Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Trump Signs USMCA into Law Amid Record Mexico Natural Gas Exports, Energy Reform Tension

Amid surging exports of pipeline natural gas from the United States to Mexico, and tension between the oil and gas industry and Mexico’s government, U.S. President Donald Trump on Wednesday signed the United States-Mexico-Canada Agreement (USMCA) into law.

The deal, which still must be ratified by Canada, is a revamped version of the North American Free Trade Agreement (NAFTA) and seen as vital to the energy sectors and economies of all three signatory countries.

In the wake of Mexico’s 2013-2014 constitutional energy reform signed under then-president Enrique Peña Nieto, international oil companies now hold exploration and production rights in both onshore and offshore blocks in Mexico. By contrast, when NAFTA took effect in 1994, state oil company Petróleos Mexicanos (Pemex) was the only operator allowed in Mexico’s upstream segment.

Peña Nieto’s successor, Andrés Manuel López Obrador, has criticized the reform and put a halt to new bid rounds, but his Morena coalition, which controls both houses of congress, has left the legislation intact.

The USMCA, meanwhile, “locks in for U.S. investors, service suppliers, and other companies the benefits of Mexico’s historic 2013 energy reforms,” according to a fact sheet on the deal published by the office of United States Trade Representative (USTR) Robert Lighthizer.

The agreement also ensures no tariffs on the flow of energy products across North America, more flexible rules of origin requirements for oil and gas moving between the three countries, and a streamlined regulatory process for U.S. liquefied natural gas (LNG) exports to Mexico and Canada, according to the USTR.

Crucially for U.S. oil companies operating in Mexico, the USMCA also preserves for select industries, among them oil and gas, the investor dispute settlement mechanism (ISDS) from Chapter 11 of NAFTA.

This means that “U.S. and Canadian firms who have invested in Mexico over the past years in the aftermath of the energy reform will continue to receive protections under the wording of the USMCA,” the Woodrow Wilson Center’s Duncan Wood told NGI’s Mexico GPI, “and that helps those companies, but it also helps Mexico to attract investment.” Wood directs the center’s Mexico Institute.

American Petroleum Institute (API) CEO Mike Sommers on Wednesday called the new agreement “a win-win for American workers and energy consumers,” adding, “North American energy markets are deeply integrated and interconnected, and the free flow of energy products and investments in natural gas and oil across our borders is critical to sustaining American energy leadership and economic growth.”

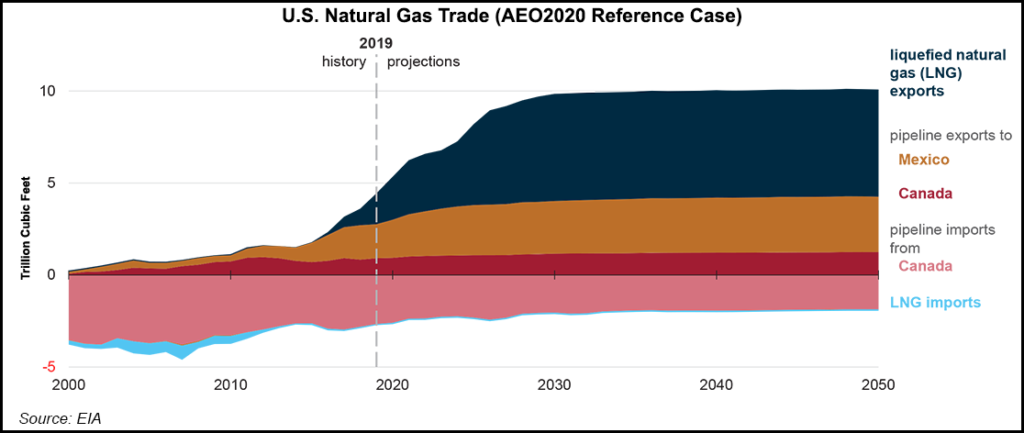

Pipeline natural gas exports from the United States to Mexico averaged 5.5 Bcf/d in October 2019, up from 4.9 Bcf/d in October 2018, according to the latest available data from the Energy Information Administration.

Sommers also highlighted that Mexico is the No. 1 destination for U.S. exports of gasoline, fuel oil and total refined products, while Canada is the leading market for U.S. produced crude oil and fuel blending components.

“These exports represent viable markets for U.S. products,” Sommers said, “spurring more production and economic benefits here at home.”

Sommers hailed the bipartisan efforts of U.S. legislators to hammer out the agreement, saying the cooperation across the aisle “sends an important signal to our trading partners and provides certainty for American supply chains that support millions of U.S. jobs.”

Independent Petroleum Association of America (IPAA) CEO Barry Russell welcomed the news, saying Wednesday, “The terms of the USMCA signed today by President Trump are good news for U.S. independent oil and natural gas producers. Free trade helps not only our industry, but the U.S. economy as a whole.”

Russell continued, “At a time when oil and natural gas production is increasing, we have the best high growth outlets we could ask for in our neighbors Mexico and Canada.” He cited that the two countries combined to account for 75% of U.S. natural gas exports and about 30% of petroleum exports in 2018.

“We appreciate the bipartisan action on this agreement that will enhance our country’s status as an energy leader and benefit U.S. workers and consumers,” Russell added.

API is one of more than 200 companies and associations from the agriculture, manufacturing, labor, energy and small business sectors that comprise the USMCA Coalition, which lobbied for the agreement’s approval by the United States Congress.

In related news, API, Mexico oil and gas trade association Amexhi and the International Association of Oil and Gas Producers (IOGP) signed on Wednesday a memorandum of understanding (MOU) “to strengthen their working relationship and joint efforts to help advance operational performance across North America operations.”

“For Amexhi, this MOU represents the opportunity to implement in Mexico the best international practices in the operations of the oil and gas industry,” said Amexhi’s Merlin Cochran, general director.

IOGP’s Wafik Beydoun, Americas director, said the partnership “will help boost the operational performance of the oil and gas industry in Central and North America, including more consistent operational practices in the Gulf of Mexico.”

The three groups pledged to “work jointly on specific projects to promote advancement in areas such as health and safety performance, environmental protection in the Gulf of Mexico, legal frameworks and even cybersecurity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |