NGI Weekly Gas Price Index | Markets | NGI All News Access

January Cold a No-Show as Weekly Natural Gas Spot Prices Tumble

A near-complete lack of anything resembling bonafide January cold continued to take its toll on natural gas spot prices during the trading week ended Jan. 24; widespread discounts dropped NGI’s Weekly Spot Gas National Avg. 36.5 cents to $1.790/MMBtu.

In New England, major hubs shed whatever remained of the modest winter premiums recorded in the prior week’s trading. Algonquin Citygate plunged $2.150 to average just $2.180 on the week.

Mirroring the sell-off in the futures market, most hubs from the Gulf Coast through the Midcontinent, Midwest and Rockies averaged below $2 on the week, weighed down by warmer-than-normal temperatures blanketing most of the country. Henry Hub tumbled 12.5 cents week/week to $1.925.

West Coast hubs also moderated heavily during the week, especially in Southern California. SoCal Citygate averaged $3.100, dropping $1.265.

Mild winter temperatures also continued their relentless assault on natural gas futures prices during the week. A lack of impressive cold into early February gave bears the initiative Friday; the February Nymex contract slid 3.3 cents to settle at $1.893. Week/week the front month fell 11.0 cents after settling at $2.003 the previous Friday.

Afternoon data from the European model Friday advertised “better demand” moving into February, reversing demand losses advertised in the model’s previous overnight run, according to NatGasWeather. But the overall weather picture remained far from bullish.

The European data “again only favored a glancing blow of colder air across the Midwest and Northeast Feb. 5-7,” the forecaster said. “Demand is still better those days than the rather bearish pattern before then,” but it would take a “much colder” shift to be considered bullish.

As for what prices do coming out of the weekend break, “it’s possible the weather data is too mild and adds demand, but to end bearish weather headwinds, the Feb. 5-10 period will need to look more intimidating” than it did in Friday’s model runs, NatGasWeather said.

Earlier in the winter, the weather had the potential to become a “bullish wildcard” for an oversupplied market, but with the end of the peak heating demand season fast approaching, the weather so far has proved “dramatically bearish,” according to RBN Energy LLC analyst Sheetal Nasta.

“Daily national average temperatures in January to date have averaged 4-plus degrees (Fahrenheit) above the 10-year average and also nearly 3 degrees higher than last year,” Nasta wrote in a recent blog post. “As such, U.S. gas consumption has been exceptionally weak in January so far.”

RBN’s supply/demand modeling showed Lower 48 residential/commercial demand averaging 45.7 Bcf/d through the first 22 days of January, down nearly 7 Bcf/d year/year. That also marks the lowest demand level during that same 22-day period going back to at least 2010, according to the firm.

“Total U.S. consumption, in turn, has averaged about 100 Bcf/d in January to date, about 3.5 Bcf/d lower than in the same period last year and 2.3 Bcf/d lower than the five-year average,” Nasta said.

To make matters worse for bulls, time is running out on winter, according to the analyst.

The weather picture through early February “leaves little to no room for cold weather to ease oversupply conditions,” Nasta said. “Absolute temperatures typically begin a seasonal rise starting around mid-February, and as seasonal temperatures rise, their influence on heating demand diminishes, meaning it would take more extreme cold-weather anomalies by late February and March in order to move the needle on demand and storage.

“Plus, once temperatures rise enough for freeze-offs to abate, production volumes are likely to bounce back to pre-winter levels and even possibly see more upside beyond that.”

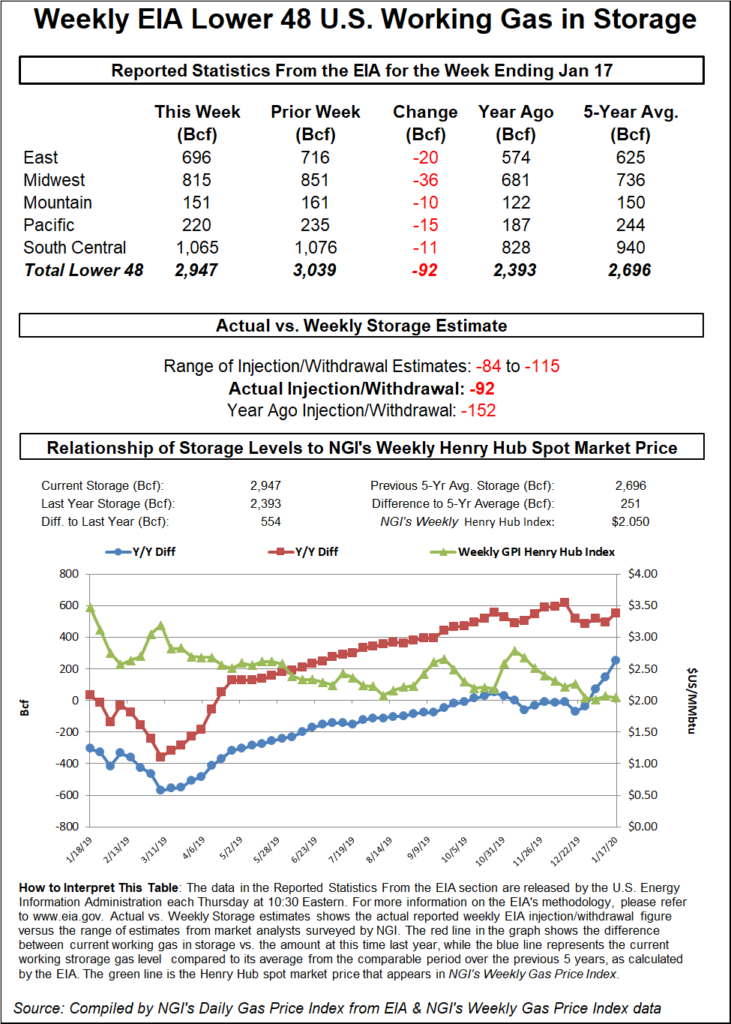

The Energy Information Administration (EIA) on Thursday reported a net 92 Bcf weekly withdrawal from U.S. natural gas stocks, slightly to the tighter side of consensus; futures prices pulled back on the news.

The 92 Bcf withdrawal, recorded for the week ended Jan. 17, compares with a 152 Bcf pull for the year-ago period and a five-year average withdrawal of 194 Bcf. Consensus estimates had pointed to a pull of around 88-91 Bcf.

In the lead-up to EIA’s report, the February Nymex contract had been trading about a nickel higher, around $1.954-1.970, with glimpses of colder temperatures near the end of the 15-day outlook perhaps leading traders to look for a bottom in the market.

Once the report crossed trading screens at 10:30 a.m. ET, the front month dropped several cents, going as low as $1.932 over the next 10 minutes.

Prior to the report, a Bloomberg survey showed a median prediction for an 88 Bcf withdrawal, while a Reuters survey landed on a 91 Bcf pull. Predictions ranged from minus 84 Bcf to minus 115 Bcf. NGI’s model predicted a 98 Bcf withdrawal.

Total Lower 48 working gas in underground storage stood at 2,947 Bcf as of Jan. 17,554 Bcf higher than year-ago stocks and 251 Bcf above the five-year average, according to EIA.

By region, the Midwest recorded a 36 Bcf withdrawal on the week, with the East pulling 20 Bcf. The Pacific withdrew 15 Bcf, while the Mountain withdrew 10 Bcf, according to EIA. In the South Central, a 19 Bcf withdrawal from nonsalt was partially offset by an 8 Bcf injection into salt stocks.

After adjusting for weather the print pointed to continued undersupply in the market, according to Tudor, Pickering, Holt & Co. (TPH).

“After three weeks of lackluster withdrawals to start the year, inventories now sit at a 9% surplus to the five-year average, and cumulative withdrawals have totaled only 245 Bcf, 90 Bcf below 2019 and about 300 Bcf below the five-year average,” TPH analysts said in a note to clients.

“On a positive note, U.S. supply continues to retreat from its December highs, averaging 94.5 Bcf/d this week,” while liquefied natural gas feed gas demand “reached a new high water mark” Thursday at 9.1 Bcf/d. “The U.S. gas market also enjoyed another week in undersupply territory, with weather-adjusted historical degree day correlations actually implying a modest increase in the undersupply to 3 Bcf/d, from 2.5 Bcf/d last week.”

Even so, the TPH analysts project a return to oversupply conditions prior to the start of the injection season.

According to Genscape Inc. estimates, the 92 Bcf pull implied a “slightly tighter” market versus the five-year average when compared to degree days and normal seasonality.

“This marks the fourth week out of the last six for a stat to come in near normal, which is notable given the perpetual looseness seen throughout 2019,” Genscape senior natural gas analyst Rick Margolin said. “That said, this week’s draw was nearly 40% smaller than the same week last year and more than 50% less than the non-weather-normalized five-year average for this gas week.”

The prospect of warmer-than-normal temperatures lingering over much of the country for another week sent spot price hubs lower from coast-to-coast Friday. Benchmark Henry Hub set the pace, giving up 4.0 cents to average $1.910.

“A weather system with rain and snow will track through the eastern United States the next several days, although there isn’t much cold air with the system as highs reach the 30s to 50s across the northern United States, locally colder, with 50s to 70s across the southern United States,” NatGasWeather said Friday.

Milder-than-normal temperatures were expected to cover much of the country during the week ahead, “but still with weather systems tracking across the country, just with limited amounts of subfreezing air. Overall, national demand will be lighter than normal the next seven days as frigid air retreats into Canada,” the forecaster said.

Several Northeast hubs posted steep discounts Friday. Algonquin Citygate fell 15.5 cents to $1.885. Farther upstream, Columbia Gas traded close to even at $1.615.

A force majeure declared earlier in the week was expected to impact westbound volumes on Columbia Gas (TCO) through Monday, according to Genscape estimates. TCO declared the force majeure starting with Thursday’s gas day, notifying shippers that it would be reducing pressure at several locations, including “LXPSEG” and “MXPSEG,” to conduct a “necessary inspection” on its MXP Line.

“During the event, total capacity at the MXPSEG throughput meter is limited to 1.17 Bcf/d,” Genscape analyst Anthony Ferrara said. This meter “has averaged 1.56 Bcf/d and maxed at 1.78 Bcf/d so far this month.” The event was limiting the LXPSEG meter to 0.97 Bcf/d, “but this restriction should not be as impactful because LXPSEG has averaged 1.10 Bcf/d and maxed at 1.31 Bcf/d so far this month.”

Elsewhere, most West Texas hubs also experienced downward pressure Friday. Waha tumbled 10.5 cents to average 71.0 cents.

In addition to a force majeure earlier in the week at its Spraberry compressor station in Midland County, TX, Northern Natural Gas (NNG) declared another force majeure Thursday impacting flows — including from the Permian Basin — on the southwestern end of its system, according to Genscape analyst Joe Bernardi.

NNG notified shippers that it hoped to resolve the event, affecting its Beaver Compressor Station in the Oklahoma Panhandle, by early Saturday.

NNG reduced operating capacity for its Beaver North Allocation Group from 947 MMcf/d to 874 MMcf/d starting with Thursday’s gas day, Bernardi said. “This group’s posted deliveries had averaged 893 MMcf/d in the previous month.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |