Shale Daily | E&P | NGI All News Access

Black Diamond Acquires 20% Stake in Saddlehorn Crude, Condensate Pipeline, Growing Rockies Footprint

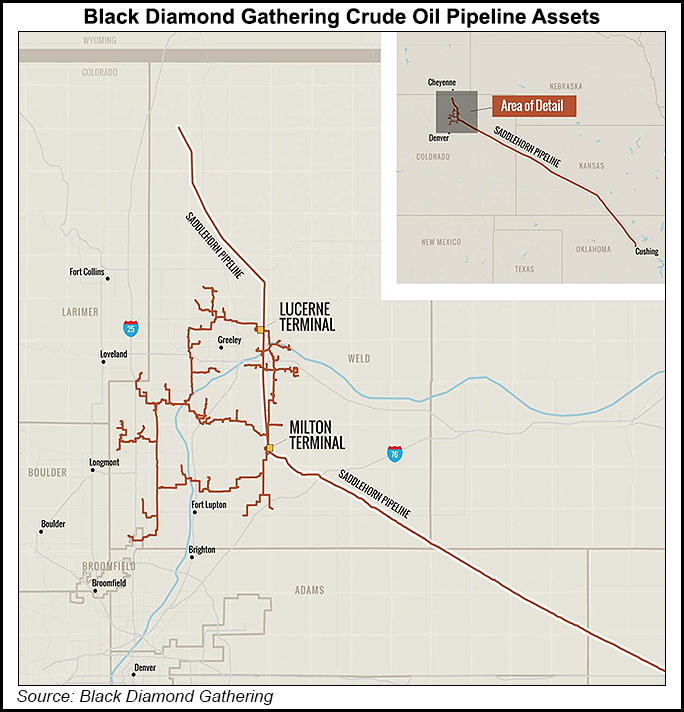

Black Diamond Gathering LLC, a partnership between Noble Midstream Partners LP and Greenfield Midstream LLC, has acquired a 20% interest in the Saddlehorn crude oil and condensate pipeline.

Saddlehorn, which moves hydrocarbons from the Denver-Julesburg (DJ) and Powder River basins to storage facilities to the oil hub in Cushing, OK, has transport capacity of about 190,000 b/d. It is expanding by another 100,000 b/d following a successful open season.

The expansion, which would bring total capacity to 290,000 b/d, is expected to enter service in late 2020 following the addition of incremental pumping and storage capabilities, Noble Midstream said. The expansion would require no additional capital from Black Diamond.

Black Diamond’s acquisition of the Saddlehorn stake cost the joint venture partners $155 million gross, or $84 million net to Noble Midstream. Saddlehorn is backed by minimum volume commitments, and Noble Midstream said the acquisition “is expected to generate returns above organic capital options and bolster the quality and diversification of the partnership’s cash flows.”

“This accretive transaction represents a rare opportunity to buy into a largely-contracted pipeline with high-quality producers and midstream operators,” said Noble Midstream COO Robin Fielder. “Saddlehorn strengthens the Black Diamond position as the premier full-service crude transportation provider in the DJ Basin and enhances the value proposition provided to our customers. Further, this investment is anticipated to generate high rates of return, provide diversification, and increase our exposure to stable cash flow streams.”

Black Diamond, an integrated oil gathering system in the DJ, comprises about 240 miles of pipeline in operation, 300,000 b/d delivery capacity and 390,000 bbl of storage capacity, and it is connected to every major takeaway pipeline in the basin.

Black Diamond doubled its DJ acreage and crude gathering volumes through a 15-year partnership announced last year with Dallas-based Verdad Resources LLC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |