NGI The Weekly Gas Market Report | Infrastructure | LNG | LNG Insight | NGI All News Access

Lawsuit Between LNG Rivals Cheniere, Tellurian Dismissed Ahead of Trial

A lawsuit between Cheniere Energy Inc. and Tellurian Inc. has been dismissed by a Texas district court. A $400 million counterclaim by Cheniere’s one-time business partner Parallax Enterprises LLC also was dismissed, days before a trial was set to begin in Harris County District Court in Houston.*

Liquefied natural gas (LNG) export pioneer Cheniere, which was co-founded by Tellurian Chairman Charif Souki in 1996, had sued its former chief, alleging he conspired to help finance a joint venture that led to the formation of Tellurian.* Tellurian Vice Chairman Martin Houston, who founded Parallax, also was named in the suit.

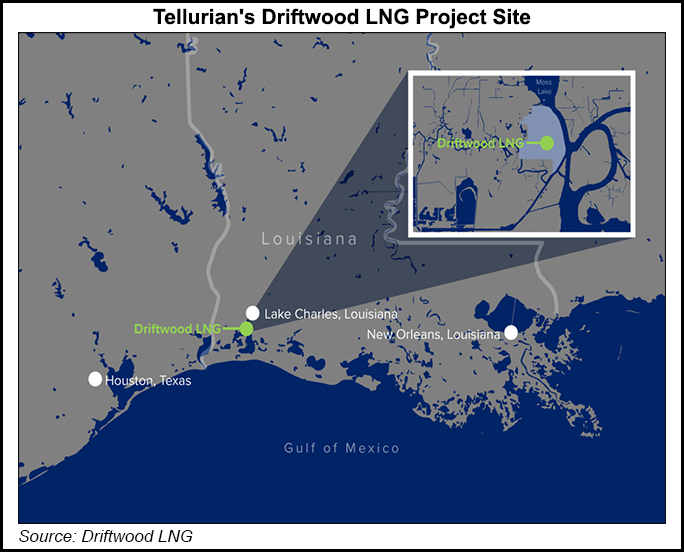

Tellurian is developing the not-yet-sanctioned Driftwood LNG, a 27.6 million ton/year (mmty) project near Lake Charles, LA. The proposed facility would be on about 1,000 acres, with deepwater access.

“Although this frivolous lawsuit was clearly an attempt to disrupt the hard work and success we are having at Tellurian, it never distracted us from our focus on building Tellurian’s global natural gas business, beginning with Driftwood LNG,” Souki said.

Cheniere declined to comment.

Driftwood is backed by a lump-sum turnkey engineering and procurement contract (EPC) with Bechtel Corp. that guarantees cost, performance and schedule. Bechtel has progressed the engineering to more than 28% complete, all construction permits have been secured and the project is “shovel ready,” according to Tellurian. Work is expected to begin this year, with first liquefaction in 2023.

Bechtel also has a longstanding partnership with Cheniere, which is currently constructing the sixth train at the Sabine Pass terminal in Louisiana. Bechtel had completed more than 38% of the project at the end of September.

Cheniere also is developing a mega expansion of the Corpus Christi LNG facility that would add another 9.5 mmty. It expects to make a final investment decision on that project this fall.

Total SA last summer upped its stake in Driftwood by investing another $500 million in the terminal. The Paris-based major also plans to purchase 1 mmty from Driftwood and 1.5 mmty from offtake volumes from the facility. Including Total’s original $207 million investment in 2016, the aggregate investment would equal $907 million.

In late 2019 Tellurian signed a memorandum of understanding to sell a portion of capacity to India’s state-owned Petronet LNG Ltd. The two parties are working toward finalizing the transaction by March 31.

“I look forward to my next trip to India and anticipate finalizing our agreements by the end of March,” Souki said.

*Clarification: In the original version of this story, the $400 counterclaim was reported to be by Tellurian Inc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |