NGI Mexico GPI | Markets | NGI All News Access

Bearish Finish for February Natural Gas Contract; Cash Steady

In a fitting end to an exceptionally bearish month of trading, February natural gas futures dropped more than a nickel into expiry Wednesday as forecasts offered little to inspire bulls. The February Nymex contract rolled off the board at $1.877/MMBtu, off 5.7 cents on the day. March settled at $1.865, down 4.3 cents.

Meanwhile, a continuation of seasonally mild conditions across the Lower 48 yielded a mix of mostly minor spot price adjustments; NGI’s Spot Gas National Avg. eased 1.5 cents to $1.765.

The latest projections from the Energy Information Administration’s (EIA) Annual Energy Outlook, which called for sub-$4 Henry Hub prices out to 2050, established a bearish backdrop for Wednesday’s price action, Powerhouse Vice President David Thompson told NGI.

“We’ve kept breaking through prior lows, prior significant lows,” Thompson said. “…It’s been an unmitigated slide lower all the way through this winter.”

From a technical standpoint, bulls will want to hold support around $1.830, near the recent intraday low in the February contract, he said.

“A break below $1.83, this most recent low, opens the door down into the $1.60s, those lows from 2016,” Thompson said.

As for the latest weather picture Wednesday, the midday Global Forecast System (GFS) data added heating degree days (HDD) to the outlook starting around the second week of February, according to NatGasWeather. The colder midday trends followed a warmer overnight shift going into Wednesday’s trading.

“The biggest milder trends the past few days occurred Feb. 5-8, as only a glancing shot of cold air is expected into the Midwest and Northeast” instead of cold that would push “more aggressively across the Canadian border,” the forecaster said. “…The GFS still remains much milder for Feb. 5-8 compared to what it had shown to open the week, but the Feb. 9-13 pattern continues to show a more impressive push of subfreezing air into the northern U.S.”

However, “over the past several months, in most instances, when the pattern looked quite cold at days 12-15, the weather trended notably milder as these days rolled into the day five to 11 period, which could occur again here.”

Genscape Inc. meteorologists removed 9 HDD from their latest aggregate 14-day forecast as of early Wednesday.

“The largest changes were applied to next Wednesday and Thursday, Feb. 5-6, with each becoming warmer by nearly 2 degree days” compared to Tuesday’s forecast, Genscape senior natural gas analyst Rick Margolin said. “The change results in the 14-day demand forecast being reduced by about 1.8 Bcf/d and 25.7 Bcf aggregate over the two-week period.”

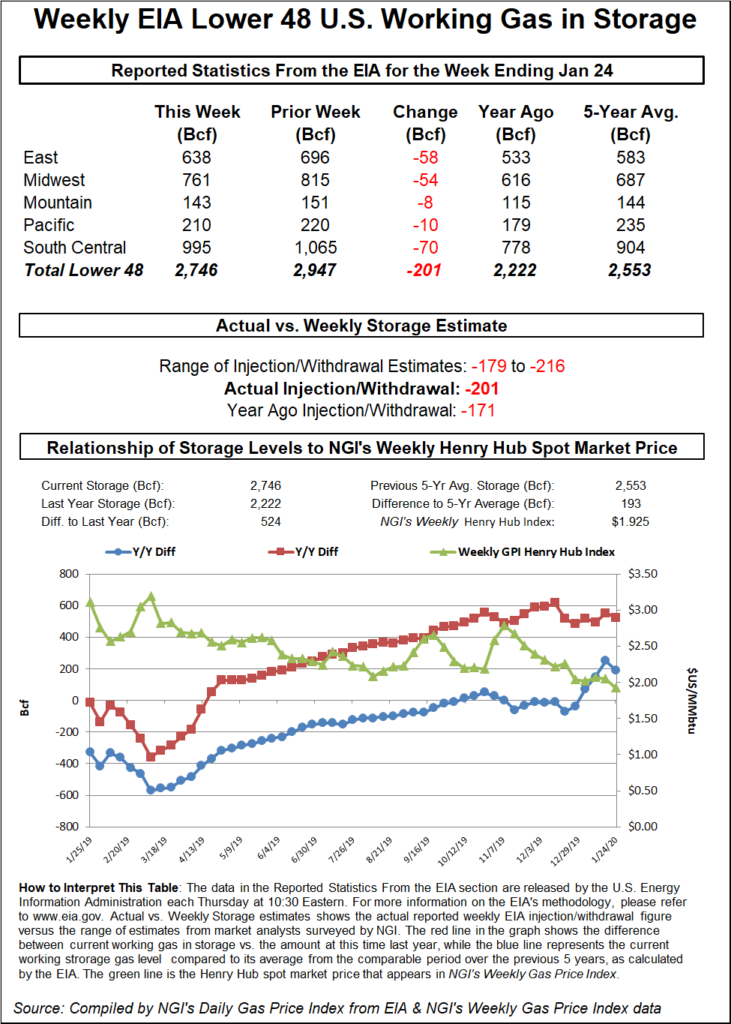

Meanwhile, estimates for Thursday’s EIA storage report have been pointing to a larger-than-average withdrawal in the neighborhood of 200 Bcf.

A Bloomberg survey as of Wednesday produced a median prediction for a 197 Bcf withdrawal for this week’s EIA report, which covers the week ended Jan. 24. Responses to a Wall Street Journal survey averaged minus 195 Bcf, while a Reuters survey also landed on a 195 Bcf pull. Predictions ranged from minus 179 Bcf to minus 216 Bcf. NGI’s model predicted a 210 Bcf withdrawal.

Last year EIA recorded a 171 Bcf withdrawal for the similar week, while the five-year average is a pull of 143 Bcf.

“A 200 Bcf-plus draw on Thursday, if it occurs, could boost the market,” EBW Analytics Group analysts said. “Further, gas-weighted HDD are expected to pick up significantly” around Feb. 7-13, “which could provide near-term support.

“There are increasing indications, though, that Indian Ocean forcing could strengthen again” toward mid-February. “If this bearish signal validates, the price of the March contract could decline significantly next month.”

Last week EIA reported a net 92 Bcf withdrawal for the week ended Jan. 17, which left stocks at 2,947 Bcf, 23.2% above year-ago levels and 9.3% higher than the five-year average.

The song of the January cash market to date — weak prices and mild temperatures — remained largely the same in Wednesday’s trading. Benchmark Henry Hub slid 3.5 cents to $1.920.

The United States will see impacts from several weather systems over the next week, but none of them will be “cold enough to impress,” NatGasWeather said Wednesday.

“One mild system will track across the South and Southeast the next few days, while cooler ones impact portions of the West,” the forecaster said. “Additional mild to cool systems will track across the country this weekend and early next week.

“Overall, highs will be in the 30s to 50s across the northern U.S., locally 20s, with 50s to 70s across the southern U.S. With frigid air remaining in Canada the next seven days, national demand will be lighter than normal.”

Northeast and Appalachia hubs posted some of the largest discounts on the day as temperatures along the Interstate 95 corridor were expected to warm up heading into the weekend. Maxar’s Weather Desk called for highs for Philadelphia, Boston and New York City to climb from the mid-20s for Thursday up into the mid-30s by Saturday and Sunday.

Tenn Zone 6 200L tumbled 14.5 cents to $2.195, while farther upstream, Dominion South fell 10.5 cents to $1.515.

Prices were mostly steady through the middle third of the country. Chicago Citygate eased 1.5 cents to $1.800. In the Rockies and California, small gains were the norm. Kern River picked up 4.5 cents to $1.750. SoCal Border Avg. added 8.5 cents to $1.925.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |