NGI The Weekly Gas Market Report | E&P | NGI All News Access

Private Sector Drives 2.7% Rise In Full-Year Mexico Natural Gas Output, Oil off 7.2%

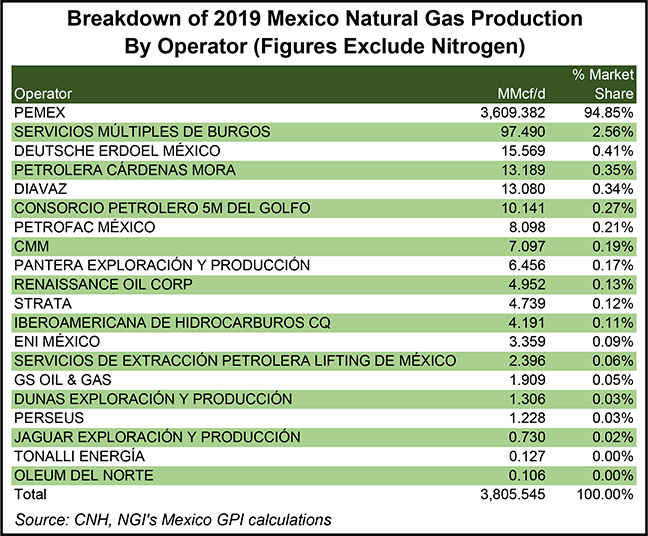

Natural gas production in Mexico averaged 3.81 Bcf/d during 2019, up from 3.71 Bcf/d in 2018, according to new data from upstream regulator Comisión Nacional de Hidrocarburos (CNH).

Output from fields operated by state oil company Petróleos Mexicanos (Pemex) averaged 3.61 Bcf/d for the year, compared to 3.58 Bcf/d in 2018.

Private sector operators, for their part, produced 196.2 MMcf/d, up 35.2% from the 127.1 MMcf/d averaged in 2018.

Among projects operated by private sector firms, production was led by the onshore CNH-M3-Mision/2018 contract in the Burgos basin operated by Servicios Múltiples de Burgos, S.A. de C.V. (SMB), a 50/50 joint-venture between Tecpetrol S.A. and Industrial Perforadora de Campeche. Tecpetrol is a subsidiary of Italian conglomerate Techint Group.

Misión was formerly operated by Pemex, with activity carried out by SMB under an oilfield services (OFS) contract. In 2018, Misión became the first OFS contract at a natural gas-focused project to be migrated to an exploration and extraction contract under the framework of Mexico’s 2013-2014 energy reform.

Among Mexico’s hydrocarbon basins, Burgos is the largest producer of non-associated gas, meaning natural gas that is not a byproduct of crude oil extraction.

Crude oil output, meanwhile, fell to 1.68 million b/d on the year from 1.81 million b/d, a decline of 131,000 b/d, or 7.2%, CNH figures show.

For December 2019, natural gas output at fields operated by Pemex averaged 3.69 Bcf/d, up from 3.52 Bcf/d in December 2018.

Private sector operators produced 220.3 MMcf/d for the month, up from 164 MMcf/d in the year-ago period, a 34.3% increase.

Mexico oil and gas trade group Amexhi had pledged for private sector natural gas and oil output to reach 240 MMcf/d and 50,000 b/d, respectively, by end-2019. The group expects those figures to reach 450 MMcf/d and 280,000 b/d by 2024.

Crude oil production by Pemex and the private sector averaged 1.66 million b/d and 47,900 b/d, respectively, during the last month of 2019, compared to 1.68 million b/d and 31,400 b/d in December 2018.

Pemex’s 2019-2023 business plan, meanwhile, lists full-year natural gas and oil production targets of 3.56 Bcf/d and 1.71 million b/d, respectively, for 2019.

Natural gas marketers in Mexico transacted an average of 5.55 Bcf/d of the molecule during December 2019, down from 6.01 Bcf/d in December 2018, according to the IPGN monthly natural gas price index published by the Comisión Reguladora de Energía (CRE).

Prices averaged 58 pesos/GJ ($3.19/MMBtu) in the 2019 month, compared to 88 pesos/GJ ($4.60/MMBtu) in the 2018 period.

CRE used 237 transactions reported by 23 marketers to calculate the December 2019 IPGN, compared to 281 transactions by 22 companies in December 2018.

Pipeline natural gas exports from the United States to Mexico averaged 5.5 Bcf/d in October 2019, up from 4.9 Bcf/d in the corresponding 2018 month, according to the U.S. Energy Information Administration.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |