NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Natural Gas Forwards Deteriorate Further as Bears Look to Aggressively Short the Market

With little chance of sustained cold weather creeping into long-range weather forecasts until at least mid-February, if ever, natural gas forward prices continued to disintegrate during the Jan. 23-29 period.

The February contract, which rolled off the board on Wednesday, dropped an average 15 cents, according to NGI’s Forward Look. March fell 8 cents on average, while the summer strip (April-October) dropped a nickel on average.

If they haven’t already, it’s a safe bet that natural gas traders are writing off this winter, as only a few brief cold blasts have hit key demand regions, limiting strong demand. Weather models as of early Thursday appeared to put the final nail in the coffin for the anemic gas market.

After showing some signs of a shift that could bring cold into the pattern at least from the Midwest back into the West, the overnight models backed off and left the forecast a touch warmer compared to the previous 24 hours, according to Bespoke Weather Services.

“Gone is the upper-level ridging around Alaska that we saw” in Wednesday’s midday runs, “an all-too-familiar theme this winter,” Bespoke chief meteorologist Brian Lovern said.

With all models showing a solidly positive Arctic Oscillation (AO), meaning a complete lack of blocking around the North pole over to Greenland, the pattern around Alaska must change to give any opportunity for cold into parts of the United States that are meaningful in terms of natural gas demand. “As long as this fails to occur, models will continue to exhibit a cold bias in the medium range, possibly setting us up for yet another top-end warm month in February as a whole,” Lovern said.

Despite the bearish weather outlook, price action was relatively quiet during the Jan. 23-29 period, with day/day changes limited mostly to a few pennies. The February Nymex futures contract expired Wednesday at $1.877, off only a nickel from the previous Thursday. March was down 4 cents to $1.870, with similarly small decreases seen further out the curve.

However, EBW Analytics Group warned that if weather forecasts continued trending warmer, the recent period of consolidation may have primed the March contract to take the next leg lower. In each of the past three years, the March natural gas contract has declined at least 19 cents from Jan. 31 to Feb. 15, with an average loss of 27 cents, or 8.9%.

“Part of these declines is due to specific weather pattern evolution and individual circumstances in each year,” the firm said. “Still, history suggests potential downside ahead as bullish risks fade significantly from February to March, and a storage squeeze is nowhere in sight, potentially negating any hesitations by bears to more aggressively short natural gas.”

To be sure, the latest government storage data did little to sway market sentiment, despite the data pointing to the strongest withdrawal of the winter season so far. That’s because the Energy Information Administration’s (EIA) reported 201 Bcf withdrawal for the week ending Jan. 24 still pales in comparison to the largest draws of the previous three winters, including last winter’s pull of 237 Bcf for the week ended Feb. 1, 2019, and the 359 Bcf draw for the week ending Jan. 5, 2018.

Inventories sat at 2,746 Bcf, 524 Bcf higher than this time last year and 193 Bcf above the five-year average, according to EIA.

Looking ahead, the core fundamentals of restrained production and repeated liquefied natural gas (LNG) records are likely to begin whittling down the natural gas storage trajectory by April, according to EBW. LNG demand hit a new record shy of 9.5 Bcf/d earlier this week and is likely to surge toward 11.0 Bcf/d or higher in the months ahead.

The second production units at both the Cameron and Freeport LNG terminals have increased feed gas demand ahead of schedule to boost LNG flows, EBW said. Moreover, Freeport has announced Train 3 is likely to begin flows by the end of March, while Cameron Train 3 may similarly beat expectations for the end of June.

“If this occurs, the two additional LNG trains may increase demand by 1.5 Bcf/d above market expectations, potentially by late spring,” EBW said.

Meanwhile, producers remain likely to announce reduced capital expenditures (capex) and production expectations, although widespread announcements are not likely until earnings calls at the end of February, according to EBW. All eyes will be on northeastern gas producers, but this is largely because many other plays are producing associated gas as a byproduct of oil-focused drilling. Further, a host of factors suggest that any declines in capex may have a limited effect on raw natural gas production.

“Although there are signs that Nymex gas futures may stabilize later this spring, downside risk should not be taken lightly,” EBW said.

Losses were widespread across forward markets for the Jan. 23-29 period, but the Northeast posted the most substantial declines at the front of the curve as yet another week has gone by with little indication of cold weather on the way.

One storm with rain and snow was forecast to sideswipe the coastal Northeast on Saturday, and even though a blockbuster event is not anticipated, slippery conditions were expected to develop in some areas as a second storm sweeps in from the West, according to AccuWeather.

“There are some key definitive factors that are likely to eliminate the chance of a big snowfall in the Northeast,” AccuWeather senior meteorologist Alex Sosnowski said. “The snow drought is expected to continue in the mid-Atlantic region, and the pair of storms this weekend is not likely to bring much in the way of snow to southern New England and the central Appalachians.”

Temperatures were forecast to be near or above freezing in most areas that would have the best chance of snow on the western fringe of the storm in the mid-Atlantic and in southern New England, according to the forecaster. Rather than put up a fight, an area of high pressure sliding eastward from Quebec is expected to “give it up” this weekend thanks to too much west-to-east movement with the jet stream.

“In order for a big snowstorm in the Northeast, cold air must hold its ground to allow the storm crank out snow instead of rain or a rain and snow mix,” Sosnowski said. “In the case of the weekend storm, the air is not that cold to begin with and it appears as though it will sound the retreat.”

Several other weather systems are on tap for next week, although those too lack any truly frigid air, according to NatGasWeather. Stronger cold shots are still expected Feb. 10-14, but the amount of cold air is uncertain, and both weather models have backed off on the intensity of cold in their latest runs.

“Here we are yet again this winter with the weather data showing frigid air pushing into the United States at days 13-16 of the forecast, but yet again dropping tons of demand once it rolls into days 6-11,” the firm said. “Sure, the supply/demand balance has tightened considerably, it’s just weather patterns aren’t taking advantage.”

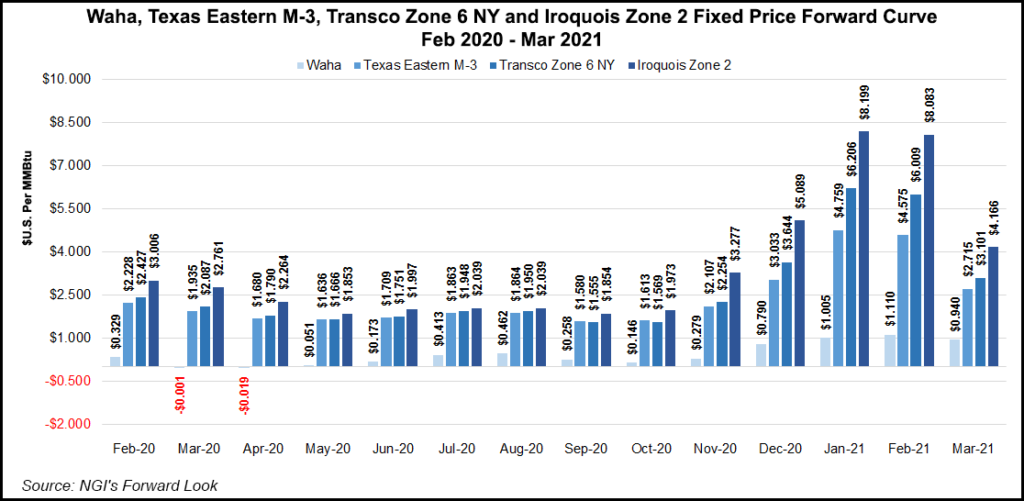

Iroquois Zone 2 February prices plunged $1.70 from Jan. 23-29 to reach $3.006, about $1.12 above benchmark Henry Hub, Forward Look data show. For comparison, the New England hub averaged about $1.30 above Henry Hub during the winter 2018-2019.

Iroquois Zone 2 March declined 48 cents to $2.761, while the summer strip fell a nickel to $2.00. The winter 2020-21 strip resumed the dramatic losses as prices tumbled 25 cents to $5.76.

Transco Zone 6 NY February prices were down 47 cents to $2.427, about 55 cents above Henry Hub. Last winter, New York averaged at a 55-cent premium to the Gulf Coast hub.

Transco Zone 6 NY March was down 10 cents to $2.087 and the summer fell 3 cents to $1.75, according to Forward Look. The winter 2020-21 strip was down 17 cents to $4.24.

In Appalachia, Texas Eastern M-3, Delivery February dropped 35 cents from Jan. 23-29 to reach $2.228, while March fell just 10 cents to $1.935. Summer was down 4 cents to $1.71, but the winter 2020-21 strip slid 10 cents to $3.44.

Permian prices continued to sink closer to negative territory, with Waha February tumbling 25 cents to average just 32.9 cents and March falling 21 cents to land at zero. The summer strip averaged 21 cents after falling 15 cents, while the winter 2020-21 package landed at 82 cents after sliding 16 cents, Forward Look data show.

Losses throughout the rest of the country generally followed the lead of the Nymex futures curve, with most packages declining no more than a dime throughout the Jan. 23-29 period. February prices rolled off the board sporting $1 handles at the majority of market hubs, as did March prices.

In fact, $2 gas did not show up in forward curves on a more widespread basis until July, and even then, most prices sat under $2.10.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |