q2016,” Mobius Risk Group said. “When a pricing inflection point will be reached remains in question, and in the meantime, supply and demand balances continue to tighten.”

To be sure, the natural gas market has several factors working in its favor. Production continues to head lower by the day, and as of early Thursday, was down to around 89.5 Bcf, according to Bespoke Weather Services. However, the firm noted that some of the decline is likely because of temporary freeze-offs.

Liquefied natural gas (LNG) intake and power burns remain strong, with NGI’s U.S. LNG Export Tracker showing feed gas deliveries hovering near 9.25 million Dth on Thursday.

Although clearly overshadowed by ultra-warm weather for winter, it appears that core fundamentals may have tightened by 4.5-5.0 Bcf/d over the last three months, a constructive sign for the 2020 injection season, according to EBW Analytics Group.

However, weather always rules in the gas market, and this winter has failed to produce the level of demand needed to support prices. Instead, the balmy winter has helped to drive a once hefty 700 Bcf-plus storage deficit to an impressive overhang to both year-ago levels and the five-year average.

On Thursday, the Energy Information Administration (EIA) reported a 137 Bcf withdrawal from storage inventories for the week ending Jan. 31. Although the figure was viewed as among the tightest of the season to date, it was dwarfed by last year’s 228 Bcf withdrawal for the similar period.

An ever tougher pill to swallow, the EIA’s reported 137 Bcf draw expanded the year/year overhang to a whopping 615 Bcf and the surplus to the five-year average to 199 Bcf.

With weather-driven demand in the new one- to 15-day forecast window having fallen for nine consecutive weeks, expected demand has been reduced by a cumulative 349 gas-heating degree days and 573 Bcf, according to EBW. Traders, rightfully, are taking a cautious approach when it comes to the latest weather data.

The European model made major revisions to its outlook both overnight Tuesday, Wednesday afternoon and again overnight Wednesday. The American Global Forecast System (GFS) model trended notably colder in its midday run on Thursday, gaining a hefty 20 heating degree days (HDD) versus Wednesday night’s run and 35 HDD versus the previous 24 hours, according to NatGasWeather.

“The weather data has been flip-flopping the past few days on how much cold air to expect into the northern United States Feb. 12-20, and that is likely to continue until the weekend break,” the firm said. It’s “up to the natural gas markets to decide if the latest GFS is worth pricing in some risk…”

The March Nymex contract settled Thursday at $1.862, up one-tenth of a cent from Wednesday’s close. April was unchanged at $1.887.

Looking ahead to early spring, EBW said nonfundamental indicators are likely to play a key role over the next four to six weeks.

On the demand side, there may be less coal-to-gas switching potential than widely recognized at sub-$2.00/MMBtu pricing, as coal plants need to stay online for reliability reasons, according to EBW. Further, global LNG demand may remain high enough during the heating season to keep feed gas demand at record levels.

On the supply side, producers line up an exhaustive planning schedule months in advance, and often require months to change their production trajectory, EBW said. “In short, aside from near-term weather forecasts, fundamental response to multi-year lows in natural gas prices will likely take time to play out. As a result, market sentiment and technical trading will likely have an increased role in near-term price movements.”

There are some risks, however. The coronavirus is wreaking havoc in energy markets across the globe as uncertainty mounts over the potential demand destruction the outbreak could cause. Goldman Sachs Commodities Research analysts in a note to clients late Wednesday said the narrowing spread between the Japan Korea Marker (JKM) and Dutch Title Transfer Facility (TTF) reflects the market’s concern that the outbreak will significantly lower Asian demand for LNG and, as a result, greatly increase the excess supply in the market. The Goldman analysts, led by Samantha Dart and Damien Courvalin, also noted that the arbitrage window for U.S. LNG exporters also has narrowed.

The reduction in the LNG import forecast comes as reports circulated Thursday that state-run China National Offshore Oil Corp. declared a force majeure amid the outbreak, meaning the LNG buyer is rejecting some contracted shipments as efforts to contain the coronavirus disrupt shipping traffic and demand.

Total SA’s Philippe Sauqet, who heads the Gas, Renewables and Power segment, said the company, after consulting with legal analysts, rejected one force majeure it received. He warned that if a longer-term situation arises in which LNG cargoes can’t be offloaded at Chinese terminals because of the virus, Total could reassess because then “there might be a real case for force majeure.”

As global prices weaken, Nymex futures may need to remain weak to maintain the 10 Bcf/d of feed gas demand expected once the third production units at the Freeport and Cameron LNG terminals enter service, according to EBW. Sub-$2.00/MMBtu by late summer remains plausible, particularly if speculators dramatically expand short positions, “but falling production and the potential for even modest shut-ins to rebalance global markets may support futures.”

A storm system may be heading toward the Northeast this weekend, which could dump snow from New York to Maine. However, a return to more moderate temperatures next week helped send regional forward prices cratering during the Jan. 30-Feb. 5 period.

A potential foot or more of snow is expected to fall by Friday in the Northeast, while icing was expected to be problematic from central Pennsylvania to southern Maine, according to the National Weather Service. But while the frigid air could lend support to cash markets in the days ahead, forwards prices reflected the much milder long-term outlook.

Transco Zone 6 NY March prices fell 5 cents from Jan. 30-Feb. 5 to reach $1.948, but April picked up a penny to hit $1.762 and the summer rose 2 cents to $1.73, Forward Look data show. The winter 2020-2021 strip plunged a far more substantial 18 cents to $3.91.

In New England, Iroquois Zone 2 March prices were down 10 cents to $2.624, while April prices rose 5 cents to $2.273. Summer fell 3 cents to $1.94, and the winter 2020-2021 dropped 11 cents to $5.39.

Unlike several other Northeast pipelines that have reversed gas flows following Marcellus and Utica shale development, Iroquois Gas Transmission continues to import Candian gas almost year-round to meet local demand, according to RBN Energy LLC. With the 1,100-MW Cricket Valley Energy Center power plant due online this spring, Iroquois prices, already maintaining a solid premium over benchmark Henry Hub, are likely to strengthen even further.

“Iroquois imports gas every day in winter, most days in peak summer and less during the shoulder seasons, but there have been no months in which Iroquois did not receive at least some gas from Canada — although May 2019 came close with only one day of imports,” RBN analyst Lindsay Schneider said in a recent blog.

That would change if Williams’ proposed Constitution Pipeline were to be built, but regulatory delays and public opposition have kept the project from moving forward. Even though gas on Iroquois is higher priced than gas supplied via other points in the area, the overall gas price environment still makes the Cricket Valley power plant economical, according to RBN.

RBN expects the plant to run as baseload-type generation, or nearly year-round rather than only during periods of high power demand. Based on gas requirements for similar combined-cycle gas turbines, the firm estimated it would increase the number of days that Iroquois imports gas from Canada to about 80% of the year, from 65% in 2019.

“There would also be some upside if the summer is particularly hot, but no real winter upside as Iroquois already imports gas on all winter days,” Schneider said. “The increased summer usage would further decouple Iroquois prices from the rest of the Northeast and make Iroquois even more of a premium pricing point in the area.”

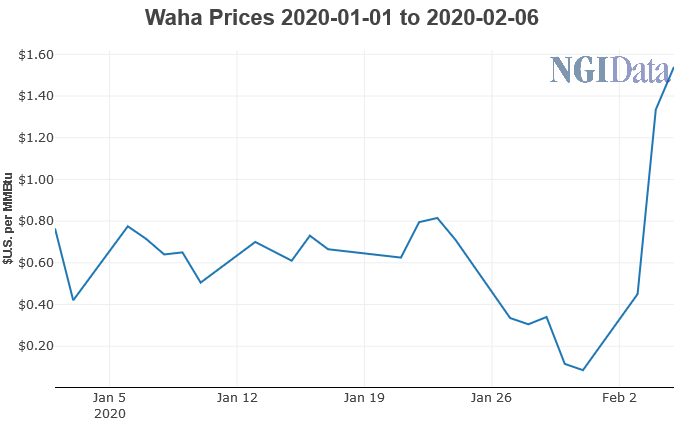

In Texas, the Permian Basin’s often struggling Waha hub enjoyed some strength in recent days. Cash basis spiked Wednesday to its strongest level since January 2019, reaching minus 31 cents, NGI data show.

Though area production continues to run strong, a cold front has moved into the area lifting demand, according to Genscape Inc. Pipeline nominations for Wednesday were revised down by 0.8 Bcf/d, a revision likely because of a spike in demand rather than freeze-offs.

“There is a decent amount of local load on intrastate systems that, when elevated, results in gas not showing up on the visible interstates,” Genscape senior natural gas analyst Rick Margolin said.

Lows in Lubbock, TX, dipped into the teens overnight Wednesday and are forecast to remain below freezing through Monday.

However, with a quick return to milder conditions, forward prices remained soft. Waha March prices rose only a penny from Jan. 30-Feb. 5 to average minus 10.2 cents, according to Forward Look. Negative prices were seen through May, while the full summer strip averaged 7 cents after falling 8 cents on the week. Winter 2020-2021 prices were down 1 cent to 77 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |