NGI The Weekly Gas Market Report | LNG Insight | Markets | NGI All News Access

U.S. Tops Canada on Export Front, But Prices Generally Lower

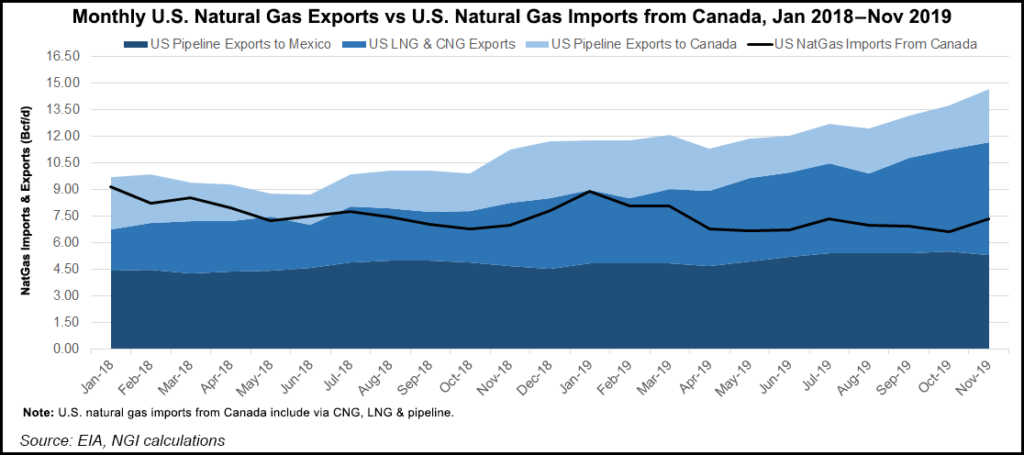

Canada faded while the United States grew as the North American champion of natural gas exports in the first nine months of 2019, according to the latest trade scorecard of the U.S. Department of Energy (DOE).

Rising U.S. exports exceeded declining Canadian volumes by 59% from January through September last year. American gas dealers increased sales in multiple markets, while Canadians continued to rely exclusively on traditional pipeline shipments to the United States.

Total U.S. exports grew by 27.3% to 3.3 Tcf or 12.1 Bcf/d in the first three quarters of 2019, up from 2.6 Tcf, or 9.5 Bcf/d, in the same 2018 period, reports the DOE’s gas regulation division.

Canadian pipeline deliveries to its gas industry’s lone export destination, the United States, fell by 6.4% to 2.09 Tcf, or 7.6 Bcf/d, from January-September 2019. Pipeline deliveries during the same time period in 2018 were at 2.2 Tcf, or 8.2 Bcf/d.

U.S. exports accelerated on three trade fronts.

The growth star was liquefied natural gas (LNG). LNG tankers loaded by five U.S. terminals carried 1.22 Tcf, or 4.5 Bcf/d, to 28 overseas destinations in the first nine months of 2019, up 61.2% year/year from 762.5 Bcf, or 2.8 Bcf/d.

Cross-border U.S. pipeline exports to Canada increased by 19.3% year/year to 693.8 Bcf, or 2.5 Bcf/d, between January and September, up from 581.4 Bcf, or 2.1 Bcf/d.

U.S. exports to Mexico grew by 10.2% to 1.38 Tcf, or 5.1 Bcf/d, up from 1.26 Tcf, or 4.6 Bcf/d, in the same period in 2018.

Prices were mixed.

Canadian sales to the United States fetched US$2.37/MMBtu in the first three quarters of 2019, up 5.2% from US$2.25/MMBtu in the same 2018 period.

Prices for U.S. exports to Canada fell by 7.1% to US$2.80/MMBtu from January-September 2019, down from US$3.01/MMBtu a year earlier.

The value of American gas exports to Mexico also shrank during the nine-month period, dropping by 16.8% year/year from US$3.16/MMBtu to US$2.63/MMBtu.

Prices fetched by U.S. LNG varied widely across their 28 destinations during the first nine months of the year, from Argentina and Belgium to Thailand and the United Arab Emirates. Average prices ranged from US$3.40/MMBtu in the Netherlands to US$6.06/MMBtu in Japan.

Since then, global gas prices have plummeted to record lows. Benchmark prices in Northeast Asia have dipped below $4.00/MMBtu in recent days, while European benchmarks are hovering around $3.00. The prices, particularly in Asia, where LNG has fetched steep prices well above $10.00 in recent years, were once unthinkable.

The coronavirus outbreak in China that is spreading across the globe and its potential impacts on demand are weighing heavily on a market that is already swimming in LNG thanks largely to steady production from Australia, Qatar, Russia and the United States.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |