NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Natural Gas Markets Sagging as Bulls Left Wondering What Happened to Winter

With little in the way of winter weather, and with prices already deeply discounted, the natural gas spot market turned in a mostly quiet week of trading during the four-day period ended Jan. 30; NGI’s Weekly Spot Gas National Avg. fell 4.0 cents to $1.750.

The general lack of winter demand in surrounding regions seemed to pile more pressure on West Texas prices during the week; the persistently cheap prices in the region posted the largest discounts in the North American market for the trading period. Also potentially impacting prices there, Transwestern declared a force majeure at a compressor in Arizona that required a capacity reduction on its mainline. Waha tumbled 46.0 cents on the week to average just 27.5 cents.

Most other regions saw more muted price action. Hubs in the Midwest, East Texas, South Texas, Louisiana, Appalachia and the Southeast generally traded close to even, with most locations also failing to crack the $2 mark.

Prices in the Northeast were mixed, with a few New England locations seeing slightly larger discounts week/week. Algonquin Citygate shed 7.5 cents to $2.105.

Meanwhile, still facing bearish headwinds from weak winter weather, futures managed to finish Friday’s trading in positive territory, helped by indications of a tightening supply/demand balance. The March Nymex contract climbed 1.2 cents to settle at $1.841/MMBtu. Week/week the front month fell 5.2 cents, with the expired February contract having settled at $1.893 the previous Friday.

The gains in the futures market Friday didn’t appear to have a weather catalyst, according to NatGasWeather. The midday Global Forecast System (GFS) run lost a handful of heating degree days (HDD) to maintain milder trends that emerged overnight, putting its projections 17 HDD warmer versus 24 hours earlier, the forecaster said.

“The timeline remains the same, with a milder-than-normal pattern for much of the United States through Feb. 9, but still with stronger pushes of cold air into the West and North Feb. 10-15,” NatGasWeather said. “However, the amount of cold air into the Midwest and Northeast has backed off considerably since the start of the week for big demand losses, with only Feb. 13-15 now looking cold enough to satisfy.

“…It does help that the supply/demand balance has tightened considerably over the past month, but it’s up to weather patterns to take advantage, and they simply haven’t.”

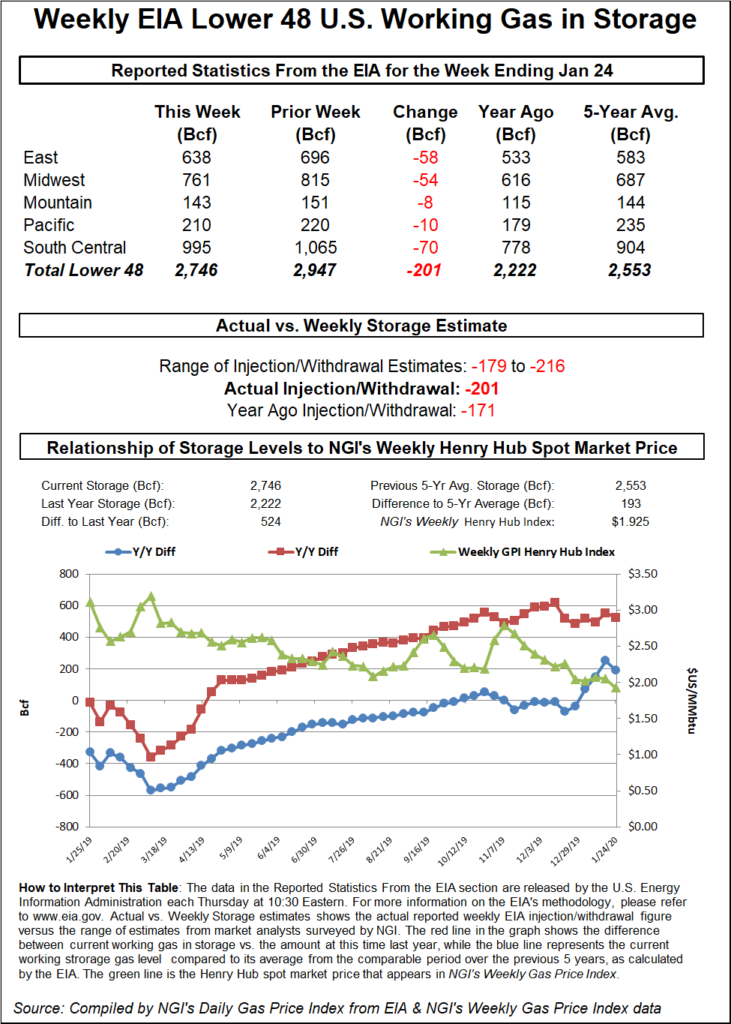

The Energy Information Administration’s (EIA) latest storage data, a 201 Bcf weekly withdrawal from U.S. natural gas stocks reported for the week ended Jan. 24, suggests continued tightness in the underlying fundamentals, according to analysts.

The 201 Bcf withdrawal compares with a 171 Bcf withdrawal recorded in the year-ago period and a five-year average pull of 143 Bcf. The print also fell on the bullish side of consensus.

A Bloomberg survey had produced a median prediction for a 197 Bcf withdrawal. Responses to a Wall Street Journal survey had averaged minus 195 Bcf, while a Reuters survey had also landed on a 195 Bcf pull. Predictions had ranged from minus 179 Bcf to minus 216 Bcf. NGI’s model had predicted a 210 Bcf withdrawal.

Total Lower 48 working gas in underground storage stood at 2,746 Bcf as of Jan. 24, 524 Bcf (23.6%) higher than last year and 193 Bcf (7.6%) higher than the five-year average, according to EIA.

By region, the South Central posted the largest weekly withdrawal at 70 Bcf, including 31 Bcf pulled from salt stocks and 39 Bcf from nonsalt. The East withdrew 58 Bcf on the week, while 54 Bcf was pulled in the Midwest. The Pacific recorded a 10 Bcf weekly withdrawal, while 8 Bcf was withdrawn in the Mountain region, according to EIA.

“Weather looks to have finally cooperated, as total degree days for the report week came in 18% above historical norms,” said Tudor, Pickering, Holt & Co. (TPH) analysts in a note Friday, “but what’s concerning to us is the dislocation between total degree days and withdrawals from storage, with cumulative degree days only 1% below the five-year average and total withdrawals tracking 12% below.

“Meanwhile, the natural gas market is continuing its undersupplied streak, with weather-adjusted historical degree day correlations pointing to a 2.5 Bcf/d undersupplied market, marking the third continuous week of undersupply.”

Even so, prices have gotten “unpleasantly close” to the $1.61 low recorded in March 2016, the TPH analysts said. They “continue to see additional supply cuts being required” to bring the market back to structural undersupply by the second half of 2020.

Genscape Inc. estimated this week’s 201 Bcf pull as tight versus the five-year average by around 1.5 Bcf/d when compared to degree days and normal seasonality.

“Weekly storage stats have been trending tighter versus weather, and this week’s report is the tightest storage stat we have seen since 2018,” Genscape analyst Eric Fell said.

Fell attributed the tighter balances in part to production declines on a combination of freeze-offs, maintenance and “some natural declines starting to set in.” Other factors include strong power burns driven by low gas prices, “surging” liquefied natural gas exports and residential/commercial demand growth, the analyst said.

Raymond James & Associates analysts estimated that the withdrawal implies the market was 2.3 Bcf/d tighter versus the year-ago period. Over the past four weeks, the market has been 2.0 Bcf/d tighter year/year on average, they said.

In what has become a familiar refrain for natural gas spot trading, underwhelming temperatures pressured prices lower across most regions Friday. Henry Hub set the pace, shedding 5.5 cents on the day to drop to $1.850.

While several weather systems were expected to hit the Lower 48 over the next week or so, NatGasWeather wasn’t expecting any of them to bring enough cold to impress the market.

“One mild system will track across the Southeast” Friday, “while a slightly cooler one impacts the Northwest,” the forecaster said. “Additional mild to cool systems will track across the country” over the weekend and into the upcoming work week.

“Overall, highs will remain in the 30s to 50s across the northern United States, locally 20s, with 40s to 70s across the southern United States. But with frigid air remaining in Canada the next seven days, overall temperatures will be warmer than normal” for most of the Lower 48.

Midwest and Midcontinent hubs generally sold off by around a dime or more. Chicago Citygate dropped 10.0 cents to $1.670, while Northern Natural Ventura fell 11.0 cents to $1.615.

Farther east, Appalachian hubs traded both sides of even, while Northeast points continued to slide. Dominion South picked up 7.5 cents to $1.525, while Transco Zone 6 NY fell 16.5 cents to $1.725.

West Texas prices continued to come under pressure Friday, with several locations recording transactions in negative territory. Waha finished at 8.5 cents, a 3.0 cent discount day/day.

The weakening in Permian Basin pricing came even as Transwestern resolved a mechanical issue at its Station 4 compressor in Klagetoh, AZ, that had been impacting flows through its Mainline Thoreau West segment.

The event had been restricting flows through the segment from 1.24 Bcf/d to around 1.05 Bcf/d. Capacity was restored as of the Intraday 2 cycle for Friday’s gas day, according to the pipeline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |